- XRP consolidates near $2.80 with bullish momentum still intact.

- Derivatives activity surges, signaling continued interest from speculative traders.

- Key support at $2.61 holds as breakout potential builds.

XRP is currently trading around $2.77 after a strong breakout earlier in the week pushed the price to an intraday high of $2.84. The move followed a clean breakout from a symmetrical triangle pattern that had capped price growth for several months.

Owing to its psychological importance, the asset now faced a period of consolidation slightly below the range of the $2.80 level. Technical analysis indicates that strong bullish momentum is still present since XRP is trading above crucial support levels.

Recent price action shows a clear shift in market structure, with former resistance levels at $2.45 and $2.60 now acting as solid support. The range of $2.61-$2.84 is currently seen and followed to take the definitive step.

Also Read: XRP Breaks $2.65 Barrier as Analysts Predict Surge Toward $6 Price Target

Technical Structure Remains Strong as Buyers Maintain Control

XRP continues to trade well above all major exponential moving averages on the 4-hour chart. The 20 EMA stands at $2.61, providing dynamic support right below the current price.

The 50, 100, and 200 EMAs are far below, which also supports the power of the current movement. This correlation ascertains that bullish momentum has not been weakened.

Widening noticeably, the Bollinger Bands show XRP price pressing against the upper band near the $2.90 level. This indicates an increasing volatility and the building of steam for another breakout.

Source: Tradingview

The supertrend indicator is also in favor of bulls, and the support line is lagging at $2.56. There has been no sign of a reversal, and it has continued to keep bullish traders in control.

Momentum indicators affirm that there is still a purchase interest. Chande’s Momentum Oscillator is moving above 35.0, with a powerful gap between +DI and -DI on the directional movement index.

The ADX stands at 35.2, confirming the trend’s power and indicating a continuation pattern rather than a reversal.

Source: Tradingview

Derivatives Market and On-Chain Activity Signal Speculative Strength

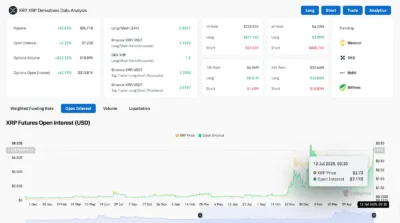

Trading activity in the derivatives market has surged, adding fuel to XRP’s recent rally. Daily volume has jumped by nearly 96 percent to $34.7 billion, indicating heightened trader interest.

Open interest has also increased by over 5 percent to $7.23 billion, suggesting participants are maintaining their positions in anticipation of further upside.

This would imply that the participants are holding their ground because they believe that there is still strength to come.

The volume of options has increased by 833 percent, indicating a future wash of speculative bets. That is why the long/short ratio of Binance made by top traders is only $2.26, with long positions being strongly favored.

Source: Coinglass

This is the same case on-chain, where the 4-hour chart shows a Money Flow Index of 85.6, proving a high flow of money.

Already, the short-term 30-minute chart hints at a cooldown, with the RSI dropping to 46.6 and MACD crossing bearishly. The corresponding shifts indicate short-term burnout. Neither of them is yet an indicator of a wider turning of the tide.

The price is still elevated above structure-critical values, which sustains the bullish narrative. As long as the buyers maintain support at $2.61, they have the upper hand.

Source: Tradingview

Short-Term Forecast Points Toward a Test of Key Resistance

XRP’s short-term price outlook for July 13, 2025, remains positive. The current range between $2.61 and $2.84 continues to serve as the consolidation zone.

An upside break of confirmation of $2.84 may trigger a re-test of resistance levels of between $3.00 and $3.12. This area will be the next intermediate target when bullish impetus gathers pace.

However, if XRP fails to hold above $2.61, it may revisit the breakout base at $2.45. Any decline below the level might subject the price to additional retracement down to the level of $2.28.

Momentum indicators have been in the buyer camp, and as a result, the trend has continued toward the upside: volume, the trend strength, and the market sentiment back the bullish continuation.

The bulls enjoy a short-term advantage due to consolidation above the 20 EMA and rising derivatives activity. XRP is still ready to take another step up unless a sudden collapse happens.

XRP is consolidating below $2.80 on July 13, 2025, with strong technical and on-chain support backing the current trend. As long as the price holds above $2.61, a breakout toward $3.00 remains likely in the near term.

Also Read: Whale Moves $70M in XRP to Coinbase as Price Nears Breakout Level