- XRP sees massive liquidation imbalance, with $10.37M from long positions.

- XRP price dips to $2.96, then stabilizes around $2.99.

- Liquidation trend continues as traders adjust positions amid volatile market.

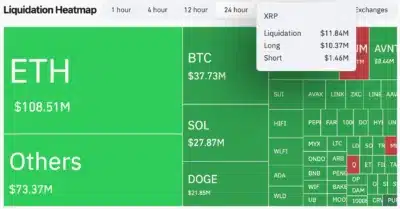

XRP traders were caught off guard as the market took a sharp turn, leading to massive liquidations. Over the past 24 hours, a staggering $11.84 million worth of XRP positions were liquidated, with $10.37 million coming from long positions and just $1.46 million from shorts. This massive imbalance shows how traders were over-leveraged before the abrupt change in price.

The liquidation rates of XRP are impressive compared to those of the broader crypto market. Although Ethereum experienced $108.5 million in liquidations and Bitcoin experienced $37.7 million, XRP’s lower dollar value is not compared to the huge 710% gap between long and short liquidations.

This sharp contrast indicates a market that is strongly tilted to long positions, taken aback when the price fluctuated.

Source: Coinglass

Also Read: SC Ventures will launch a $250M Fund for Digital Assets, Backed by Middle Eastern Investors!

Price Action and Tight Range Amidst Liquidations

XRP’s price action today mirrored the chaotic market dynamics. The token dipped to $2.96 before finding some support around $2.99, showing signs of stabilization. The $3 price point has emerged as a key level, with traders watching closely to see if XRP can hold above it.

If the price fails to maintain this level, the liquidation trend could continue, leaving traders scrambling to adjust their positions.

XRP Chart Highlights Price Movements and Liquidations

The XRP chart shows a dip to $2.96, followed by a slight recovery back to $2.99. As of now, XRP is trading at approximately $3.03, with resistance at $3.14 and support at $2.70. The Bollinger Bands indicate a narrowing price range, which suggests reduced volatility following the sharp market movements.

The Relative Strength Index (RSI) sits at 54.19, indicating a neutral market condition between overbought and oversold levels. This suggests the market is stabilizing, but traders remain cautious as the effects of the liquidations continue to unfold.

Also Read: Trending: Pantera Capital CEO’s Comment on XRP and SWIFT Stuns Community