From March 2022 to the present, the crypto industry has been actively evolving. The year 2023 is coming to an end, marking the conclusion of the longest bearish phase in the history of the cryptocurrency market.

The ecosystem has been expanding its connections with traditional finance, launching major networks, and many cryptocurrencies have soared to new heights.

Over the past year, the industry has further matured, successfully overcoming challenges that could have been fatal just a few years ago. Despite a decrease in market capitalization, regulatory pressure, and a crisis of trust, several strong projects, such as WB Network and BASE, have entered the market. New trends have emerged that have the potential to reshape the dynamics within the industry.

In the crypto space, something is always happening, and this year was no exception. I have compiled the key events and narratives of 2023 into one article.

1. Taylor Swift dodged a bullet, declared the lawyer suing Tom Brady and Shaq

Adam Moskowitz, the attorney leading a collective $5 billion lawsuit against the famous promoters of the bankrupt FTX, emphasized Taylor Swift’s cautious approach in her dealings with the cryptocurrency exchange during an April podcast episode of The Scoop with Frank Chaparro.

Reportedly, Swift questioned whether FTX was selling unregistered securities, a step that most other celebrities, including Shaquille O’Neal and Tom Brady, did not take. Moskowitz’s lawsuit targets numerous high-profile individuals for promoting unregistered securities through FTX, expressing surprise at the lack of due diligence by most influential figures.

However, later, New York Magazine reported that Swift had signed a contract as a sponsor for FTX. Subsequently, former CEO Sam Bankman-Fried decided to terminate the deal himself, leaving Swift’s team disappointed.

2. EU Council’s Bold Move: MiCA Reshapes Digital Asset Landscape

On May 16, the EU Council unanimously adopted the regulation on the regulation of cryptocurrencies in the European Union (MiCA), among other things, establishing a legal framework for digital asset transactions and the operations of industry companies.

Unlike most other jurisdictions attempting to fit cryptocurrencies into securities or financial legislation, the EU, in developing MiCA, took into account the peculiarities of blockchain technology and the circulation of digital assets.

The rules establish:

- Classification of tokens.

- Disclosure requirements for crypto companies.

- Rules for the issuance, distribution, and exchange of digital assets.

DeFi protocols and related operations are not addressed in this version of the regulation but are likely to be regulated in the future after conducting the necessary research.

The significance of MiCA extends beyond introducing the first transparent regulatory framework for cryptocurrencies in the EU. The regulation has also influenced countries such as Turkey and Ukraine, in particular. However, there are risks noted in the implementation of rules without considering the specifics of the national market.

It is important to note that most key provisions of MiCA, such as requirements for stablecoin issuers, mandatory company registration, and the exchange of tax information, will only come into effect in 2024.

3. In June, the SEC initiated legal actions against Binance and its former CEO, CZ, accusing them of violations of securities laws

The SEC also filed a lawsuit against Coinbase, which followed a day after the Binance lawsuit, accusing the cryptocurrency exchange of similar violations — operating without proper registration and merging three functions typically separated in traditional securities markets: brokers, exchanges, and clearing agencies.

In March, the SEC had previously sent a Wells notice to Coinbase — an official notification informing individuals or companies that the SEC intends to take enforcement actions against them.

4. Ripple secured a partial victory over the SEC, celebrated as a win by the asset’s community on X

In July, a federal district judge referred the ongoing lawsuit between the SEC and Ripple to court, refusing to make a summary judgment on the status of XRP as an unregistered security.

On July 13, Ripple achieved a partial but significant victory in court against the SEC. The lawsuit, filed by the SEC in 2020, sought to classify the cryptocurrency XRP as a security and its sales as an unregistered security offering.

The SEC examined the distribution of XRP tokens through four different methods

- To retail investors through exchanges.

- As payment for goods and services.

- To institutional investors.

- The sale of tokens by the project founders — Chris Larsen and Brad Garlinghouse.

The regulator aimed to categorize all these methods of XRP sales as an unregistered security offering. However, the court ruled that only cases involving institutional investors met the Howey Test and could be considered investment contracts.

One of Ripple’s key arguments in this case was the so-called “Hinman’s notes” — documents from 2018 in which the former head of the SEC’s Division of Corporate Finance referred to crypto assets, including Bitcoin and Ethereum, as commodities. The Commission attempted to keep the documents confidential, but the court decided to consider them.

After the decision, the SEC filed an appeal, but the judge rejected the application due to the absence of disputed issues. In October, the regulator also had to drop charges against Chris Larsen and Brad Garlinghouse, and SEC Chairman Gary Gensler expressed disappointment with the case’s outcome.

Regarding the offering of XRP tokens to institutional investors, the case will continue in April 2024, so the decision made in July does not yet signify a complete victory for Ripple.

5. The launch of the mainnet of WB Network and BASE in August

WB Network is a blockchain solution from WhiteBIT, one of the largest cryptocurrency exchanges in Europe. On August 3, the WhiteBIT Network was launched. The long-awaited project entered the industry with a retro drop statement and the integration of $WBT as a full-fledged coin.

$WBT proved to be a decisive step towards uniting all WhiteBIT services into a comprehensive ecosystem of products from both marketing and technical perspectives.

Predictions of creating a comprehensive network were confirmed when the WB Network testnet was launched in April 2023. It shed light on the blockchain interface and technological foundation.

The test network of the WB Network was complemented by WB Soul, an advanced technological ecosystem for non-transferable and immutable data.

>>>Free Tool: Use our simple crypto profit calculator to calculate your potential profits and returns on your cryptocurrency investments.<<<

Coinbase followed WhiteBIT’s example and also launched its mainnet called BASE shortly after.

BASE blockchain testnet was released on February 23, 2023, and projects in the Web3 space began to be hosted on it almost immediately. Just three months later, innovations such as Blackbird (a hospitality service), Parallel (a collectible card game based on NFTs), Thirdweb (a set of blockchain development tools), and OAK (a cryptocurrency for an exclusive community seeking a more accessible blockchain landscape) emerged.

However, most importantly, the test network fully revealed the nature of the blockchain’s future goals and applications. BASE focuses on developing a chain that is more adapted to Web3.

BASE for decentralized development was released on August 9. It achieved staggering results: in less than a month, 11.5 million transactions were conducted, setting a record of 15.88 transactions per second, and reaching 1 million unique users just 11 days after release.

6. The NFT market has experienced a downturn, but Justin Bieber seems to be unaware of it

The NFT market sharply declined from the turbulent days of 2021 when individual fragments could be purchased for multi-million-dollar sums.

However, the reality of high interest rates in the U.S. and a bearish market, driven by the collapse of major cryptocurrency companies, has lowered the value of some collections.

Despite their prices exceeding several million dollars in 2021, certain NFTs from the Bored Ape yacht club are currently selling for less than $50,000.

Here are a few more stars and companies that have suffered from the NFT market downturn:

- In August, the creators of Web3 Nifty confirmed their imminent closure. With the support of billionaires Mark Cuban and Joseph Lubin from ConsenSys, the company raised $10 million in startup funding. Initially offering NFTs from the 1996 Warner Bros. film “Space Jam,” the company later expanded its offerings to include intellectual property from “The Matrix” and “Game of Thrones.” Faced with widespread mockery, the company transitioned to the Web3 content creation platform.

- Currently, prices for NFTs from the Bored Ape Yacht Club, one of the most popular collections, have dropped. For example, a Bored Ape NFT owned by Justin Bieber has seen its value drop by approximately 95% over the past two years. In January 2022, the Grammy-winning musician entered the NFT world, reportedly spending 500 ETH (around $1.3 million at the time) on Bored Ape #3001, an NFT belonging to the Bored Ape Yacht Club (BAYC) collection by Yuga Labs. However, as of July 2023, according to Bitcoinist, Justin Bieber’s “Bored Ape” is valued at only around $59,000.

7. The trial of Sam Bankman-Fried

On November 3, a jury found the founder of FTX and the associated trading company Alameda Research, Sam Bankman-Fried (SBF), guilty of fraud, financial manipulation, embezzlement, criminal conspiracy, and money laundering. However, the actual sentencing will be announced in the spring of 2024.

Later, attorney David Mills stated that “winning the FTX case was impossible,” and SBF himself was the “worst person” he had ever seen during the questioning.

8. The conclusion of the investigation against Binance

On November 21, another significant case was resolved as Binance announced an agreement with the U.S. Department of Justice, which had been investigating the platform’s activities.

The DOJ had accused the exchange of unlicensed money transfers, violating sanctions, and violating banking secrecy laws. Binance’s CEO, Changpeng Zhao (CZ), faced charges of money laundering. The regulator agreed to close the case in exchange for:

Binance ceasing operations in the U.S. (its subsidiary, Binance.US, will continue to operate in the country):

- CZ stepping down

- Full supervision by the authorities

- A fine of $4.3 billion

Richard Teng replaced Changpeng Zhao as the CEO, proclaiming a commitment to collaboration with authorities and creating a transparent and clear regulatory environment for crypto companies. CZ himself awaits a verdict in the U.S. on the charges in February 2024.

Overall, experts view the conclusion of the Binance case positively for the industry, as it contributes to strengthening trust in the market and conveys the U.S. regulators’ stance to other violators.

Despite CZ’s resignation, the exchange may reportedly lose its dominant position, but CZ remains a crypto billionaire according to Bloomberg’s rankings.

9. The longest bear market has come to an end, bringing joy to investors

Additionally, there has been a rapid surge in Solana’s value, as over the year, the price of the SOL has increased tenfold, and the ecosystem has successfully recovered from the FTX crash. The rise of BIL was also observed as early as September, and as of December 27, the coin is trading at $112.

10. How the Top Cryptocurrencies Have Changed

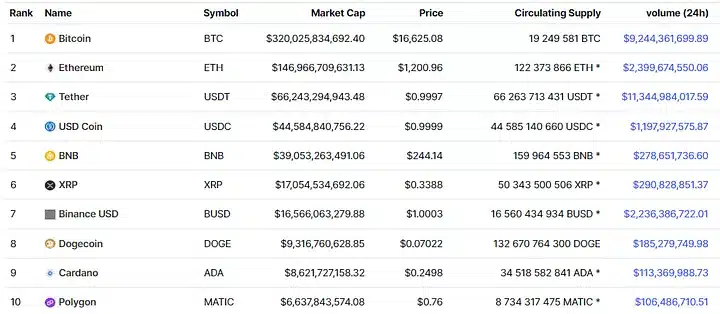

According to CoinMarketCap, as of January 1, 2023, the list of the top 10 cryptocurrencies by market capitalization looked as follows:

Top 10 cryptocurrencies by market capitalization as of January 1, 2023. Data from CoinMarketCap.

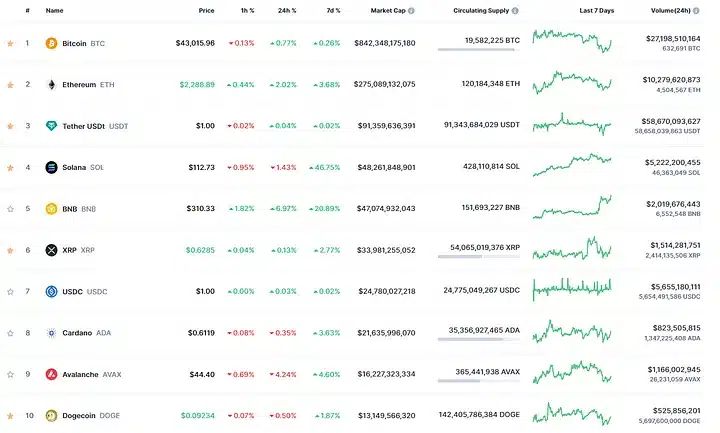

It slightly differs from the list of the top 10 cryptocurrencies as of December 27, 2023.

Top 10 cryptocurrencies by market capitalization as of December 27, 2023. Data: CoinMarketCap.

Some of the most significant changes include:

- The absence of the BUSD stablecoin — In February, after an investigation by the New York Department of Financial Services (NYDFS), Paxos announced the halt of BUSD issuance. On December 15, the largest project partner, Binance Exchange, also ceased supporting BUSD.

- Decrease in the market capitalization and market share of USDC — It seems that the “regulated” asset in the U.S. did not withstand the closure of partner banks and failed to regain investor trust after the dealing. The monopoly in this niche now belongs entirely to USDT.

- The return to the top 10 of the Avalanche blockchain — This occurred amid a surge in activity driven by Inscriptions and a reevaluation of the network as infrastructure for GameFi projects.

However, projects like Cardano, Ethereum, Tether, XRP, and Dogecoin have consistently held the top positions in the market for several years and seem reluctant to relinquish them. Nevertheless, the bull phase is just beginning, and it is challenging to predict which narratives will gain user support in this cycle.

Conclusion

As we say goodbye to 2023, it’s clear that this year marked a significant transformation for the cryptocurrency sector. Rising from the depths of the longest bear market, the crypto industry demonstrated impressive resilience and adaptability.

Despite facing regulatory hurdles and market ups and downs, the year recorded notable achievements. Looking back, 2023 unfolded as a year of trials, triumphs, and pivotal instances, molding the narrative for the trajectory of the crypto industry.

As we enter the upcoming year, the insights acquired and lessons learned are poised to play a crucial role in the ongoing advancement and development of the cryptocurrency landscape.

>>>Free Tool: Use our simple crypto profit calculator to calculate your potential profits and returns on your cryptocurrency investments.<<<