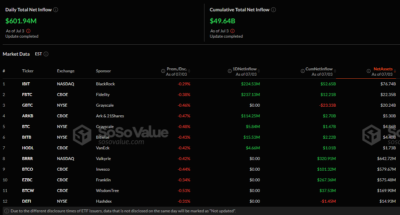

- Fidelity’s FBTC leads the ETF surge with a massive $237 million single-day inflow.

- Bitcoin ETFs rake in over $602 million as prices edge closer to the $110,000 mark.

- Spot ETF assets now cover 63.3% of Bitcoin’s market cap after two weeks of aggressive inflows.

Bitcoin ETFs witnessed a significant surge in institutional inflows on July 3, totaling over $602 million in a single trading session. This marks one of the strongest daily performances for the ETF sector, signaling renewed Wall Street interest as Bitcoin approaches the $110,000 level.

Fidelity led the market through its FBTC ETF, which gathered a sum of $237 million, confirming its stature as the market juggernaut. ARKB, a firm by ARK Invest, came in close behind with $114 million, and BITB, administered by Bitwise, had an addition of $15.53 million. A rare net demand was recorded in the GBTC, which has been experiencing constant outflows, as investors reported $5.84 million in purchases, signaling a possible change in sentiment.

In addition to the Bitcoin-related funds, Ethereum ETFs also saw massive inflows totaling $149 million. The major exception was Grayscale, where ETHE experienced an outflow of $5.35 million, regardless of the inflow that prevailed in the entire sector.

Also Read: Rosie Rios Says XRP Is the Future of Finance—Hints at Major Shift Ahead

Massive ETF Inflows Fuel Bitcoin’s Push Toward $110K Mark

The sharp rise in capital through ETFs comes as Bitcoin recently broke above a key descending resistance line. This technical breakout has brought the cryptocurrency closer to the critical resistance zone between $110,000 and $115,000. Market indicators remain positive, although the RSI is hovering around 57, suggesting some caution due to potential profit-taking.

With over $3 billion in net inflows over the past two weeks, total net assets held by Bitcoin spot ETFs have surged to $137 billion. This amount currently comprises about 63.3 percent of the total market capitalization of Bitcoin. The massive inflow of institutional capital has enhanced the positioning of ETFs as a primary entrance for large investors who want to access Bitcoin.

Traders are intensively analyzing whether further ETF inflows can carry Bitcoin beyond its existing resistance. A break above 115,000 might open a path to a drift towards 120,000. Nevertheless, the $100,000 to $103,000 range should be considered a short-term pullback in case the buying momentum reduces.

Wall Street’s aggressive reentry into Bitcoin ETFs highlights the asset’s growing acceptance among institutional investors. With capital flooding into regulated crypto instruments, Bitcoin’s path toward new highs now rests on the sustainability of these inflows.

Also Read: SHIB Burns Explode: 1.3 Billion Tokens Torched as Daily Rate Soars 4,000%