- Analyst Zach Rector notes many new XRP investors had unrealistic price expectations leading to growing frustration.

- Santiment data shows retail FUD at a 6-month high, historically a contrarian buy signal.

- Rector urges patience, suggesting institutional entry and ETFs are inevitable.

Financial analyst Zach Rector has weighed in on the growing tension among XRP retail investors, noting that many newcomers entered the market this year with unrealistic expectations, including predictions of $1,000 for XRP, which has led to widespread frustration as price action remains subdued.

“Lots of new people came in this year and had unrealistic expectations for XRP this year ($1,000 XRP). This, combined with poor economic conditions on Main Street, has created a very frustrated retail XRP trader,” Rector said in a post on X.

Despite the current discontent, Rector urged holders to remain patient, suggesting that the entry of institutions and ETFs into the XRP market is “inevitable” and that traders should avoid panic-selling before this next major phase begins.

“I just hope they vent their frustration without actually selling because the institutions and ETFs are inevitable. Just a matter of letting the government shutdown pass,” he added.

Lots of new people came in this year and had unrealistic expectations for XRP this year ($1,000 XRP). This combined with poor economic conditions on Main Street has created a very frustrated retail XRP trader.

I just hope they vent their frustration without actually selling… https://t.co/piZaM5KkuO

— Zach Rector (@ZachRector7) October 7, 2025

Also Read: XRP Falls Behind BNB After Massive 26% Rally Stuns Crypto Market

Santiment Data Shows Retail Fear at 6-Month High

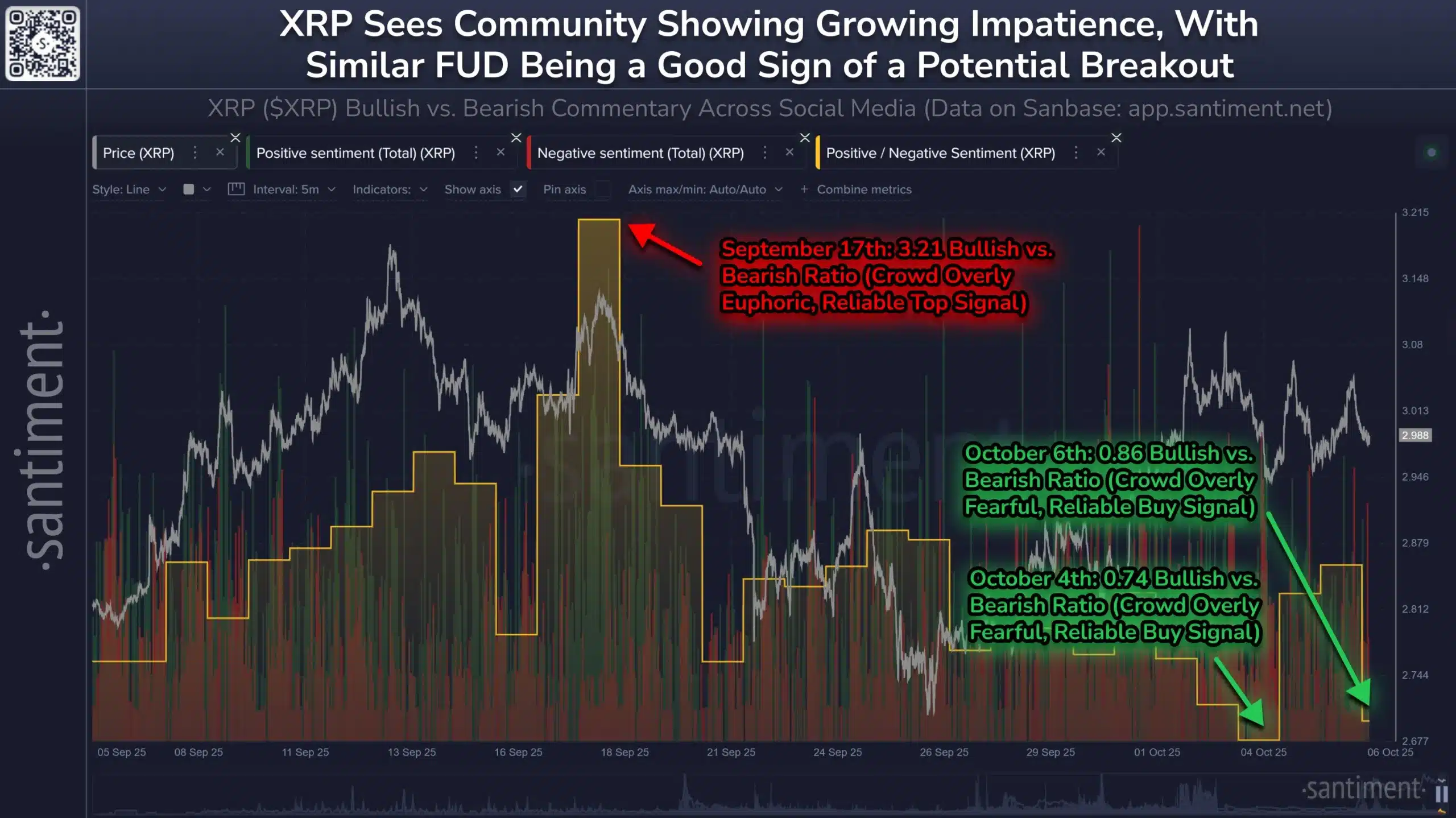

Rector’s comments came in response to new social sentiment data from Santiment, which revealed a sharp increase in retail FUD (fear, uncertainty, and doubt) surrounding XRP. According to Santiment, bearish commentary has outpaced bullish sentiment for two of the past three days, a pattern historically linked with potential market reversals.

“XRP is seeing its highest level of retail FUD since Trump’s tariffs were announced six months ago,” Santiment noted. “There have been more bearish comments than bullish for two of the past three days, which is generally a promising buy signal. Markets move opposite to small trader expectations.”

The accompanying Santiment chart visualizes XRP’s bullish versus bearish sentiment ratio across social media, showing key points of crowd psychology relative to price action. On September 17th, the bullish-to-bearish ratio peaked at 3.21, signaling overly euphoric sentiment and marking a reliable top before a price correction.

Source: Santiment/X

By October 4th–6th, the ratio plummeted to between 0.74 and 0.86, indicating excessive fear among traders, which is typically a buy signal in Santiment’s behavioral model. The sentiment flip aligns with XRP’s current price movement near $3.00, where the asset is consolidating after testing resistance levels seen in recent technical analyses.

Analyst View: Fear Could Precede Breakout

Rector’s remarks suggest that current fear in the XRP community may actually precede institutional accumulation, rather than mark the end of the rally. The combination of social pessimism, technical consolidation, and upcoming regulatory clarity could form a foundation for XRP’s next major leg upward.

“Frustration often peaks right before major transitions,” an analyst noted in a previous commentary. “Once the noise fades, the utility narrative and institutional involvement will speak for themselves.”

Conclusion: Crowd Fear Often Signals Opportunity

While retail traders appear shaken by lackluster price action and economic pressures, both sentiment data and institutional trends point toward potential strength ahead.

With Santiment’s metrics flashing a reliable buy signal and Rector’s long-term outlook underscoring the inevitability of institutional adoption, the current market fear surrounding XRP may, paradoxically, be its most bullish indicator yet.

Also Read: CME Group Starts Countdown to This Huge XRP and SOL Update