- XRP rebound wipes out millions as short sellers scramble to exit

- Liquidation imbalance exposes heavy bearish mispositioning in XRP derivatives

- Sudden price surge signals growing pressure on leveraged short positions

XRP posted sharp volatility after a brief dip below $1.83 reversed market expectations and caught short sellers off guard, as the early Asian session decline encouraged bearish positioning across derivatives platforms. However, buying pressure returned quickly and flipped momentum within minutes.

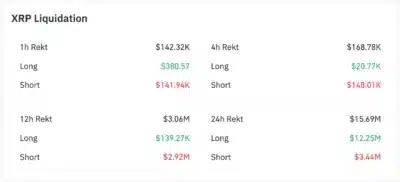

According to CoinGlass, liquidation data showed an unusually severe imbalance during the rebound. Shorts worth $2.92 million were liquidated within 12 hours, while long positions saw minimal impact. As a result, the liquidation imbalance surged to 37,296%, signaling extreme bearish mispositioning.

Soon afterward, XRP jumped from $1.82 to nearly $1.90 in a rapid move. That price action triggered a chain reaction of stop losses. Consequently, more than 99.7% of forced liquidations came from short positions during the most volatile phase.

Besides the immediate spike, bearish pressure continued building throughout the session, as total short liquidations reached $3.44 million over 24 hours according to CoinGlass. That figure outweighed long losses by more than 10 times, confirming the depth of downside miscalculations.

Also Read: $2 Billion XRP Strategic Reserve – What XRP Holders Should Know

Short sellers overwhelmed as price reclaims control

Lower time frame charts reflected a structured liquidation pattern rather than erratic trading. XRP climbed in five distinct waves, paused briefly, then pushed above $1.8970. That secondary surge forced late short entries to exit rapidly, reinforcing upside momentum.

Source: Coinglass

Additionally, XRP held near $1.896 after the move, showing limited selling resistance. This price behavior suggested buyers maintained control instead of taking quick profits. Moreover, funding rates and open interest remained moderate, indicating leverage stayed below overheated levels.

Derivatives positioning exposes market vulnerability

Significantly, traders appeared confident in a short term pullback following last week’s 14% breakout. That belief led to crowded short exposure across perpetual markets. When price failed to retrace, forced liquidations amplified the upward move.

From a structural perspective, such uneven liquidation flows rarely fade quietly. Markets often seek higher prices to rebalance positioning. Hence, if support remains intact, XRP may continue testing the psychological $2 level, which has struggled to hold in recent sessions.

Meanwhile, traders are closely watching volatility metrics and open interest trends. Although leverage remains controlled, renewed price swings could reignite short pressure. The latest move highlighted how quickly sentiment can reverse when derivatives positioning becomes heavily skewed.

XRP’s rebound underscored the risks associated with crowded bearish trades, as the sudden surge reflected liquidation-driven momentum rather than isolated buying activity. Price action continues to show sensitivity to positioning shifts as market participants adjust exposure.

Also Read: Coinone explores sale of chairman’s stake as talks open with global crypto firms