Last updated on November 6th, 2024 at 06:59 am

Technology stocks rally in the U.S. brings positive momentum to Bitcoin after yesterday’s correction. Meanwhile, SUI leads the altcoin market with an 18% price surge.

The crypto market entered positive momentum as its total capitalization surged past the critical $2 trillion resistance, indicating strong market resilience. This 1.2% daily breakout has become a positive sign for investors, indicating renewed market strength.

Read Also: TEPCO Subsidiary Taps Bitcoin Mining to Harness Excess Renewable Energy

Cryptocurrency market total capitalization. Source: TradingView

The positive dynamics can be followed by Bitcoin’s (BTC) 4% recovery. On September 11, the first cryptocurrency reacted with the correction to the faster-than-expected U.S. Consumer Price Index (CPI), down 1.5% to $55,500. At the time of writing, Bitcoin is trading for over $58,000, reaching a weekly high.

BTC/USDT 1h chart. Source: WhiteBIT TradingView

The rise correlates with Asian morning hours on the back of a rally in U.S. technology stocks and gains in the Asian equity market. Thus, Nvidia (NVDA) ended the day up 8.2%, while major stocks Microsoft (MSFT), Google (GOOGL), and Apple (APPL) jumped as high as 2.13%.

Nevertheless, spot Bitcoin exchange-traded funds (ETFs) in the U.S. indicated strong outflows on Wednesday after a two-day inflow streak. According to SoSoValue data, on September 11 ETFs lost nearly $44 million.

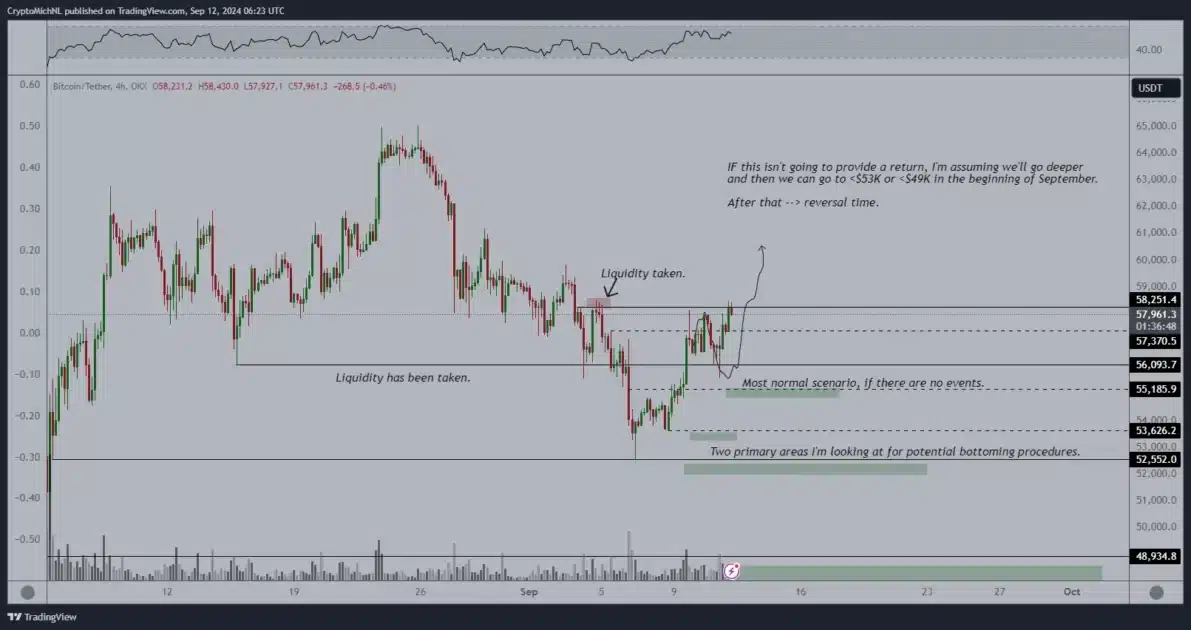

The recovery may result in a greater bullish rally, says analyst Michaël van de Poppe. In the post for X, he assumed that $62,000 is the next goal for Bitcoin, given its breakout above $58,000 sustains.

Read Also: Sharp Decline in Bitcoin and Ethereum Whale Transactions Sparks Market Speculation

BTC/USDT 4h chart. Source: Michaël van de Poppe

Meanwhile, BeInCrypto highlights $59,000 as a crucial resistance, which, if broken, still may spur a strong upward trend for Bitcoin.

Altcoin Market Dominated by SUI

While the altcoin market has been indicating positive momentum, layer-1 blockchain’s token Sui (SUI) showed an influx with over 18% growth in the last 24 hours. At the writing time, the token is trading for $1.0287, nearing its all-time high of $1.0495.

SUI/USDT 1h chart. Source: WhiteBIT TradingView

Sui is likely making the waves due to Grayscale’s recent announcement about opening the Grayscale Sui Trust. According to the asset operator, the NAV per share of the Trust is $13.50, and each share has 14.95 SUI tokens in it, putting the value of each token at 90 cents.

Read Also: Ethereum’s Incentive Structure May Shift with New-Based Rollups