- XRP posts the same inflows for two weeks amid market surge

- Ripple applies for a U.S. banking license to launch RLUSD stablecoin

- Identical XRP inflows hint at growing institutional interest and confidence

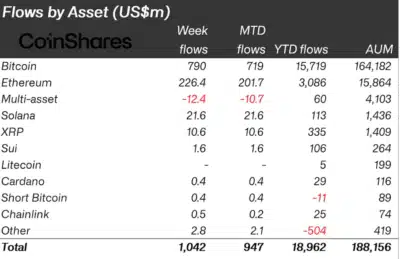

XRP investment products posted identical weekly inflows of $10.6 million for two consecutive weeks, according to data published by CoinShares. This consistency stood out amid a broader surge in digital asset investments.

The market recorded a total of $1.04 billion in inflows last week, continuing its 12-week streak of positive momentum. Bitcoin was the leader in terms of inflow volume, with 790 million, and Ethereum took second place with 226 million.

Although lower compared to XRP, the continual inflow of 10.6 million into the currency in the given weeks received attention because of the sheer similarity of the inflow within the two weeks.

Also Read: Stellar (XLM) Surges 5 Percent as Traders Rotate Away From XRP Momentum

Ripple, the company closely associated with XRP, is actively pursuing significant financial regulatory approvals in the United States. It is reported that Ripple has applied for a national banking license to operate under the U.S. Office of the Comptroller of the Currency. This action aligns with Ripple’s preparations to launch its new stablecoin, RLUSD.

Moreover, Standard Custody & Trust, an affiliate of Ripple, is trying to get access to the Federal Reserve master account. Approval of this application would allow RLUSD to be issued and redeemed without time limitations. Such access would place Ripple in a position similar to that of traditional financial institutions.

Source: Coinshare

Identical Inflows Suggest Strategic Accumulation Around Ripple’s Regulatory Push

The timing of XRP’s repeated inflows aligns with these strategic regulatory developments. Analysts suggest the identical figures may not be coincidental, as they could reflect structured investment activity tied to Ripple’s growing institutional presence.

A sudden spurt in the likelihood of an exchange-traded fund with XRP has also motivated investors’ interest in XRP. According to recent estimates, the likelihood of approval stands at 95 percent, which is another boost to belief in the future of XRP in the market.

When other investments registered a fluctuation in the amounts invested, XRP held steady, pointing to the occurrence of a distinct market behavior. The repeated inflows indicate the growing confidence in Ripple’s long-term regulatory strategy and infrastructure prospects.

Even as Ripple passes through the regulatory framework, its bid to find its way directly into banks hints at a trend towards greater financial connectivity. XRP’s role in this strategy is becoming more defined, with investment data reflecting early market reactions to that direction.

Also Read: Ripple vs SEC: Ripple Pro-Lawyer Bill Morgan Rejects ‘Staged Lawsuit’ Theory