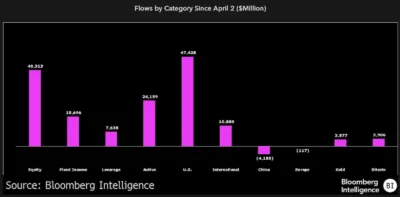

Since April, investors have shifted billions into US and technology-focused ETFs, signaling a renewed appetite for growth assets. Data from Bloomberg Intelligence shows U.S.-centric ETFs leading all categories with $47.4 billion in inflows.

The equity ETF market attracted $40.3 billion in investment funds, and active strategies received $24.2 billion in new capital. Fixed-income ETFs accumulated $15.7 billion from investors throughout the same period. Leveraged funds received $7.6 billion because short-term traders demonstrated an increased appetite for risky investing opportunities.

Source: Bloomberg Intelligence

Bloomberg analyst Eric Balchunas described the sharp rise of Technology ETFs as a “semi-shock” in the recent market pattern. Ecosystem investors quickly returned to tech stocks once they felt comfortable after lengthy periods of market apprehension.

Bitcoin-related ETFs have grown substantially from investors showing increased interest during this period. The BlackRock iShares Bitcoin Trust ETF (IBIT) received $531.2 million worth of investments on a single day on May 5. The Bitcoin-related ETF IBIT received $5.58 billion through its 15-day inflow period starting from April 17.

Also Read: Jim Cramer Exposes Why Following Popular Market Trends Could Cost You Big

Bitcoin ETF Momentum Signals Growing Confidence in Crypto Markets

IBIT’s assets under management have now reached $34.3 billion, surpassing BlackRock’s iShares Gold Trust (IAU). However, it still trails the SPDR Gold Shares (GLD), which maintains $98.1 billion.

Major Bitcoin exchanges saw their trading volume grow 12 percent to $22 billion on May 6 during 24 hours. More investors started using regulated crypto investment vehicles while institutional interest was rising.

Despite the broader regional decline, US investments in European ETFs surged. Chinese-focused ETFs managed to pull $4.2 billion in capital from investors, while non-U.S. ETFs gained $10.9 billion from investors during the same period. European financial products sold $117 million to investors during this period.

The overall decline in regional investments did not deter US investors from increasing their funding in European ETFs. During the first quarter of 2025, European funds received $10 billion in assets because of Germany’s infrastructure development alongside EU sector investment schemes. The activity for ETFs EWG and EUAD served as a leader in attracting investments, which resulted in $469 million for EUAD through October 2024.

Conclusion

Surging capital into US, tech, and crypto ETFs underscores investors’ growing confidence in high-growth sectors. IBIT’s rise highlights strong institutional demand for Bitcoin exposure amid shifting market conditions.

Also Read: The Crypto Tournament Game: How Trading Competitions Drive User Engagement and Market Liquidity