Despite recent price increases, CryptoQuant, a leading blockchain analysis platform, has stated that it remains a good time to enter the crypto market. Bitcoin (BTC) surged by 34% in November, yet CryptoQuant believes the market is not yet in its full bull run. According to the platform, while prices have risen, the explosive growth typically seen in a full bull market has yet to occur.

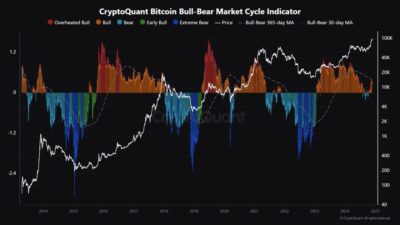

In addition to Bitcoin’s strong performance, altcoins have also shown considerable gains, reinforcing that the market still has room for growth. According to the Bitcoin Bull-Bear Market Cycle Indicator collected by CryptoQuant, the market is not in the “Extreme Bull” stage. According to the platform, these are standard adjustments known as a drawdown, which, in bull markets specifically, are expected to occur and can afford reasonable opportunities to enter into the trade.

Also Read: Binance Sees Surge in Bitcoin Profit-Taking Amid Price Surge, Indicating Strong Market Sentiment

Market Indicators Point to Future Growth

CryptoQuant highlighted the importance of drawdowns during bull cycles. Historical data shows that previous bull runs, such as those in 2017 and 2021, experienced significant pullbacks. 2017 Bitcoin saw a 22% dip, while the 2021 cycle saw corrections of 10% and 30%.

Thirdly, the current market cycle that began in 2024 has seen contraction, mainly comprising a drawdown of between 15% and 20%. According to CryptoQuant, such a shift is standard, and deeper drops may be good moments to join forces and invest in this market.

Source: CryptoQuant

It also highlighted critical industry trends that may explain why Bitcoin could extend higher; one is the Net Taker Volume, also called the 24HMA, which compares buying and selling pressure. At the time, taker selling pressure has approached considerable values of -$30,000,000, indicating improved willingness of buyers to pay more.

Another bullish signal is the Accumulation/Distribution line, which has increased since early November, indicating a strengthening of buying pressure even though distribution is evident.

Source: CryptoQuant

CryptoQuant’s data suggests that the current market cycle still holds significant potential for growth. Investors could benefit by entering the market during dips and positioning themselves for future gains.

Also Read: MicroStrategy Makes Largest Bitcoin Purchase, Boosting Holdings to 386,700 BTC