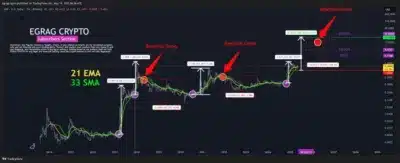

XRP holders are on high alert after crypto analyst Egrag Crypto released a new chart that outlines two extreme possibilities for the asset’s future price. The analyst’s detailed breakdown centers on the relationship between two key indicators: the 21-week Exponential Moving Average (EMA) and the 33-week Simple Moving Average (SMA).

According to crypto analyst Egrag Crypto, past market cycles show that when the 21 EMA crosses below the 33 SMA, XRP typically enters a prolonged downtrend.

The formation of this cross is called a “bearish cross” by Egrag, and during both May 2018 and November 2021, XRP fell by 87 percent and 72 percent, respectively, after the signals were made public.

Source: Egrag

Egrag points out that if there is another decline like this, the average could trigger a fall of around 79.5 percent. He points out that sometimes optimism sparks immediate trend changes, yet slowly moving averages usually signal bigger shifts in the market.

Also Read: Bitcoin Surges Past $107,000 as Major Altcoins Record Moderate Gains

Massive Price Targets Identified in Bullish Scenario

While the bearish outlook is significant, the analysis highlights a sharply contrasting bullish case. A “bullish cross,” where the 21 EMA rises above the 33 SMA, has historically preceded major price surges for XRP. Egrag identifies four previous instances where this formation triggered the explosive upward movement.

One notable example recorded a price increase of 1600 percent, which the analyst used to project potential targets if the bullish signal reappears. Under the same circumstances, Ripple could increase to $27, while a powerful rally may push the price to $37, representing a 6500 percent rise from the current level.

Source: Egrag

Two other targets, $5.712 and $9.575, match previous Fibonacci resistance zones, while significant support is formed at $1.6394. If broken, the zone may strengthen the bullish case or push prices down.

Egrag emphasizes the importance of tracking these technical formations rather than relying on short-term sentiment.

Also Read: SEC Delays XRP ETF Again—Is This a Sign of Bigger Trouble Ahead?