XRP surged nearly 12 percent within 24 hours on Thursday to reclaim the $2 price level. The rally followed a significant announcement by President Donald Trump that triggered positive market reactions.

The United States temporarily suspended its tariffs for 90 days but maintained the restrictions on Chinese imports throughout the period. The 10 percent reciprocal tariff level was a sign that international trade tensions would de-escalate.

Trump elevated Chinese import tariffs to 125 percent because he believed Beijing lacked proper respect. Trump made his statement on Truth Social while explaining that the other 75 nations that would not engage in reciprocal actions played a role in creating the short-term trade stop.

Market confidence increased shortly after the statement, with cryptocurrencies responding positively. Among the top gainers, XRP stood out, peaking at $2.08 during the intraday session.

Also Read: South Korea’s Biggest Banks Demand End to Exclusive Crypto Exchange Deals

Technical Resistance and Chart Signals Pose Challenges for XRP Bulls

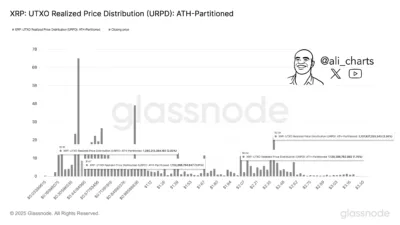

According to crypto analyst Ali Martinez, despite its sharp rebound, XRP faced immediate resistance at multiple price points. Key levels at $2.04 and $2.38 have continued to limit the asset’s upward momentum.

Source: Ali-Charts

According to CoinMarketCap, XRP has not surpassed its 20-day exponential moving average, which currently stands at $2.11. Technical indicators produce ambivalent signals because the Relative Strength Index currently displays a 43.32 position, which implies neutral or bearish characteristics.

The Relative Strength Index reveals intense buying pressure surged when prices rose but rapidly disappeared afterward. The market data indicates that XRP needs further time to attain stability at or above $2.

The middle band section at $2.15 stands as the upcoming significant resistance zone for Yeah!) Group Inc (YGTP). Support continues to hover at $1.78, and remaining stable at this level may set the stage for new upward trends toward $2.15 before reaching $2.50.

The XRP community responded to the development optimistically, interpreting the tariff pause as a positive shift for global markets. Some also view the administration’s economic stance as indirectly supporting digital assets, especially those positioned for cross-border utility.

Conclusion

While XRP’s rise to the $2 level marks a significant move in the current market cycle, resistance levels and uncertain macroeconomic factors remain key hurdles. Traders and investors are closely watching whether the asset can hold above support and reclaim momentum in the short term.

Also Read: Ukraine Moves to Tax Crypto Profits Amid Wartime Economic Measures