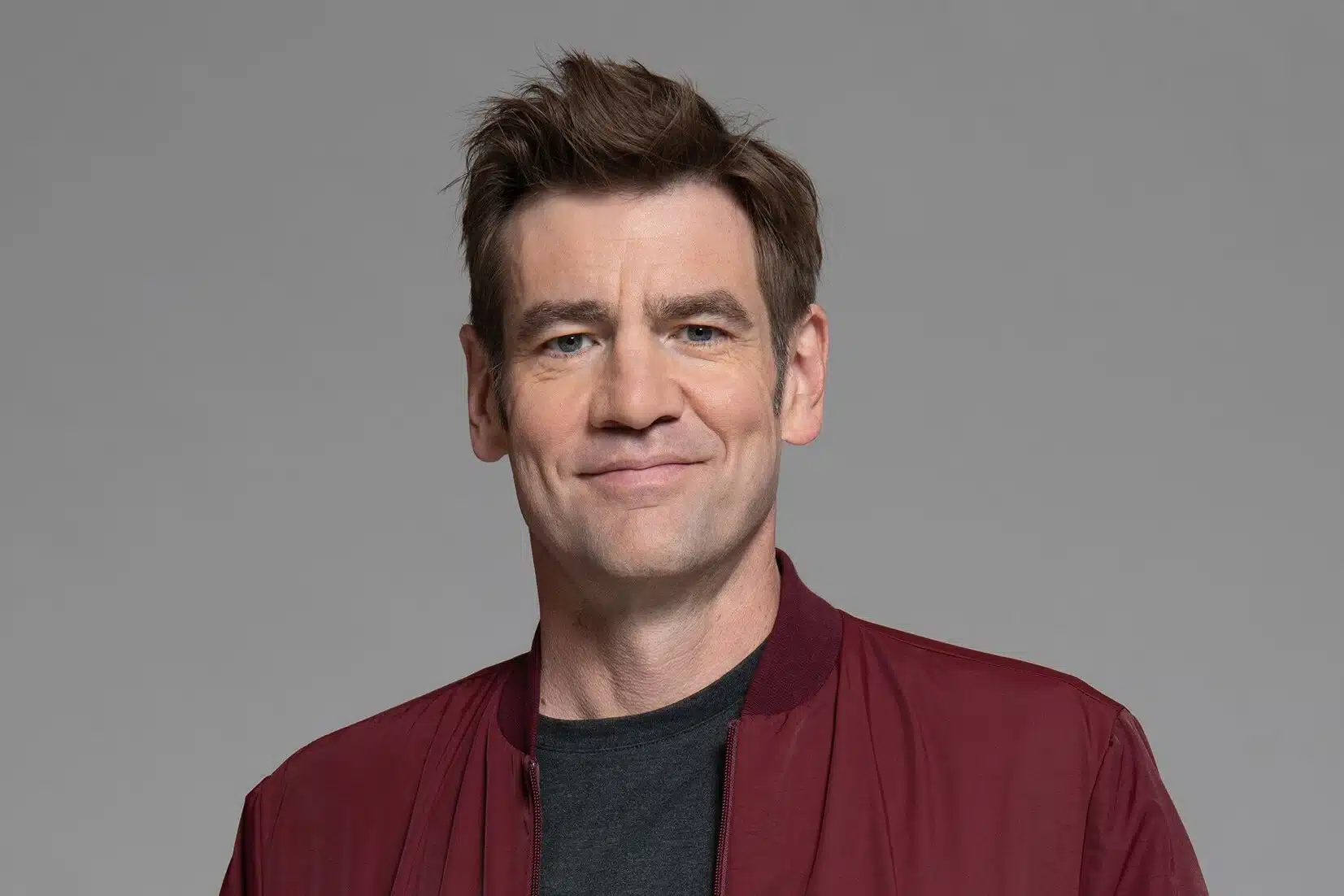

Chris Dixon is a leading investor, entrepreneur, and thinker in the blockchain and Web3 ecosystem. As a general partner at Andreessen Horowitz (a16z) and the founder of its crypto-focused division, Dixon has been instrumental in shaping the investment philosophy behind the decentralized Internet.

Through a16z Crypto, Dixon has championed early investments in major blockchain projects and advocated for developer-centric infrastructure, helping Web3 grow beyond speculation into a credible, innovation-driven movement.

Also Read: Warning: Ron Paul and Kiyosaki Say U.S. Debt Could Crush Freedom

Chris Dixon: Early Life and Career Path

Chris Dixon was born in Ohio in 1972. He entered the professional world by studying philosophy at Columbia University and then obtaining an MBA from Harvard Business School. From the very beginning, Dixon demonstrated a combination of academic inquiry and technical ambition that later cemented his differentiated approach to tech and venture capital.

Dixon attracted attention as a co-founder of SiteAdvisor, an internet security company that was purchased by McAfee in 2006, and Hunch, an eBay recommendation engine in 2011. These ventures prepared him for the transition from startup founder to venture capitalist.

After joining Andreessen Horowitz in 2010, Dixon began focusing on frontier technologies such as AI, virtual reality, and cryptocurrency. His faith in the future of decentralization prompted him to start a16z Crypto in 2018.

Dixon’s crypto thesis stressed that blockchains would make possible the next generation of internet services owned by communities, not corporations.

The Rise of a16z Crypto and Its 2025 Position

Under Dixon’s stewardship, a16z Crypto has become one of the most influential investment bodies in the blockchain sphere. The firm has invested in early-stage innovators such as Coinbase, OpenSea, Uniswap, dYdX and Optimism.

By 2025, a16z Crypto will operate as both a venture fund and a research-driven crypto lab. It facilitates startups and builds on Ethereum and Layer-2 solutions and next-gen infrastructure, such as zero-knowledge systems and decentralized identity.

Dixon organized a16z Crypto to provide more than just capital, policy guidance, developer tooling, and learning materials for a healthier, more responsible Web3 ecosystem.

Instead of chasing hype cycles, Dixon’s team had long-term theses around open networks, user ownership, and protocol composability, which suited Crypto’s original ethos.

Chris Dixon’s Net Worth and Strategic Investments

As of 2025, Chris Dixon’s estimated net worth is around $500 million, primarily attributed to his early involvement in crypto ventures through a16z and his equity in unicorns like Coinbase and OpenSea.

Beyond investing, Dixon channels resources into public goods and developer education. He helped found the a16z Crypto Startup School, whose graduates produce hundreds of builders yearly and fuel efforts for decentralized protocols.

He also contributed to foundational essays like “Why Decentralization Matters,” which inspired a wave of entrepreneurs and helped shape opinions

on his approach. He prioritizes long-term alignment and open participation to outmode traditional VC gatekeeping, positioning him as the champion of Crypto—its community-first future.

Philosophy, Influence, and Future Vision

Chris Dixon believes the Internet is undergoing a major shift—from centralized platforms to decentralized protocols. He argues that Web3 enables user sovereignty, better incentive models, and a return to the open Internet’s roots.

He regularly compares Web2’s extractive data models to the power to give ownership and governance rights to Web3 users. His writings show that tokens, smart contracts, and DAOs are not merely tools for finance but also for restoring trust online.

Dixon envisions a world in which these internet platforms and what controls them are owned and community-operated, like open-source software. In this vision, creators are paid directly, and users vote on upgrades, while innovative births come from the edges, not just Silicon Valley boardrooms.

As much as Crypto may be overhyped, Dixon is a patient optimist who often speaks of how the best Web3 ideas are growing young.

Challenges and Milestones in Dixon’s Web3 Mission

Dixon’s pilgrimage hasn’t been entirely smooth; a16z Crypto has undergone examination for its alleged centralization of power in an atmosphere said to be decentralized. However, Dixon has consistently called for transparency and distributed governance across its portfolio.

The crypto winter from 2022–2023 pushed investor conviction to the limit. While many firms backed off, Dixon doubled down, raising a $4.5 billion crypto fund, the largest of its type until then.

Issuing through volatility and regulatory obscurity, Dixon kept building for open protocols and tempering projects, such as Farcaster (decentralized social), Aztec (privacy infrastructure), and Helium (decentralized wireless).

His foresight and discipline helped a16z Crypto achieve dominance at the end of 2025 and provide situated value to both financial returns and ecosystem opportunities.

Conclusion

Chris Dixon has played a pivotal role in the evolution of Web3 through his investments, thought leadership, and commitment to open innovation.

His ability to combine long-term vision with tactical execution has positioned him as one of the most respected voices in crypto venture capital.

As decentralized systems become more mainstream in 2025 and beyond, Dixon’s influence is embedded in the infrastructure, protocols, and cultural mindset of Web3 builders worldwide.

His work inspires developers to prioritize trust, ownership, and transparency in the digital age.

FAQs

1. What inspired Chris Dixon to focus on Crypto?

He believed blockchain technology could restore the open, user-owned values of the early Internet by enabling decentralized applications and services.

2. What is Chris Dixon’s net worth in 2025?

His estimated net worth is around $1.2 billion, mainly from equity in crypto startups and his leadership at a16z Crypto.

3. What makes a16z Crypto unique among VC firms?

It combines capital, research, policy advocacy, and developer support to nurture long-term crypto infrastructure and protocols.

4. What challenges has Dixon faced in the Web3 space?

He navigated regulatory uncertainty, bear markets, and criticism of centralization while promoting community ownership and protocol governance.

5. What is Dixon’s vision for the future of the Internet?

He envisions an open, decentralized internet where users own their data, creators get paid fairly, and communities—not monopolies, govern networks.

Also Read: Andre Cronje: Early Life and Net Worth – The Vision Behind Yearn Finance and DeFi Innovation13