- XRP Ledger activity plunge reflects timing effects, not lasting network disruption

- Weekend liquidity gaps triggered sharp metric drops without damaging XRP Ledger fundamentals

- Institutional flow pauses exaggerated activity data while XRP price structure stayed stable

At first glance, it seems disastrous to report that XRP Ledger activity fell by 99% in just 48 hours, yet the timing of the drop offers important clarification. According to market analysts monitoring on-chain data, the decline coincided with a typical weekend liquidity slowdown as institutional and enterprise participants paused operations.

XRP Ledger payment volumes rely heavily on concentrated flows rather than continuous retail usage, with market making, cross-border settlement testing, and institutional transfers driving activity. These flows do not occur evenly across the trading week, so when major participants step back over the weekend, reported activity can fall sharply without signaling distress.

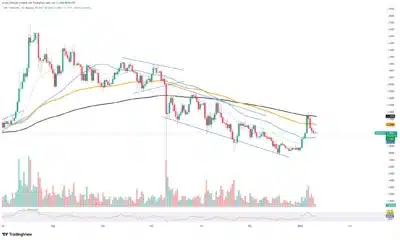

The calculation window influenced the severity of the reported decline because activity levels before the drop were elevated and exaggerated the percentage change. Price behavior reflected restraint instead of panic, with XRP holding above short-term support while facing resistance near longer-term exponential moving averages.

Volume trends reinforced that interpretation as trading volumes remained thin and irregular during low-liquidity weekend sessions.

Also Read: XRPL Sets 11.5M XRP Liquidity Target as DeFi Push Nears Critical Phase