The global crypto market continues to experience bullish sentiment and our price analysis for today November 13 reveals a potential continuation of the trend.

According to CoinMarketCap data, the Crypto Fear and Greed Index rests at 72 indicating that the bulls are still dominating the market. Regardless of this, Bitcoin has opened the week with a slight correction. However, altcoin traders do not appear to be disturbed about the small price pullback.

A slight price correction is seen as a good sign by traders as it is viewed as a buying opportunity for those who are looking to get into action given that Bitcoin is expected to rally into 2024.

With Bitcoin up over 120% so far this year, the sentiment surrounding cryptocurrencies has improved. BitInfoCharts data shows that strong purchasing has led to a substantial increase in cryptocurrency wallets holding more than $1 million in Bitcoin this year, from 23,795 on January 1 to 81,925 now.

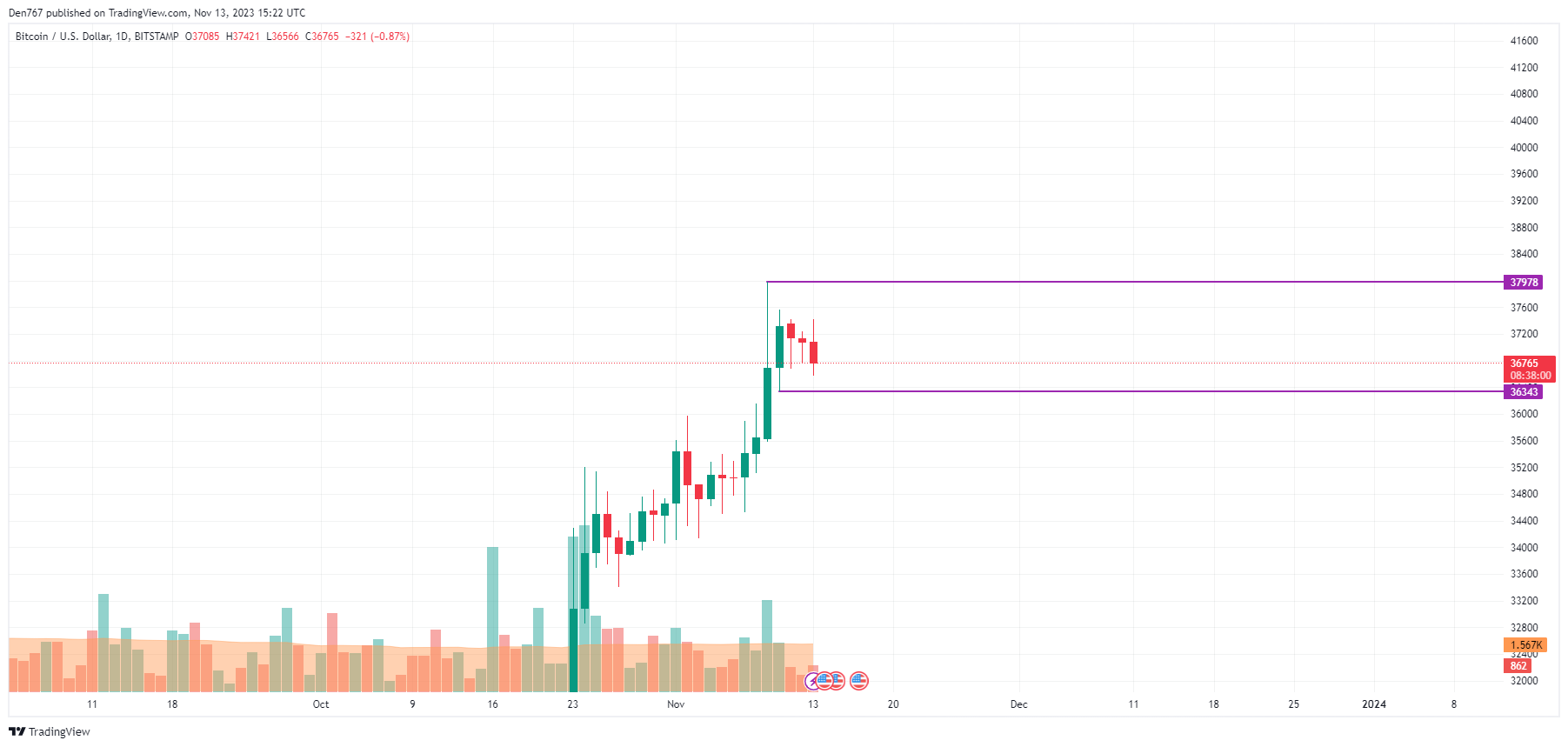

Bitcoin (BTC) price analysis

Per Coinstats data, the price of Bitcoin is currently down by 0.88% over the last 24 hours. If the price declines to the $36,343 support level, then Bitcoin might face a correction. As a result, the bears will take over and the price might be pushed further down to the $35,500-$36,000 zone.

Additionally, the RSI’s overbought position signals the potential for a short-term correction or consolidation. If the bears manage to pull the BTC/USDT pair below the channel, the decline can go all the way down to $32,400 and finally $31,000.

Source: TradingView

At the time of writing, Bitcoin is changing hands at $36,769 with a 24-hour trading volume of $17,459,322,037 ($17.4 billion).

Ethereum (ETH) price analysis

The second-largest cryptocurrency by market cap, Ethereum on the other hand has started the week on a rather positive note. The price of the coin has increased by 1.6% since yesterday.

Compared to Bitcoin, ETH has gained more over the last 24 hours and even in the last 7 days. Ethereum has spiked past the $2,029 level.

If the price continues to remain above this mark and overcomes the $2,200 obstacle, then there is a better chance for an even upward movement to $3,000 since there are no major resistance levels in between.

Source: TradingView

According to Coinstats data, Ethereum (ETH) is currently trading at $2,096 with a 24-hour trading volume of $20,950,669,679 ($20.9 billion).

Ripple (XRP) analysis

XRP has enjoyed the best gains among the two aforementioned coins. It continues to maintain a spot in the top trending cryptocurrencies in the market right now. At the time of writing, XRP value has grown by 7.01% in the last 24 hours.

Looking at the XRP chart, traders should pay more attention to the nearest $0.6283 level. If the price continues to remain above this level, then traders could expect a pump to $0.74. Furthermore, XRP might continue a rally toward $0.85.

However, if the price closes near or below the $0.6283 level, then we might see a decline to the $0.60 zone soon and to the $0.56 support.

Source: TradingView

At the time of writing, XRP is trading at $0.72 with a 24-hour trading volume of $1,537,044,864 ($1.5 billion).

Read more: