- XRP futures surge as institutions prepare for settlement corridor expansion.

- Bio-asset tokenization fuels growing demand for XRP in global markets.

- Institutional traders build long positions ahead of expected XRP liquidity boost.

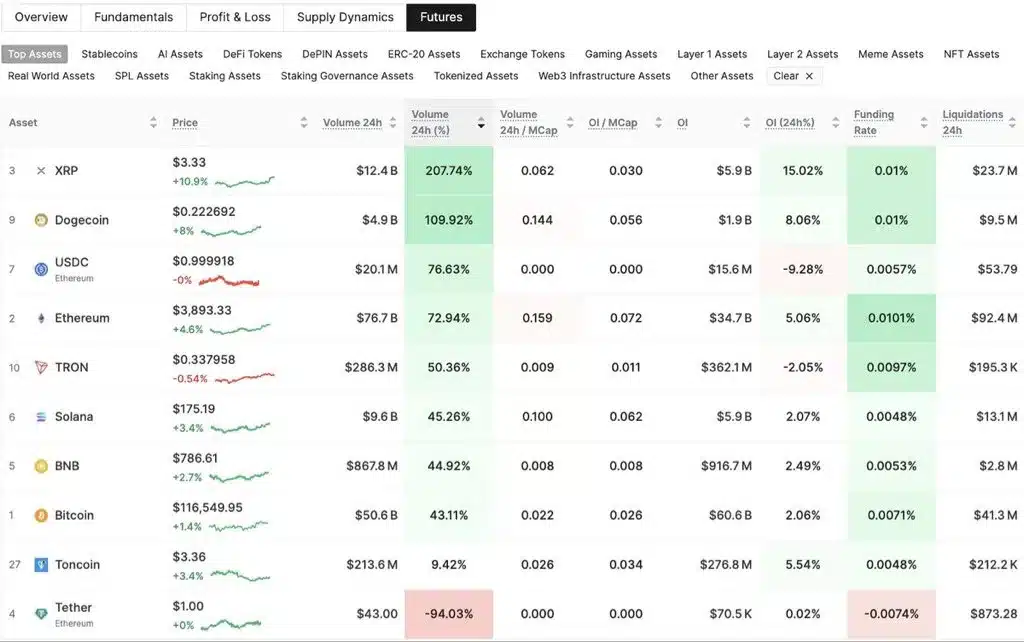

According to market analyst Pumpius, XRP futures posted a significant jump in trading volume and open interest within a single day. Statistics indicate that futures volume increased by 208% to $12.4 billion, higher than Solana’s $9.6 billion. Open interest increased 15 percent to $5.9 billion, and the funding rates remained positive, which implies that traders are paying to be long.

The analyst explained that in futures markets, a simultaneous increase in both metrics, combined with positive funding, often signals that large players are building directional positions. This is the trend in conventional finance and is an indication of firm belief in the institutions of traders.

Strategic Positioning Ahead of Settlement Corridor Expansion

Pumpius linked the recent surge to potential triggers in the payment and settlement infrastructure. Remarkable improvements include the ISO 20022 upgrades implemented in Fedwire and CHIPS, as well as the unexpected rise in throughput in Ripple payment corridors in the MENA and ASEAN.

🚨 THE XRP FUTURES SURGE

In 24 hours:

• Futures volume up +208% to $12.4B (overtaking Solana’s $9.6B)

• Open interest +15% to $5.9B

• Funding positive = longs are loading

If you think it’s random, you haven’t been watching the grid. 👇🧵 pic.twitter.com/xNirO4n67c

— Pumpius (@pumpius) August 9, 2025

Also Read: 777% XRP Pump About to Happen, Analyst Says Chart Doesn’t Lie

He also pointed out over-the-counter build-up patterns that are similar to exchange-traded fund seeding preparations.

As cross-border settlement corridors are widened, market makers need to hedge against XRP’s future settlement needs. This is done by opening long futures positions today and subsequently settling the transactions later via the OTC market, ensuring that the market is stable and not subjected to acute spikes in spot prices.

Source: Pumpius/X

Role of Tokenization and Bio-Asset Settlement

The surge in activity also coincides with the early launch of XDNA, the native token of the DNA Protocol built on XRPL for anchoring genomic identity data. Pumpius describes bio-asset settlement corridors such as those run by projects like DNAOnChain using XRP as the settlement layer. The Early Genesis Phase of XDNA has commenced to onboard laboratories in Africa to introduce identity-bound transactions that will be settled using XRP.

He suggested that the current positioning reflects preparation for a dual corridor activation involving both traditional financial settlements and identity-data tokenization. This would demand much liquidity, and early positioning of futures is critical to big players.

The sharp rise in XRP futures volume and open interest appears closely tied to institutional moves anticipating expanded settlement corridors and emerging tokenized identity-data flows. Future market activity indicates that significant developments could unfold before they become widely recognized by the public.

Also Read: Ethereum Breakout Signals Wave 3 Surge With $5,600 Target in Sight