- XRP appears to be completing its corrective Wave 2, with key Fibonacci retracement levels around $1.64 (Coinbase) and $1.44 (Binance).

- A bullish Wave 3 could follow, with a projected target above $7.00 in early 2026 if the Elliott Wave structure holds.

- Price action differs between Coinbase and Binance, but both may align soon.

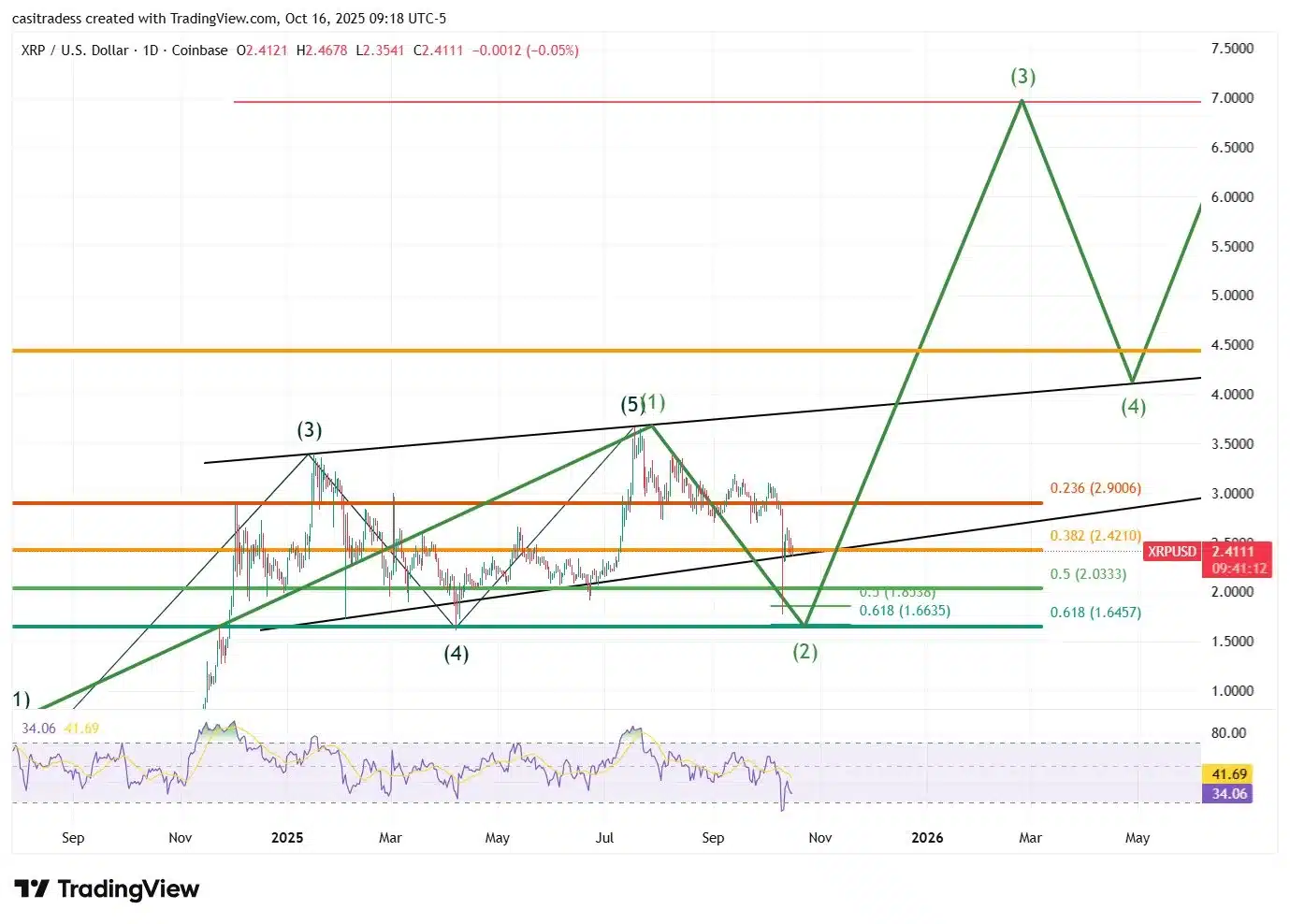

Popular crypto analyst CasiTrades has issued a new macro update on XRP, suggesting the digital asset is nearing the end of its Wave 2 retracement and may soon begin a significant Wave 3 rally, potentially leading to substantial upside in early 2026.

Elliott Wave Structure in Focus

According to CasiTrades, the daily chart of XRP on Coinbase indicates that the cryptocurrency is in the final stages of a corrective Wave 2, part of a larger five-wave Elliott Wave cycle. The analyst shared an annotated chart to support this theory, highlighting how XRP is approaching a critical Fibonacci retracement zone, which typically acts as a launchpad for Wave 3.

“Zooming out on the #Coinbase XRP Daily chart gives you a look at how close we are to finishing the retracement before a large wave up,” CasiTrades tweeted, signaling an optimistic outlook.

Key Levels and Market Discrepancy Across Exchanges

On Coinbase, XRP is currently trading around $2.41. The recent local low printed at $1.77, which has not yet touched the 0.618 Fibonacci retracement level at $1.64, a common target for Wave 2 completions. The chart indicates that XRP could still dip slightly lower to hit this retracement level, aligning with classical Elliott Wave theory before initiating a strong upward move.

Also Read: XRP Ledger’s Upcoming Batch Feature Sparks Developer Excitement but Faces Support Hurdles

🚨XRP MACRO Update. Likely Completing Wave 2 Before the Next Major Run! 🚨

Zooming out on the #Coinbase XRP Daily chart gives you a look at how close we are to finishing the retracement before a large wave up! 🚀

The discrepancy between exchanges is very interesting here… On… pic.twitter.com/MHEdhYk4Wt

— CasiTrades 🔥 (@CasiTrades) October 16, 2025

In contrast, on Binance, XRP had already gone significantly lower during the recent market crash. Its 0.618 Fibonacci retracement level lies near $1.44. Another wave down on Binance wouldn’t necessarily result in a new low, but would still allow the exchange to retest its retracement zone.

“Each exchange is misaligned right now,” CasiTrades noted, “but they could re-align as the next waves complete.” The analyst suggests that if Coinbase dips to $1.64 and Binance retests $1.44 without breaking its prior low, both markets could simultaneously complete their Wave 2 structures, bringing the macro wave counts into alignment across exchanges.

Macro Bullish Setup

The chart shared by CasiTrades shows a previously completed Wave (1) peaking near $3.80, followed by a declining Wave (2) that is approaching its final leg down. This potential bottom is projected between $1.63 and $1.77.

The next impulse wave, Wave (3), is projected to reach above $7.00, marking a new macro high for XRP before another corrective move in Wave (4) and a final Wave (5) higher. Momentum indicators, such as the RSI, are also approaching oversold conditions, currently hovering near 34, suggesting that XRP may be forming a local bottom.

Source: CasiTrades

Conclusion: Watch for the Final Wave Down

If CasiTrades’ macro-outlook proves accurate, XRP could be on the verge of a significant reversal. Traders and investors should monitor price action closely across both Coinbase and Binance, particularly near the $1.64 and $1.44 levels, respectively. A bottom in this region could validate the Elliott Wave count and trigger a powerful Wave 3 rally.

As always, market participants should combine technical analysis with proper risk management and awareness of broader market conditions before making investment decisions.

Also Read: Breaking: Ripple Acquires GTreasury in $1 Billion Deal to Enter Corporate Treasury Market