Investors woke up today to a rally in the crypto market, led by the flagship cryptocurrency, Bitcoin. The movement has ignited optimism across the market as participants hope for a continuous trajectory. Bitcoin topped $61,000 earlier today even though it has now shed some of its gains and is not trading around the $60k zone.

Consequently, the total crypto market valuation has jumped to $2.08 trillion after spiking by 2% according to CoinMarketCap data. With this latest surge, investors are curious as to why the price of Bitcoin is up today. Let us look at some of the reasons catalyzing the upward trend in the market today.

Why Bitcoin Price is Up Today

Bitcoin has been consolidating between the $55,000 and $6,000 zone in the past seven days until its price broke the $61k mark earlier today. Here are some of the factors that caused the hike.

Read Also: MicroStrategy to Issue Senior Notes for $700 Million to Help Fund Direct Bitcoin Purchases

Anticipation of Rate Cuts by the Federal Reserve

One of the major reasons driving the entire crypto market surge today is the expectancy of a significant rate cut today by the Federal Reserve. This decision will be made during today’s Federal Open Market Committee (FOMC) meeting. The Federal Reserve would decide whether or not to cut the interest rate by a quarter or half point.

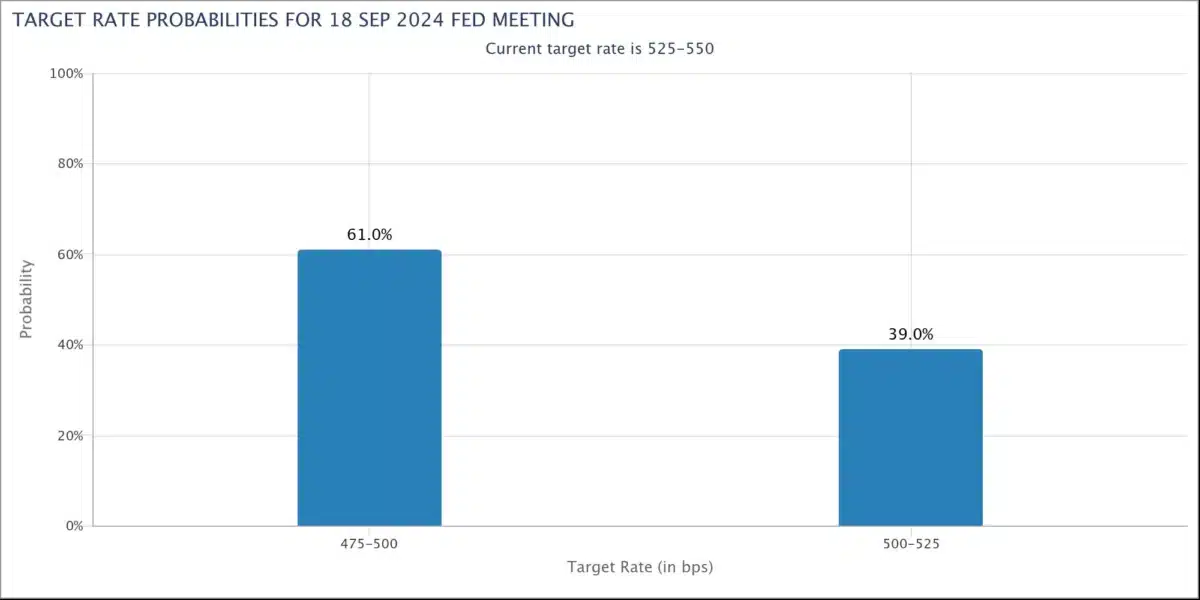

Following a series of rate hikes that increased borrowing costs to the highest level in about 20 years, the market expects the Federal Reserve to implement a cut that would be widely beneficial. In anticipation, traders have upped their bet as the CME Group’s FedWatch tool reflects a 61% likelihood of a half-point rate cut in contrast to a 39% quarter-point hike.

Target rate probabilities for the September 18 Fed meeting. Source: CME FedWatch

A 50-point cut would be beneficial for Bitcoin and other cryptocurrencies since lower interest rates catalyze investments in riskier assets like crypto.

Rising Bitcoin Spot ETF Inflows

Another reason why the Bitcoin price is up today is the rise in BTC exchange-traded funds products. According to a recent report by Spot on Chain on X (formerly Twitter), the net flow of Bitcoin ETFs recovered significantly as the price of Bitcoin crossed $61k in the last 24 hours. As per Soso Value data, Bitcoin ETFs saw a daily total net inflow of $186.7 million as of September 17, a continuation of the $403 million total net inflows observed last week, ending September 13.

Read Also: Crypto Market Eyes Federal Reserve’s Interest Rate Decision, Potential Impact on Bitcoin and XRP

Source: Soso Value

Stock Market’s Performance Affects Bitcoin

The United States stock market experienced a significant uptrend over the last day. The Standard and Poor’s 500 (S&P 500), a stock market index that tracks the performance of the top 500 largest public companies on the stock exchange, surged to a new all-time high of 5,670.81, indicating a 20% increase in 2024. The Bitcoin price has mirrored this pattern surging over 3 percent in the last 24 hours.

Bitcoin Price Movement

After trading as high as $61,258, Bitcoin has retraced a little even though it is still trading above $60k. According to CoinMarketCap data, Bitcoin changed hands at $60,313, indicating a 3.20% spike at the time of writing. What is more, a visible uptrend in its 24-hour trading volume can be spotted, jumping by 39.08%, reflecting increasing activities among investors and traders.

Source: CoinMarketCap

Market participants are not hoping for Bitcoin to break its new resistance level of $61,725 following the decision from the FOMC meeting. If this happens, then we might see an upward trajectory towards the $65k mark. But, a failure to breach this resistance could mean a downward trend below $60k.

Meanwhile, investors are advised to brace for volatility which could happen if the Fed only does a quarter-point cut today. This could have a heavy impact on investors and traders who are hoping to return to a more riskier market.

Read Also: MicroStrategy Expands Bitcoin Holdings with $1.11 Billion Purchase