The iShares Bitcoin Trust (IBIT) from BlackRock has achieved a significant step in the race for the spot Bitcoin ETFs. Being self-funded, IBIT is ranked highest among the new ETFs that started in 2024 with an inflow of approximately $20 million in the current year. This accomplishment brings out the realization of cryptocurrency as a mode of investment, especially with institutional investors.

The IBIT’s fast rise to the top has piqued the interest of industry professionals. Nate Geraci, president of the ETF Store, emphasized IBIT’s growing popularity on social media, pointing out its massive advantage over other ETFs introduced in 2024. Among the 375 new ETFs launched this year, the next largest non-spot Bitcoin ETF attracted $1.3 billion in inflows, demonstrating IBIT’s robust market presence.

Also Read: BlackRock’s Mitchnick Tempers Hopes for Solana and XRP ETFs

Rising Prominence Among Top Spot Bitcoin ETFs

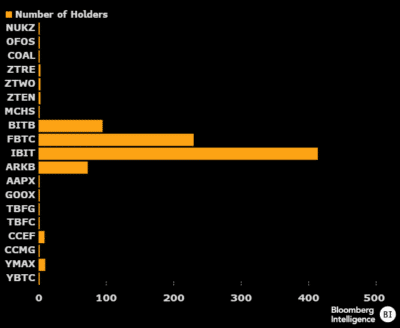

The four leading spot Bitcoin ETFs launched this year include BlackRock’s IBIT, Fidelity’s FBTC, Ark Invest’s ARKB, and Bitwise’s BITB. The Global X Russell 2000 ETF was in fifth place, and BlackRock’s Ethereum ETF – ETHA was sixth out of the ten most popular ETFs. Bloomberg Senior ETF Analyst Eric Balchunas pointed out that IBIT ended with 414 reported holders as of May, significantly outpacing its rivals. BITB, FBTC, and ARKB have around 100, slightly under 250, and less than 100 reported holders, respectively.

Source: Eric Balchunas

This is well in line with, and in fact, reflects a growing trend of investor interest in both Bitcoin and Ethereum through investments in the form of ETFs. The involvement of institutions in cryptocurrency is growing, with banking multinational company Goldman Sachs saying that the company owns $419 million worth of Bitcoin ETFs. Similarly, BlackRock’s chief executive officer, Larry Fink, has also admitted that Bitcoin has the role of portfolio diversification and is equal to gold.

Bitcoin Market Recovery Signals Positive Momentum

The biggest cryptocurrency has significantly rebounded, reaching the $60,000 price level. Bitcoin rose 4.2% in the last 24 hours, reaching $61,245. However, trade volume fell by 12.6% to $28 billion, indicating a more cautious posture from investors. In August, the trends can look somewhat volatile, while, in the current period, there are signs of a bullish trend in the Bitcoin market.

Therefore, BlackRock’s IBIT has become the most sustainable spot Bitcoin ETF of 2024 and a sign of institutional endorsement of cryptocurrency. As more investors hope to invest in Bitcoin and Ethereum, the market’s growth is set to continue.

Also Read: Larry Fink, CEO of BlackRock, Endorses Bitcoin as a “Legitimate Financial Instrument