Corporations are rapidly shifting their financial strategies as Bitcoin emerges as a key reserve asset. Japan’s Metaplanet and U.S.-based Cardone Capital have initiated bold moves to anchor their balance sheets with significant Bitcoin holdings.

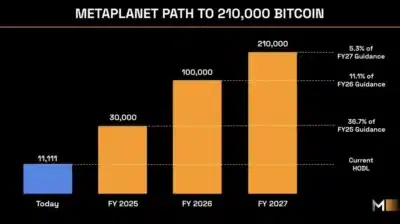

Metaplanet has laid out a multi-year acquisition plan to secure 1 percent of Bitcoin’s total supply. The company currently holds 11,111 BTC and plans to raise that to 30,000 BTC in fiscal year 2025. In its roadmap, it then sets the target of 100,000 BTC in 2026 and 210,000 BTC the year after.

According to Metaplanet CEO Simon Gerovich, who shared the strategy chart on X, the firm is taking a deliberate and structured approach. Strategy executive chairman Michael Saylor backed the post, pointing to the firm’s vision to become a Bitcoin Sovereign.

A long-gone idea related to nation-states is now gaining ground in corporate institutions. It is an indicator of a transition to less fiat money based on financial models and old banking systems.

Source: Simon Gerovich

Also Read: Ripple-SEC Case Could End Soon as Expert Dismisses 2026 Delay Concerns

Companies Set New Standards in Bitcoin Treasury Strategy

Metaplanet’s efforts align with the playbook used by Strategy, which currently holds more than 592,100 BTC. If Metaplanet meets its targets, it will become one of the largest corporate holders of Bitcoin, especially in the Asia-Pacific region, where digital asset adoption is accelerating.

Cardone Capital has pursued a less aggressive, although equally vigorous, approach in the United States. Led by Grant Cardone, the real estate investment company recently acquired 1,000 BTC worth approximately 101 million dollars. The corporation stated that it will gain another 3,000 BTC by the end of 2021.

According to Grant Cardone, the move will be a strategic blend of Bitcoin and real estate due to their long-term advantages, which he terms substantial assets. Cardone Capital’s current property under management comprises over 14,000 multifamily units worth 5.1 billion dollars.

With these developments, Bitcoin is emerging as a core ingredient in corporate treasury management. It is becoming a major reserve asset and is being treated as such by companies in an institutional trend towards the adoption of Bitcoin worldwide.

Metaplanet and Cardone Capital’s decisive steps signal a broader corporate shift toward Bitcoin reserves. As more firms adopt similar strategies, the global race for Bitcoin holdings is gaining momentum.

Also Read: Ripple vs. SEC Conclusion to Reach 2026? New Speculation Triggers XRP Community