- XRP ETFs see record inflows, institutional demand continues to surge.

- Critical $2.04 support could trigger massive XRP price breakout soon.

- Institutional interest in XRP remains strong, fueling potential price rally.

Institutional demand for XRP is surging as the cryptocurrency’s exchange-traded funds (ETFs) experience consistent inflows, reflecting strong interest from regulated investors. According to SosoValue, XRP ETFs have recorded an impressive 13 consecutive sessions of net inflows, with no outflows since launch. This streak demonstrates the ongoing appetite for XRP from institutional funds, even during market fluctuations.

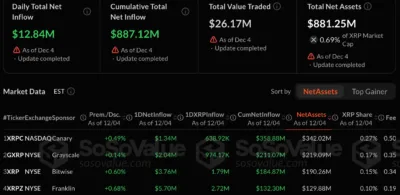

As of December 4, XRP ETFs saw daily net inflows of $12.84 million, raising cumulative inflows to $887.12 million. The total net assets across these XRP ETFs now stand at $881.25 million, with $26.17 million exchanged in the most recent trading session. This level of activity signals that institutional investors continue to accumulate XRP, showcasing confidence in the asset’s future prospects despite short-term price movements.

Also Read: Coinbase Partners with Karnataka to Revolutionize India’s Web3 Future

XRP ETFs Driving Record Investments from Top Issuers

Leading issuers are capitalizing on the growing institutional interest in XRP. Canary Capital’s XRPC holds $358.88 million in net assets, while Grayscale’s GXRP has $211.07 million. Bitwise’s XRP ETF reports $184.87 million in assets, and Franklin Templeton’s XRPZ has accumulated $132.30 million. These consistent inflows emphasize the increasing preference for XRP among regulated investors, offering a safe and structured method to gain exposure to the digital asset.

Source: SosoValue

This uninterrupted streak of daily net inflows indicates XRP’s increasing institutional adoption. ETFs allow investors to secure exposure to XRP with regulatory protection, making it an attractive option for funds looking to gain exposure to the asset in a controlled environment.

XRP Poised for Massive Price Gains with Critical Support Level at $2.04

Technically, XRP is approaching a key support level at $2.04, according to market analyst CasiTrades. This level has acted as crucial support during the current correction, and its strength will determine whether XRP can break higher. If the $2.04 level holds, XRP could target $2.41 resistance, potentially pushing toward $2.65. A sustained rally could take XRP to new highs, with analysts predicting a range of $7-$10 in a bullish scenario.

However, failure to maintain support at $2.04 could send XRP toward the $1.64 support level, completing a larger corrective phase before any further upward movement.

Institutional Inflows Could Catalyze XRP’s Price Surge

XRP’s price action will depend on continued institutional inflows into its ETFs. If these inflows remain steady, XRP’s price may experience significant upward movement, potentially reaching new all-time highs. Conversely, a reduction in institutional involvement could slow the momentum, leading to downward pressure. With institutional support, XRP remains well-positioned for a potential price surge.

Also Read: XRP Validators Warned: Upgrade to Rippled 2.6.2 Now or Face Amendment-Block