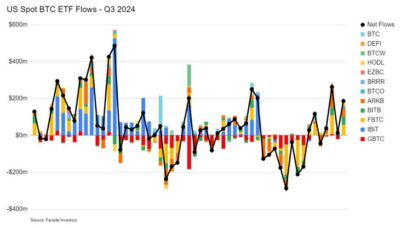

On Tuesday, Bitcoin exchange-traded funds (ETFs) attracted $187 million in new investments, marking a substantial day for cryptocurrency-focused funds. The Fidelity Wise Origin Bitcoin Fund (FBTC) led the inflows, which pulled in $56.6 million. Bitwise’s Bitcoin ETF (BITB) followed closely with $42.2 million, while VanEck’s Bitcoin ETF (HODL) secured $3.2 million.

Source: @CarpeNoctom

Also Read: BTC Crosses $61K: Why Did Bitcoin Price Surge Today?

BlackRock iShares ETF Sees No Activity Despite Competitor Gains.

While there was a general increase in flows into Bitcoin ETFs, there was no flow activity in BlackRock’s iShares Bitcoin ETF (IBIT) on the same date. This performance shocked many market spectators, especially given BlackRock’s leadership since the product’s launch in January. The BlackRock ETF has investments of more than $21 billion in Bitcoin, while the fund launched in January this year.

While competitors recorded steady inflows, BlackRock’s IBIT has remained stagnant, a development that has aroused the curiosity of cryptocurrency analysts. The fund has been one of the most active funds in the Bitcoin ETF niche but has recently almost come to a standstill.

Broader Trends in Bitcoin ETFs and Investor Behavior

The slowdown in BlackRock’s iShares ETF activity may suggest shifting investor preferences within the broader Bitcoin ETF landscape. As Bitcoin ETFs continue to mature, competition among fund managers has intensified. Management fees, liquidity, and historical performance have become significant factors for investors. This could be why some funds, such as Fidelity’s Wise Origin and Bitwise’s ETF, are experiencing higher inflows.

Further, fluctuations in the Bitcoin inflows have also resulted from macroeconomic factors alongside the highly volatile Bitcoin prices. Investors may diversify across multiple funds to reduce risk and understand the available management styles. As for BlackRock, the giant status coupled with the dominant market share may hamper the growth in the near term as the investors turn to smaller and more agile funds when volatility surges.

Conclusion

Tuesday’s figures highlight the competitive landscape of Bitcoin ETFs, with Fidelity, Bitwise, and VanEck making notable gains. BlackRock’s iShares ETF, despite its commanding position in the market, is facing an unexpected slowdown. Market analysts will closely watch if this trend continues or if BlackRock regains momentum in the coming weeks.

Also Read: MicroStrategy to Issue Senior Notes for $700 Million to Help Fund Direct Bitcoin Purchases