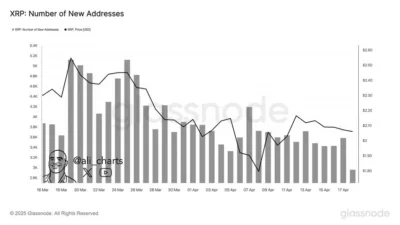

XRP has seen a notable reduction in user activity over the past month, raising concerns among analysts and traders. According to data shared by crypto expert Ali on social media, the number of newly created XRP addresses has dropped significantly—from approximately 5,200 in mid-March to just 2,900 by mid-April.

Source: Ali-Charts

This contraction in new wallet generation suggests a potential cooling of user interest or onboarding on the XRP Ledger. Blockchain network organic user growth is typically evaluated through new address counts throughout history. This swift decrease in new addresses requires ecosystem watchdoges to exercise caution since it indicates negative adoption patterns for the extended future.

Significantly, this slowdown in network expansion appears to mirror XRP’s price and trading behavior. Based on Glassnode on-chain data new wallet creation activity peaked at its most during March 19 and slowly dissipated afterward. The long-term downward trend continues even though market numbers occasionally bounce upward yet current volumes stay below historical averages.

Also Read: Whales Quietly Buy Millions in ETH as Prices Drop and Market Stalls

Technical Indicators Reflect Persistent Market Uncertainty

Meanwhile, XRP’s price chart on Bitstamp highlights a similar trend of consolidation and subdued momentum. The price for the asset remained within a narrow range above $2 during the entire month of April while failing to exceed the Bollinger Band upper boundary.

Technical indicators demonstrate that market participants are without robust bullish sentiment. The Moving Average Convergence Divergence (MACD) reveals a modest bullish crossover while its histogram bars signal modest rising market force. The current moderate trading volumes across sessions indicate that institutional and retail participant levels have shown no substantial increases during recent trading sessions.

Market conditions indicate an upcoming trend change because Bollinger Bands show signs of tightening which often indicates that prices could either halt their motion or begin a new direction. This aligns with the narrowing volatility observed across XRP’s recent candlesticks, which show smaller body sizes and a declining range.

In parallel, XRP’s price action continues to reflect investor caution. The market shows fleeting moments of buying activity through green candles but this increased interest lacks continuity for sustained upward price movement. The price action of this asset shows market indecision since it stays confined between $2.05 and $2.23.

Conclusion

The XRP ecosystem appears to be entering a consolidation phase, both in terms of price activity and network growth. The reduction in newly created addresses demonstrates that broad market involvement is showing signs of decline. Without a resurgence in adoption or significant news catalysts, XRP may remain range-bound in the near term.

Also Read: New Theory Emerges About the Ripple vs. SEC Lawsuit – What if it Was Never About XRP?