- XRP drops to 4th position, affected by whale transactions.

- Long and short positions impact XRP’s price in recent decline.

- Whale transfers and market sentiment lead to XRP’s price drop.

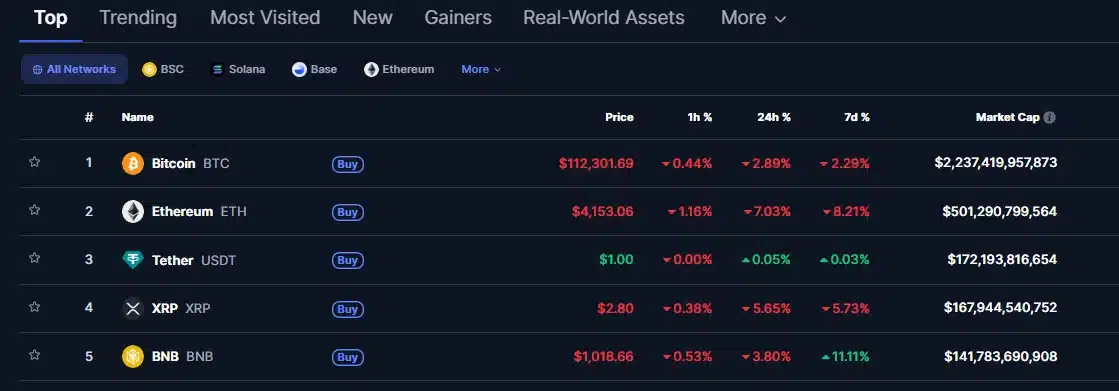

XRP has faced a noticeable price decline, dropping by 5.65% to $2.80, which has pushed it down to the 4th position in the cryptocurrency rankings just below the USDT stablecoin. This drop comes amidst increased market activity, with key factors influencing the token’s performance today.

One significant contributor to the downturn is the large volume of whale transactions observed in the market. Whale Alert reported two massive XRP transfers, one involving 135 million XRP (worth approximately $397 million) and another with 141 million XRP (valued at around $415 million), both moved from unknown wallets.

Such large transfers are often seen as signals of shifting market conditions or possible whale-driven movements.

Also Read: WisdomTree: XRP to Reach Supply Shock Faster Than Bitcoin, Here’s Why

Source: Coinmarketcap

Long and Short Positions Reveal Market Sentiment

According to Coinglass, the data, XRP has seen heavy long positions with $331.77K in 1-hour long orders and $57.19M in 24-hour long orders. Despite the strong presence of these long positions, XRP has still faced a decline, highlighting that the market’s broader sentiment could be changing.

The short positions for XRP have also seen notable activity, with $1.72 million in 4-hour short orders and $891.8K in 24-hour short orders. This shift towards short positions suggests that some traders are betting against XRP’s short-term price movements, which could be exacerbating the current price drop.

Despite the recent slump, XRP’s market cap remains substantial at $168.34 billion, although it’s down 5.73% in the past 24 hours. This price correction is further compounded by a rise in trading volume, which has surged by 114.36% to $7.11 billion, reflecting significant market movements that may be linked to these whale transactions and changing long/short positions.

These factors together show how whale activity, long/short dynamics, and overall market sentiment are impacting XRP’s price. While XRP remains an important player in the market, the shifts seen in both whale activity and trading positions suggest that XRP’s short-term outlook could face more volatility.

Also Read: Federal Register Cites XRP in Recent Document: Details