The XRP market is witnessing a wave of excitement as large investors, commonly referred to as whales, are withdrawing billions of XRP from exchanges. This sudden movement has triggered speculation that a potential supply squeeze could drive XRP prices higher in the coming days.

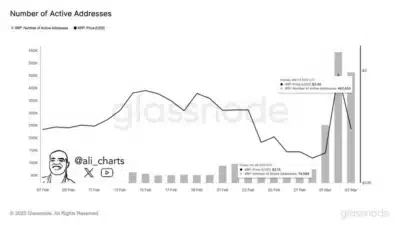

According to crypto analyst Ali Martinez, XRP’s network activity has surged dramatically, with active addresses increasing by 620% in just one week. Active addresses rose from 74,589 to 462,650, indicating a sharp rise in investor interest and heightened market activity.

Moreover, the XRP Ledger (XRPL) has grown significantly, expanding by 24% in 2024 reaching a total of 6.2 million accounts. The increasing number of trust line connections between accounts suggests a rising adoption rate and enhanced utility for XRP in financial transactions.

Also Read: SEC’s Crypto Crackdown Crumbles: Cumberland DRW Walks Free Amid Wave of Dismissals

Institutional Interest and Regulatory Developments Strengthen Demand

Institutional demand for XRP continues to grow as financial firms increasingly integrate Ripple’s technology into their payment infrastructures. The rising use of XRP in cross-border transactions and financial services reinforces investor confidence in the asset’s long-term utility.

Additionally, market analysts closely observe the developments around potential XRP-backed exchange-traded funds (ETFs). Multiple asset managers have already submitted filings for these financial instruments, replicating the growing institutional interest in Bitcoin ETFs.

A regulatory approval for XRP ETFs could provide further momentum for institutional adoption and market expansion.

Regulatory clarity remains a crucial factor influencing XRP’s market outlook, particularly with Ripple’s ongoing legal battle against the U.S. Securities and Exchange Commission (SEC).

As the case nears its conclusion, a favorable decision could attract more institutional investors and create a more stable regulatory environment for XRP in the financial sector.

Political factors also contribute to the evolving XRP market dynamics, particularly following Donald Trump’s election victory, which triggered a 500% surge in XRP’s price in November.

With Trump perceived as supportive of cryptocurrency policies, traders are speculating on further price movements driven by regulatory decisions under his administration.

XRP Price Outlook Amid Market Developments

Meanwhile, at the time of writing, XRP was trading at $2.51, marking a 2.66% increase in the last 24 hours, and continues to hold above crucial support levels. The 50-day Exponential Moving Average (EMA) at $2.44 strongly supports the overall bullish sentiment among traders.

Key resistance levels to monitor are positioned at $2.69, $2.82, and $2.96, with a potential breakout above $2.69 likely to push XRP toward higher price points. If XRP fails to maintain support at $2.44, a decline toward the next support level at $2.27 may occur, leading to possible retracements.

Source: Tradingview

Meme coin activity on the XRPL has also increased, contributing to rising transaction volumes across the network. This trend aligns with the explosive growth of meme coin markets on other blockchains, driving increased demand for XRP trust lines and enhancing overall ecosystem activity.

As whales continue accumulating XRP and institutional adoption gains momentum, traders are closely monitoring key resistance levels. A decisive move above $2.69 could indicate the beginning of the following significant rally for XRP, potentially setting the stage for further price gains.

Also Read: XRP Lawsuit Update: Is Ripple Negotiating its Case With the Second Circuit Court?