- Whale trader sparks controversy with new $163M Bitcoin short bet.

- Crypto markets shaken as “insider whale” profits ahead of crash.

- Binance denies involvement amid chaos following massive Bitcoin short.

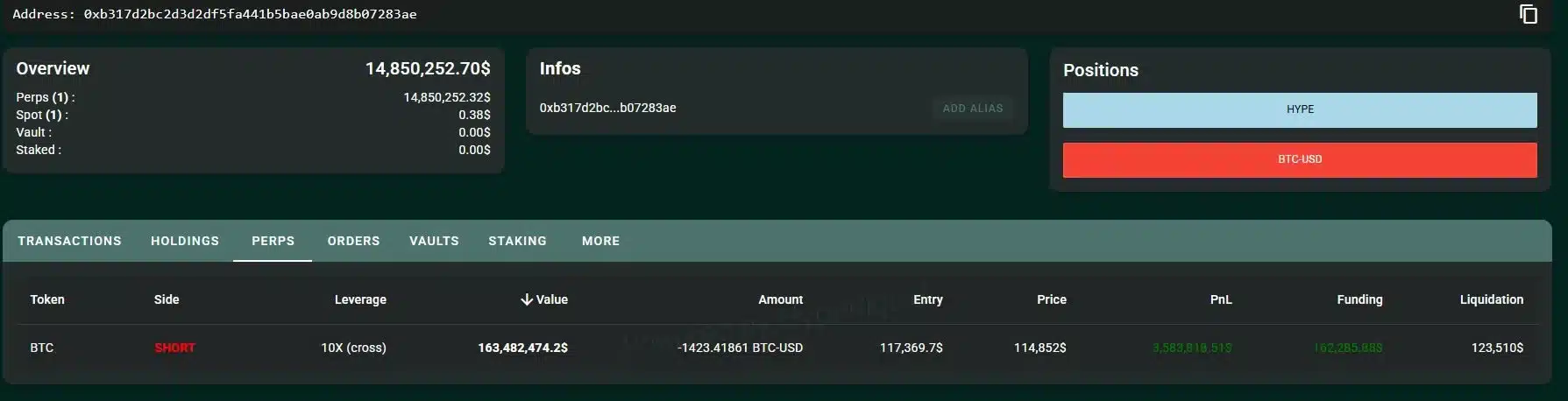

A mysterious crypto whale has once again shaken the digital asset market after opening another massive short position on Bitcoin. The trader, identified by wallet address 0xb317 on the Hyperliquid decentralized derivatives exchange, has reportedly placed a $163 million leveraged perpetual short contract against Bitcoin.

This move comes just days after the same trader made headlines for earning an estimated $192 million in profits from a well-timed short placed shortly before Donald Trump’s tariff announcement.

The event triggered a sharp sell-off across the crypto market, leaving many to suspect insider knowledge behind the perfectly timed trades.

The new position, valued at 10x leverage, is already showing a profit of around $3.5 million. However, it faces liquidation if Bitcoin rises to $125,500. With Bitcoin currently trading near $114,900, the whale’s latest maneuver has once again drawn significant attention from the crypto community.

Source: Hypurrscan

Also Read: Here’s How the Recent XRP Crash Compares to the Past – What Comes Next?

Crypto Community Labels Trader as “Insider Whale”

Many observers on social media have accused the trader of being an “insider whale,” pointing to the uncanny timing of the positions. According to analyst MLM, the trader opened another nine-figure short on Bitcoin and Ethereum minutes before a cascade that wiped out leveraged positions across the market.

Data from HyperTracker indicated that more than 250 wallets lost millionaire status on Hyperliquid following the market crash. Meanwhile, a separate trader reportedly took a more bullish stance by opening a 40x leveraged $11 million long position on Bitcoin, attempting to profit from any potential rebound.

The sharp decline has reignited discussions about transparency and fairness in unregulated crypto markets. SWP Berlin researcher Janis Kluge noted that the recent turmoil highlights the risks of market manipulation and the absence of clear oversight in decentralized trading environments.

Binance Responds to Speculation Over Market Turmoil

As speculation grew, some traders blamed Binance for contributing to the crash, citing failed order books, malfunctioning stop-losses, and brief token depegs. Binance denied any involvement, clarifying that the event was caused by a display issue rather than a technical failure.

The exchange confirmed that its core futures and spot systems remained fully functional throughout the incident. Additionally, Binance offered approximately $283 million in compensation to traders who were liquidated while using depegged assets such as USDE, BNSOL, and WBETH as collateral.

Despite the chaos, Binance’s native token BNB rebounded sharply, surging by 14 percent in the past 24 hours to reclaim levels above $1,300. The strong recovery reflected cautious optimism among traders even as the market continues to grapple with heightened volatility and growing fears of insider influence.

Also Read: Nate Geraci: No XRP ETFs Until This Happens