BlackRock entered the spotlight after blockchain intelligence platform Arkham revealed on X that the global asset manager purchased $50 million worth of Ethereum (ETH). Based on Arkham’s data, the transactions were traced through Coinbase Prime, with amounts ranging from 9,000 to over 58,000 ETH.

The revealed data included visuals showing a consistent accumulation of Ethereum by addresses tied to BlackRock. These movements, valued between $23 million and $61 million, reflect growing institutional attention toward digital assets.

This activity has stirred discussions across the financial and crypto sectors. Many observers are questioning whether BlackRock’s timing signals internal knowledge, regulatory positioning, or a broader strategic shift into blockchain technologies.

Also Read: Wall Street is Watching XRP to Escape Hyperinflation, Pundit Claims

Ethereum Exchange Activity Signals Increased Market Movements

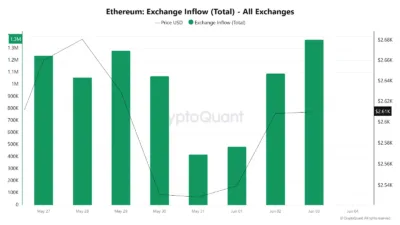

Meanwhile, Ethereum’s exchange activity has surged within the same timeframe. According to CryptoQuant data, exchange inflows climbed from around 200,000 ETH on May 27 to over 1.3 million ETH by June 1, before declining again.

Despite this influx, Ethereum’s price remained relatively stable between $2,580 and $2,650. This indicates that selling pressure from large inflows was balanced mainly by sustained buying interest, helping ETH avoid any steep price correction.

Ethereum’s market behavior showed resilience during this period. Fixed price movements were observed, which indicated confidence among investors despite high trading volumes.

As of now, CoinMarketCap shows Ethereum priced at $2,626.67, with a 0.47 percent gain in the past 24 hours. On the day before, trading volume stood at $19.76 billion, though it fell by almost 18 percent, pointing to a dip after the initial boost.

While the reasons behind the increased inflows remain unclear, analysts suggest large holders may be restructuring their portfolios. Experts are also examining whether big players in the industry will adjust their actions in response to new trends or guidelines.

BlackRock’s investment in Ethereum has convinced others in the industry to consider institutional involvement. As digital asset volumes and prices remain high, this trend shows that more traditional finance players are adopting digital assets.

Also Read: Solana Tumbles, Bitcoin Holds Firm as Crypto Giants Bleed Over the Week