Coinbase (COIN) and MicroStrategy (MSTR) have emerged among the top-traded stocks, joining Tesla (TSLA) and Nvidia (NVDA) in the spotlight. Both crypto-related stocks gained over 18%, indicating increased investor interest in digital assets. Meanwhile, tech giants Apple, Microsoft, and Meta each dropped more than 1%, suggesting some investors may be shifting focus away from traditional tech.

Tesla rose by 10.99%, generating $30.39 billion in trading volume, reflecting strong investor confidence in the electric vehicle giant. However, Nvidia, which is leading the artificial intelligence business, saw its stock price decrease by 1.44%, indicating that the circuit board might be considered a semiconductor, nevertheless a warning sign for the chip industry.

Also Read: MicroStrategy Boosts Bitcoin Holdings with $2.03 Billion Purchase as BTC Hits New High

Bitcoin’s Rally Fuels Rising Crypto Enthusiasm

Bitcoin surged to $88,550, achieving a 6% gain within 24 hours, supported by a trading volume of over $97 billion. Bitcoin’s market cap has risen to $1.67 trillion, and its share of the overall cryptocurrency market rose to 58.31%. This has boosted the futures trading volume by 40.5% while liquidation surged by 35.75%, proving more action and investors’ risk-taking propensity in the market.

Source: Coinglass

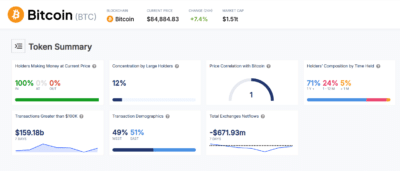

Bitcoin fundamentals are sound, as all current participants within the Bitcoin network are making a profit. Over $159 billion has been recorded to have been transacted over the last week regarding large transactions. Moreover, exchanges registered outflow amounting to $671 million and lend credence to the fact that there is a steady inclination to hold these despite increasing institutional and retail demand.

Divergence Between Tech and Crypto Markets

The rally in crypto stocks highlights a notable contrast with traditional tech, as Apple, Microsoft, and Meta’s declines suggest some consolidation within the sector. Furthermore, gold fell by 0.38 percent, a measure of a move to risk an asset. The Crypto Fear & Greed Index is now at 76, remarkably cautious optimism. At the same time, fluctuations in funding rates suggest that such fluctuations may hold a high trend in the volatility stratosphere.

Source: IntoTheBlock

As traditional tech consolidates, the sustained momentum in crypto markets hints at a potential shift in investor sentiment. With Bitcoin’s strong upward trend, the market watches closely to see if the bullish sentiment in digital assets will continue.

Also Read: Jeremy Hogan Foresees Major Changes in SEC Crypto Cases as Gensler’s Tenure May End by 2025