Last updated on September 12th, 2023 at 08:03 pm

Gender imbalance has always been an issue in the cryptocurrency industry, even now, when the industry has already matured considerably. Many men still believe that women cannot grasp finances, which is why many male traders, when creating their communities, do not particularly encourage the presence of female traders, female influencers, and crypto writers.

Cryptocurrencies, by their nature, can be considered a part of the mainstream financial and pop culture sphere, and the issue of gender imbalance has become a frequent topic of discussion on social media.

Statistics

I’ve noticed that female leaders are not well-received, but for balance, I consider it essential to see influential women in leadership roles in the crypto space.

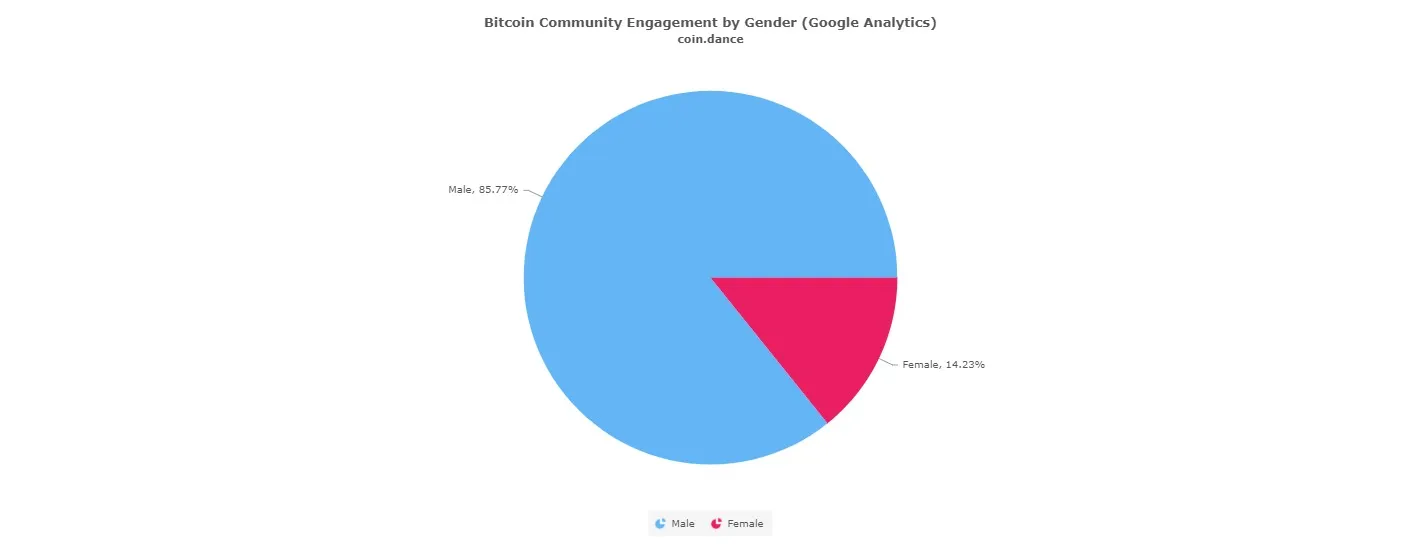

Furthermore, it is equally important to study how many women are actually investing in cryptocurrencies and using them on a practical level. According to Coin Dance, women make up 14 percent of investors in the blockchain sphere, as shown in the graph titled “Bitcoin Community Engagement by Gender.”

Data collected by CoinDance indicates that there is still a significant imbalance between the number of men and women in the crypto space.

“Bitcoin Community Engagement by Gender.” Last updated this week by CoinDance

Behavioral Differences — Nurture, Not Nature

I want to emphasize that there is nothing in female biology that compels female traders to behave differently from traders of other genders. More likely, the stereotype that has developed is a result of cultural conditions.

While exploring the internet, I came across a report for Finance Magnates titled “On the Trading Floor — The Battle of the Genders,” where Gemma Andrews, the Director of Parq Recruitment, wrote,

“I don’t think [female] aspirations differ from male ones, but I do think their approaches to success are different, and it should be that way.”

Since most global societies expect women to be the primary caregivers, they are raised accordingly.

“Women, consider crypto,” Alexia Bonatsos, a venture capitalist, wrote on Twitter. “Otherwise the men are going to get all the wealth, again.” I could have… https://t.co/hqviWl8TqD

— Simon (@kometxxl) March 21, 2018

The results of this study showed that all female traders in this field did not exhibit any unusual behavior. However, paradoxically, some traders are more inclined to take risks, regardless of their gender. Steven Simonis, Senior Writer at Finance Magnates, writes,

“Traders, both men and women, trade in different styles, approaches, and risks. Over the years, I’ve seen traders with small positions with stable profits and others with constant losses. Big risk-takers show greater profits but also lose big money. Styles vary, but the one thing that remains unchanged is that traders are a unique breed.”

My Experience as a Margin Trader

I first learned about trading and margin trading from a good acquaintance, who recommended choosing an exchange that supports margin trading. Some of these platforms include Coinbase Pro, Huobi, Bitfinex, Kraken, WhiteBIT, and others.

I decided to go with the exchange where I already had an account — WhiteBIT. This exchange allows trading only with a cross-margin account.

In simple terms, a cross-margin account is an account that holds margin assets. In this case, there is one margin level, and liquidation applies to all assets in the account simultaneously.

Please note that due to the high market volatility, you can risk losing all your funds in the account. Nevertheless, cross-margin trading allows profits from one pair to offset losses from another.

Example of Using Leverage

I contribute a portion of the total order value from my balance. I used margin to create leverage, allowing me to open larger positions than I could with only my own funds.

Example: I planned to invest $2,000 in Bitcoin with 5x leverage. The required margin would be 1/5 of $2,000. So, this means I need to have at least $400 in my account.

If I were to use 20x leverage, I would only need $100. Please note that the higher the leverage you choose, the higher the risk of liquidation.

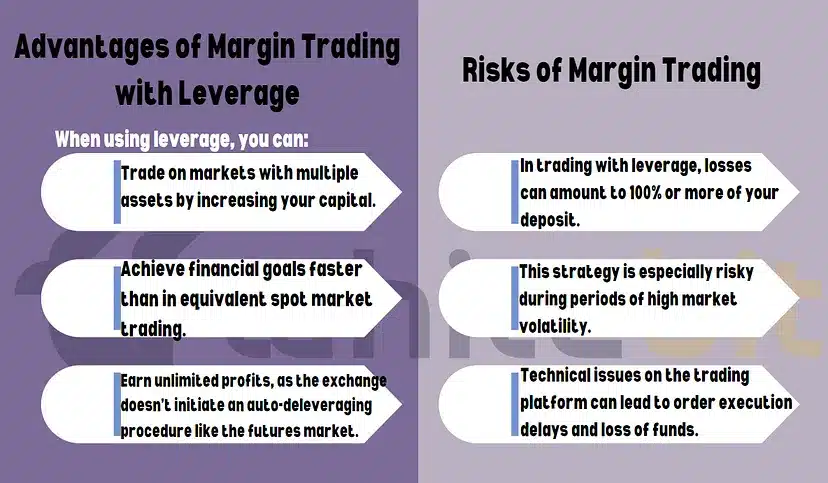

Margin trading has become a common strategy for traders, allowing people to profit from significant and rapid price fluctuations by opening long or short positions.

Advantages of Margin Trading on WhiteBIT

1. Margin trading allows you to trade with amounts significantly exceeding your own funds, which is a clear advantage compared to other trading, as it amplifies profits if the right position is taken.

2. WhiteBIT currently provides access to leverage from 1x to 20x.

3. There is a wide variety of margin trading pairs, which are constantly updated.

4. The platform offers a user-friendly interface.

5. You can access a detailed history of your positions in the “Trader History” tab.

6. WhiteBIT supports trigger-stop, limit, and market orders.

5 Tips from a Female Trader

In general, based on my personal experience, I’m very grateful to many members of the crypto community who helped me get started with trading. Here are 5 pieces of advice that will help you trade successfully:

- Acknowledge Your Mistakes: Often, novice traders take more time to admit their mistakes. It’s important to recognize when you’ve made an error.

- Seek Help from the Community: Once you’ve realized you’ve made a mistake, don’t hesitate to reach out to people who have a better understanding of the topic for assistance.

- Learn to Say “No”: Sometimes in trading, the best move is to refrain from making a trade. Practice stopping yourself from turning trades into gambles.

- Follow Guidelines: Both beginners and experienced traders should have a clear understanding of how the mechanism works. Therefore, read the user guides and listen to advice from trusted trader-influencers.

- Avoid Unnecessary Risks: Try to carefully consider each move and avoid risky maneuvers. According to David Heskett, the Executive Director of Financial Skills, women tend to take fewer risks, as he mentioned in an interview:

“We’ve found that men take more risks than women. It would be great if they also made more money, but they don’t.”

Conclusion

The cryptocurrency industry continues to grapple with gender imbalance, with women facing difficulties in gaining recognition and support within the crypto community.

Trading offers users ample opportunities to increase their income, but it also comes with inherent risks, especially in margin trading. Carefully considering leverage and adhering to the advice we provided above can help you trade successfully.

In the end, what matters most in the world of trading is knowledge, strategy, discipline, and an understanding of the market. Regardless of gender, anyone can thrive in the cryptocurrency trading arena.

Disclaimer:

This article is for informational purposes only and should not be considered as financial or investment advice. Always conduct your own research before making any financial decisions.

Read More: