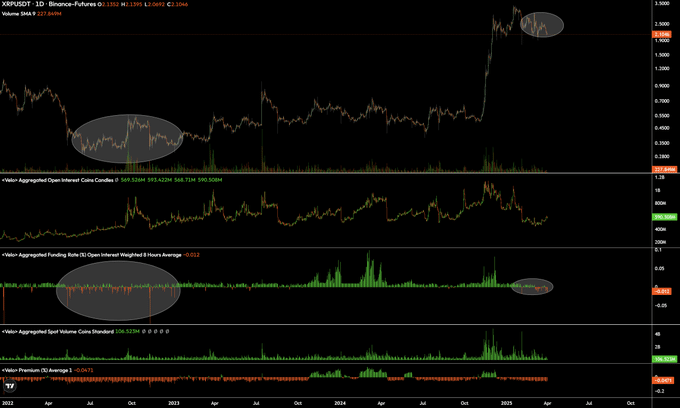

XRP’s funding rate has declined to negative 0.012 percent, revisiting levels last observed when the asset traded around $0.33. Despite the bearish indication from this metric, XRP continues to trade steadily above the $2.09 level, showing resilience in the face of cautious market sentiment.

CryptoinsightUK reports that investor reluctance has emerged as traders avoid making moves according to their data. Investors currently hold back their capital commitments because changes in market direction are unclear. The open interest levels also show a notable lack of investment.

Source: @Cryptoinsightuk

According to current data, XRP currently has a value of $2.09 while experiencing a 1.92% daily market increase. XRP has experienced a dramatic 25.22 percent surge in its daily trading volume, reaching $3.96 billion. XRP maintains its market capitalization at $122.21 billion through 58.2 billion XRP circulating supply.

Also Read: Solana (SOL) Faces Technical Pressure as Key Support Nears Breaking Point

Based on available data, the current open interest stands at 591 million XRP worth $1.18 billion. The current market value stands at levels much lower than what market participants witnessed during previous periods of confident growth and bullish price trends.

Spot volume has also remained moderate, indicating a lack of aggressive buying or selling pressure from the broader market. XRP’s price had dropped 14.5 percent over the past week but has since stabilized above its psychological support level.

Options Market Strengthens Amidst Futures Weakness

Coinglass derivatives data shows that XRP’s perpetual futures volume has decreased by 17.62 percent to $7.12 billion. Meanwhile, open interest in futures fell 3.67 percent, now at $3.56 billion.

However, options trading activity has sharply risen, with volume increasing by 120.23 percent to $7,500. Options open interest also grew significantly, climbing 146.96 percent to $983,490.

This divergence indicates a shift in trader sentiment. While futures contracts are seeing a cooling interest, the spike in options activity suggests anticipation of potential price volatility.

The ongoing negative funding rate indicates a market skewed toward short positions. If XRP begins to rally, short sellers may be forced to buy back their positions, potentially triggering a short squeeze.

CryptoinsightUK pointed to this scenario, noting similarities with a past market setup that preceded a major XRP price move. The funding rate’s resemblance to levels from earlier consolidation phases has renewed speculation about a bullish reversal.

Bitcoin’s recent dip to $81,000 also played a role in XRP’s recent market fluctuations. That move led to a broader altcoin retracement, bringing XRP close to breaking its $2 threshold before rebounding.

Conclusion

The contrast between rising options activity and weak futures engagement reflects uncertainty in XRP’s short-term direction. While the asset maintains its position above $2.09, market participants remain alert for a decisive breakout.

Also Read: Next SEC Closed-Door Meeting to Trigger XRP Bullish Reversal? Here’s What’s Happening