XRP is under pressure as bulls attempt to hold the $2.13 level after a failed breakout attempt near $2.20 earlier this week. The current rejection marks the third consecutive session where the price has struggled to gain momentum above clustered resistance, leading to cautious sentiment among traders.

Short-term exhaustion and muted demand in options markets have capped upside potential. Despite this, the medium-term structure remains constructive, with key support from the 200 EMA holding strong near $2.05.

As of June 22, XRP is trading just above $2.13, having failed to sustain earlier gains. Price action reflects a classic range-bound structure, as buyers and sellers battle below a major supply zone at $2.18–$2.22 — a region that overlaps with the 50-day EMA and prior support.

Also Read: Pi Network Price Prediction for June 22

Technical Outlook

Bollinger Bands

On the daily chart, the XRP price remains capped beneath the $2.22 mark. The 20, 50, and 100 EMAs are tightly compressed above price, reinforcing resistance in this zone. Meanwhile, the 200 EMA offers immediate support at $2.05, keeping the market in a narrow trading range.

On the 4-hour chart, XRP is wedged between resistance at $2.18 and the 200 EMA support at $2.05. The narrowing Bollinger Bands suggest decreasing volatility, which often precedes a strong breakout. However, no clear direction has emerged yet.

Source: Tradingview

RSI and MACD Show Indecision

Currently sitting at 48 on the 4-hour timeframe, the Relative Strength Index (RSI) indicates neutrality and a lack of strong momentum, while the flat MACD with no crossover further reinforces the prevailing market indecision.

The super trend indicator also turned neutral after briefly flashing bullish earlier in the week, a sign that buying interest remains limited in the short term.

Source: Tradingview

Market Behavior

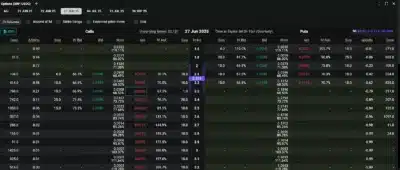

The June 27 expiry options data indicates high open interest in the $2.10 and 2.20 strikes, with the $2.20 calls being highly implied or 68.5 percent. This indicates that the market players are closely monitoring this resistance area and have yet to place directional bets above it.

On-chain flow shows signs of accumulation, as Coinglass indicates that XRP experienced net outflows of $24.76 million on June 20 — a signal that investors are moving assets off exchanges for long-term storage. This has classically been a precursor to bullish breakouts, but the price has not continued in the current marketplace.

The non-response to price in the face of the outflows would suggest that there is still selling pressure at the higher levels and a general lack of conviction by the bulls. XRP will likely remain in a sideways structure until the $2.18- $2.22 zone is broken decisively.

XRP Price Forecast Table (2025–2029)

| Year | Minimum Price | Average Price | Maximum Price |

| 2025 | $1.98 | $2.18 | $2.40 |

| 2026 | $2.15 | $2.40 | $2.80 |

| 2027 | $2.30 | $2.66 | $3.10 |

| 2028 | $2.45 | $2.90 | $3.45 |

| 2029 | $2.60 | $3.20 | $3.90 |

Yearly Price Breakdown

2025

XRP may average $2.18 this year, with range-bound action between $2.05 and $2.22 likely dominating unless bulls reclaim control above resistance. A breakout toward $2.40 is possible if macro sentiment improves and volume supports a move above $2.25.

2026

With broader adoption and potential regulatory clarity, XRP could climb to a high of $2.80. Sustained support may form around $2.15, anchoring average price action near $2.40 for the year.

2027

If institutional interest and cross-border use cases expand, XRP may see prices rally toward $3.10. Increased ecosystem engagement could stabilize average prices near $2.66, with support forming at $2.30.

2028

Ongoing development and utility integration may drive XRP’s value to a high of $3.45. With a strong user base and consistent on-chain metrics, prices may average around $2.90.

2029

If the ecosystem matures and market cycles favor altcoin expansion, XRP may reach $3.90. The year could close with an average of nearly $3.20, while long-term support holds around $2.60.

Conclusion

XRP is trading in a tight consolidation range, struggling to break past key resistance near $2.20. Despite bullish on-chain signals and strong support at $2.05, traders are still awaiting a confirmed breakout before committing to new positions. With options data and EMA alignment pointing to hesitation, XRP may continue oscillating between $2.05 and $2.22 until volume confirms a breakout direction.

FAQs

1. What is the current XRP price today?

XRP is trading near $2.13, just below key resistance at $2.18.

2. Why is XRP not breaking out above $2.20?

Strong overhead resistance and short-term exhaustion are capping price gains near the $2.20 level.

3. What support is holding XRP up now?

The 200 EMA at $2.05 is acting as strong support on both the 4-hour and daily charts.

4. Are options traders bullish or cautious on XRP?

Options data shows high interest around $2.10–$2.20, but elevated implied volatility signals caution.

5. What needs to happen for XRP to rally?

A clean breakout above $2.22 with volume and RSI confirmation is needed to shift momentum upward.

Also Read: Bitcoin Cash (BCH) Price Prediction 2025–2029: Will Bitcoin Cash Hit $630 Soon?