XRP has plunged to a two-week low of $2.07, dropping over 5% in the past seven days as bearish momentum builds. The decline follows a wave of technical and market-driven signals that have unsettled traders and investors.

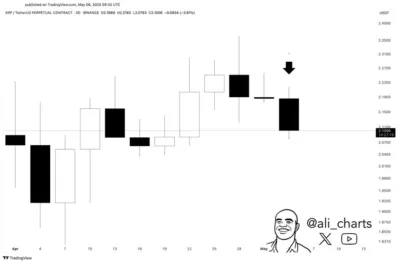

According to crypto analyst Ali Martinez, a TD Sequential indicator on XRP’s 3-day chart recently triggered a sell signal. The recent signal points to an extended decrease in XRP value if current market conditions fail to normalize within the near future.

Source: Ali-Charts

On-chain activity shows a dramatic reduction because daily active addresses dropped to 21,000 users. Network-wide participation and market demand have dramatically dropped according to the recorded decrease from 108,000 in December to 21,000.

Also Read: Trump-Backed Crypto Project Begins USD1 Airdrop After 99.97% Vote Approval

ETF Delays and Fading Community Buzz Weigh on Sentiment

Investor confidence has been further hit by delays from the U.S. Securities and Exchange Commission. The agency recently extended its decision deadline on Franklin Templeton’s spot XRP ETF to June 17. The delay has temporarily stalled optimism over potential institutional inflows into XRP.

Meanwhile, community discussions surrounding XRP have slowed Research conducted by Santiment shows XRP conversations have decreased substantially throughout the last three months. Market enthusiasm among retail investors seems to decline according to this data which contributes heavily to price trends.

Ripple’s RLUSD Sparks Utility Concerns as Market Caution Grows

Ripple’s launch of RLUSD, a USD-backed stablecoin, has introduced new concerns about XRP’s long-term relevance. While RLUSD is intended to support the XRP Ledger, its rapid adoption in settlements has raised questions about whether XRP’s role might shrink over time.

Market-wide caution is also influencing XRP’s price movement. Investors are bracing for updates from the Federal Open Market Committee, with potential rate policy shifts adding to the risk-off mood. This uncertainty is pushing many altcoins, including XRP, into correction territory.

Source: Tradingview

Technically, XRP remains under pressure as the RSI has dipped to 46.56, reflecting growing bearish control.

Bollinger Bands show XRP trading just under the midline at $2.13, with support at $2.05 and resistance near $2.29. A move below $2.05 could trigger further selling, while regaining $2.29 may signal short-term recovery.

Also Read: Ripple CTO: Institutional XRP Adoption Will Pave the Way for Massive Breakthrough