The XRP market has remained relatively calm despite the final resolution of Ripple’s legal battle with the United States Securities and Exchange Commission.

The SEC’s recent decision to withdraw its appeal officially brought the high-profile case to a close, ending years of uncertainty for the company and the XRP token.

After the development, XRP saw a short-lived spike to $2.60 before returning to around $2.43. The reaction has surprised many in the crypto community who expected the legal victory to trigger a sustained price rally.

On The Good Morning Crypto show, host Abdullah “Abs” Nassif addressed the disappointment among XRP holders. He said many retail investors had followed the case closely, anticipating a sharp increase in value once Ripple was cleared.

According to Johnny Krypto, co-founder of Merlin, the muted price response was predictable. He explained that the market had already reacted in advance, pointing to the surge from $0.50 to $2.50 in November because Ripple expected to win the lawsuit.

Krypto stated that markets tend to price in major events before they occur, especially when the outcome becomes widely anticipated. He added that if the SEC had pursued the appeal, XRP could have dropped significantly instead of maintaining stability.

The resolution of the case has removed a significant obstacle for Ripple. However, analysts agree that it will take more than legal clarity to push XRP to new highs in the current market environment.

Also Read: XRP Rich List Declines Despite Legal Victory — Here is What Happened

XRP Price Movements Reflect Market Volatility

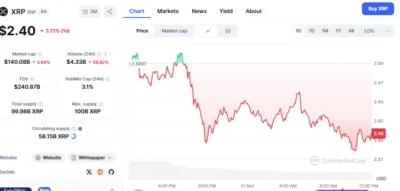

Despite the legal victory, XRP’s price action remains unstable. At the time of writing, XRP is trading at $2.40, marking a 3.72% drop over the past 24 hours.

After an initial surge to $2.50, XRP faced strong resistance, leading to a steady decline. The market cap has also decreased to $140.08 billion, reflecting a 3.64% loss. Additionally, 24-hour trading volume has dropped by 58.82%, reducing trading activity and investor hesitation.

Source: CoinMarketCap

The chart shows fluctuations throughout the session, with multiple attempts to break resistance levels. However, the downward trend suggests a market correction or profit-taking phase after previous gains.

The volume-to-market cap ratio of 3.1% indicates weaker liquidity, which may contribute to further short-term volatility.

XRP is expected to consolidate within the $2.35 – $2.45 range unless a strong catalyst emerges. Market sentiment, institutional participation, and further developments in Ripple’s ecosystem will determine the next move.

Focus Shifts to Utility and Institutional Adoption for XRP’s Future Growth

With the lawsuit no longer hanging over Ripple, attention is turning to the company’s strategy for adoption and utility. On the show, Nassif and guests highlighted the importance of real-world use cases and institutional involvement in determining the next phase of growth for XRP.

Krypto noted that new demand will be essential. He said Ripple must now attract large-scale partnerships and institutional capital to support higher price levels.

Analyst Mario pointed out that XRP trades at a higher base than during the legal dispute. He said the token was suppressed under $1 for an extended period but has since established support near the $2 mark.

Mario added that Ripple’s work on stablecoin integration, tokenization, and payment solutions could play a key role in the future of tokens. With legal uncertainty removed, institutions may now consider entering the XRP market without fear of regulatory complications.

While short-term expectations may not have been met, the broader outlook remains positive. According to Krypto, XRP could reach between $4 and $8 during a bullish market cycle, provided there is sufficient momentum from adoption and investment.

Conclusion

XRP’s subdued price movement following Ripple’s legal win highlights the market’s tendency to react to expectations rather than actual events. Recent price fluctuations suggest a consolidation phase as investors reassess the next growth catalyst.

Experts maintain that XRP’s future performance will depend on utility, partnerships, and institutional engagement now that regulatory concerns have been cleared. Market participants will watch closely for signs of new capital inflows that could drive the next major move.

Also Read: Here is a New Important Date For XRP Holders