The market sentiment clears out with a strong bullish bias as macroeconomics updates poise Q4 for significant gains.

TL;DR

- Bitcoin (BTC) crosses $64,000 in momentum as the Bank of Japan (BoJ) restrains it from pushing interest rates higher.

- QCP Capital and Michaël van de Poppe expect significant returns from Q4 2024.

- Altcoins jumped higher following the sentiment, with Sui leading the gains.

Bitcoin (BTC) has surged 10% after a busy week, including historically big rate cuts by the U.S. Federal Reserve. The Fed established a 5% interest rate, down 50 basis points (bps) for the first time since 2020.

BTC/USDT 1h chart. Source: WhiteBIT TradingView

Read Also: Bitcoin ETFs See Significant Inflows, BlackRock’s iShares Bitcoin ETF Underperforms

This was followed by BTC briefly crossing $64,000 in Asian morning hours on Friday – partially due to the Bank of Japan (BOJ) decision to hold rates unchanged, avoiding a repeat of July’s market recession fears.

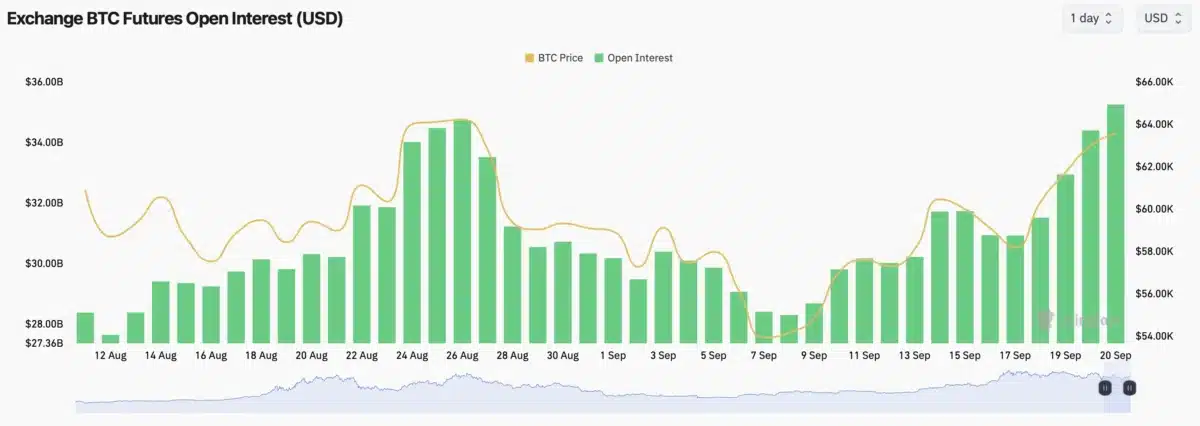

The Fed’s decision ultimately fueled the market. According to data from CoinGlass, Bitcoin saw a $5 billion uptick in open interest (OI) just around the FOMC meeting.

Bitcoin futures open interest (OI). Source: CoinGlass

All things considered spurred a fair share of optimism among investors. Michaël van de Poppe, a renowned market analyst, expects the fourth quarter of the year to be “bullish.” “Good things are likely to happen on the crypto markets after this week. Bullish Q4,” he wrote in a post on X.

Bank of Japan keeps rates at the same level, while the FED has cut the rates by 50 bps earlier this week.

Good things are likely to happen on the #Crypto markets after this week.

Bullish Q4.

— Michaël van de Poppe (@CryptoMichNL) September 20, 2024

Institutions also expect returns in Q4. “The US 2Y/10Y treasury spread, an indicator of recession, has been inverted since July 2022 but has recently steepened to +8bps,” QCP Capital traders said in a market broadcast Friday. “This reflects market optimism and a shift towards risk-on assets.”

As per the Bitcoin, analyst RektCapital sees $67,000 as a crucial breakout level to watch. “Bitcoin is breaking the Lower High downtrend dating to late July as we speak,” he said in an X post.

Altcoin Market Soars Up

Crypto markets followed economic updates, jumping slightly below 2% in the past 24 hours, according to data from CoinGecko. Today layer-1 tokens and memecoin lead the gains. Solana (SOL) and Ether (ETH) surged 7%, while Sui’s SUI skyrocketed 10% in the last 24 hours, totaling 50% weekly growth.

SUI/USDT 1h chart. Source: WhiteBIT TradingView

Newly-listed memecoins kept on sending mixed signals to investors. Baby Doge Coin (1MBABYDOGE) added 5% to its price, while Neiro Ethereum (NEIRO) slumped 10%, never making this out of a bearish trend since Monday. Ultimately, investors and users converge onto bullish outlooks for the market in Q4.

Read Also: MicroStrategy to Issue Senior Notes for $700 Million to Help Fund Direct Bitcoin Purchases