- Bitcoin consolidates near $68,000, waiting for breakout above $74,124.

- Fidelity’s Jurrien Timmer predicts $60,000 as Bitcoin’s cycle bottom.

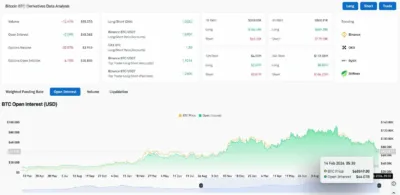

- Spot inflows and rising open interest signal Bitcoin market accumulation.

Bitcoin price today trades near $68,795, down slightly in the past 24 hours after testing the $69,400 resistance zone. This price action comes after Fidelity’s Director of Global Macro, Jurrien Timmer, called Bitcoin’s $60,000 low the cycle bottom, predicting a new bull market will begin after a consolidation phase.

Despite the recent pullback, Bitcoin has shown resilience by holding strong support levels. The market appears to be shifting toward accumulation, with positive spot flows suggesting that buyers are gradually returning to the market. However, the critical question now is whether Bitcoin can break above the $74,124 resistance level, a crucial point that will determine the next major move

Also Read: ASTR (ASTER) Price Prediction 2026–2030: Can ASTER Hit $1.00 Soon?

Spot Inflows and Rising Open Interest Signal Accumulation

Exchange flow data supports the argument that Bitcoin is experiencing accumulation rather than distribution. According to Coinglass, Bitcoin’s open interest has climbed by 2.09% to $45.36 billion, indicating that traders are rebuilding positions after the February 5 liquidation event. Moreover, spot flows show $12.90 million in net inflows on February 14, a reversal from the earlier outflows that pressured Bitcoin’s price in early February.

Source: Coinglass

This combination of rising open interest and spot inflows suggests that demand is returning to the market, supporting the thesis of a market consolidation before the next bull run. As Timmer noted, this could lead to a new cyclical bull market, further supported by institutional adoption and maturing volatility in Bitcoin’s price.

EMA Structure and the 200-Day EMA Resistance

On the daily chart, Bitcoin is still trading below all major moving averages, with the 20-day EMA sitting at $74,124, the 50-day at $81,594, the 100-day at $88,177, and the 200-day at $94,353. These EMAs continue to act as resistance, forming a clear ceiling for Bitcoin’s price in the short term.

While Bitcoin has shown signs of stabilization, the price remains firmly below these moving averages, indicating that the corrective phase may not yet be over. However, a daily close above the 20-day EMA at $74,124 would signal the first signs of trend exhaustion and could open the door to higher levels.

The key resistance levels to keep an eye on are the 20-day EMA at $74,124, the 50-day EMA at $81,594, the 100-day EMA at $88,177, and the 200-day EMA at $94,353. These moving averages act as crucial barriers, with each one representing a level where Bitcoin’s price has previously struggled to break through, and they will play a significant role in determining the next potential price action.

Bitcoin’s Range-Bound Trading Shows Consolidation Phase

On the hourly chart, Bitcoin is trapped in a tight range between $68,000 and $70,000, with parabolic SAR at $69,395 acting as immediate resistance. The Relative Strength Index (RSI) is holding at 61.53, showing no clear directional bias. Buyers are defending the $68,000 level, while sellers are rejecting any price above $69,400, preventing a breakout toward $70,000.

This range-bound trading reflects Timmer’s prediction of a “backing and filling” phase, where Bitcoin moves within a narrow range before deciding its next major direction. If Bitcoin can break above $69,395, the $70,000 level could come back into focus. However, if the price breaks down below $68,000, Bitcoin could revisit the $66,000 support level and potentially challenge the $60,000 lower bound.

Key Support and Resistance Levels for Bitcoin

For Bitcoin’s bullish case to remain intact, it must maintain support above the $68,000 level and break through the 20-day EMA, which sits at $74,124. A sustained close above this resistance level would indicate the beginning of a new bull market, potentially pushing Bitcoin toward higher resistance zones. If Bitcoin can hold above these levels, it could pave the way for further upward movement. The critical levels to monitor include support between $60,000 and $68,000, while the resistance levels to watch are the 20-day EMA at $74,124, the 50-day EMA at $81,594, and the 100-day EMA at $88,177.

Bitcoin Price Prediction 2026–2030

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2026 | $60,000 | $75,000 | $90,000 |

| 2027 | $65,000 | $80,000 | $95,000 |

| 2028 | $70,000 | $85,000 | $100,000 |

| 2029 | $75,000 | $90,000 | $110,000 |

| 2030 | $80,000 | $100,000 | $120,000 |

2026

Bitcoin enters 2026 with a critical focus on maintaining support above $60,000. A confirmed breakout above the 20-day EMA at $74,124 would signal the start of the next accumulation phase, possibly targeting higher levels by mid-year. However, until this breakout occurs, Bitcoin’s price may remain within a consolidation phase.

2027

With institutional adoption continuing and the macroeconomic environment improving, Bitcoin could experience a steady uptrend. During this period, volatility may compress as Bitcoin stabilizes within higher price ranges. A sustained move above $80,000 could confirm the next phase of the bull market.

2028

Bitcoin’s fundamentals remain strong, and if institutional inflows persist, Bitcoin could attempt a more sustainable recovery, gradually moving toward $100,000. Given its expanding use case in the financial ecosystem, this period could mark the beginning of a more mature phase for Bitcoin.

2029

By 2029, Bitcoin could be well on its way to testing new highs, assuming it successfully maintains support above previous resistance zones. A clear long-term uptrend could emerge, with $110,000 as a possible target.

2030

In the long term, Bitcoin is likely to be firmly entrenched above the $100,000 mark. If it establishes a new base above former resistance levels, it could see further price discovery, ultimately challenging its previous all-time highs.

Conclusion

Bitcoin has shown signs of consolidation and stability, supported by institutional adoption and positive market inflows. While the current price action is range-bound, a breakout above key resistance levels, including the 20-day EMA at $74,124, could signal the start of a new bull market. The outlook for 2026–2030 remains bullish, with Bitcoin poised for long-term growth if it can maintain upward momentum above critical support and resistance levels.

FAQs

1. Why is Bitcoin’s price moving sideways now?

Bitcoin is currently in a consolidation phase, with support at $60,000 and resistance at $74,124. The market is waiting for a clear breakout before deciding on its next move.

2.What is the key support level for Bitcoin?

The key support level is $60,000, followed by $68,000.

3.What resistance must Bitcoin break to turn bullish?

A daily close above the 20-day EMA at $74,124 is required to confirm a trend reversal and open the path to higher prices.

4. Could Bitcoin fall back to $60,000?

Yes, a breakdown below $68,000 could retest $60,000, which would invalidate the current bullish thesis.

5. Is Bitcoin still in a downtrend?

While Bitcoin is in a corrective phase, the market is stabilizing, and a breakout above key resistance levels could signal the end of the downtrend.

Also Read: Pyth Network (PYTH) Price Prediction 2026-2030: Will PYTH Hit $0.078 Soon?