Banq, a division of embattled crypto custodian Prime Trust, on June 13 filed for Chapter 11 bankruptcy protection in the U.S. district court of Nevada. Banq specializes in handling payments for businesses using cryptocurrencies.

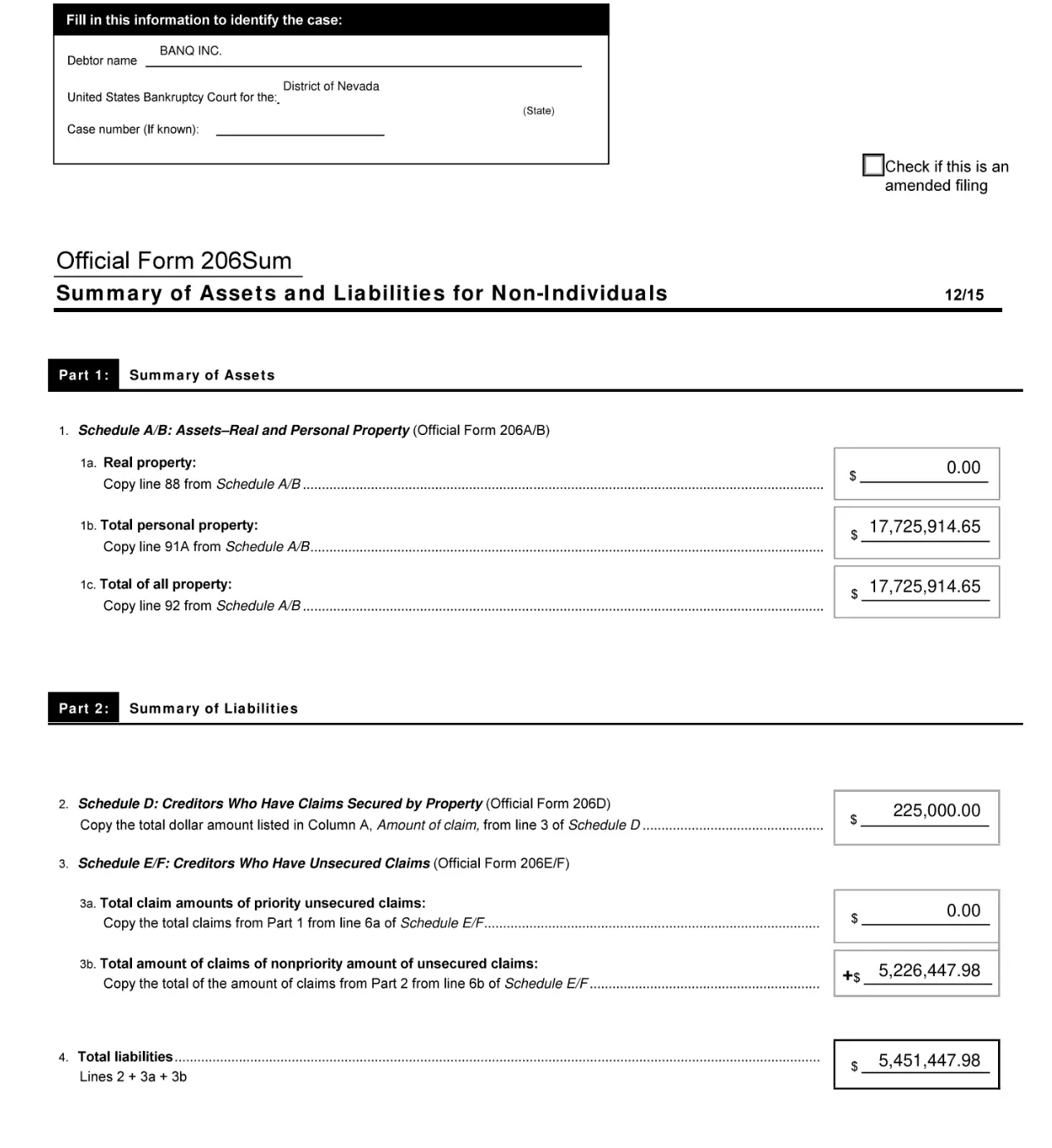

According to the filing, Banq declares total assets worth $17.72 million against a total of $5 million in liabilities. The bankruptcy filing comes shortly after its parent company, Prime Trust reached an acquiring agreement with BitGo after experiencing a financial crisis following the Celsius bankruptcy.

Source: PACER

Meanwhile, TrueUSD, which has a banking connection with Prime Trust, stated that the stop in stablecoin mints and redemptions is due to “Prime Trust’s bandwidth issues.”

Haru Invest associated with Banq or Prime Trust?

When Banq was established in 2020, it offered “mobile SDKs [software development kits] on top of Prime Trust APIs for easy integration of all the crypto and fiat funding services,” according to its website. Haru Invest apparently received service from Banq or Prime Trust.

Haru Invest, a South Korean crypto yield business, suspended operations yesterday, claiming issues with an undisclosed service provider, which is assumed to be Banq or Prime Trust.

“Recently, we have come across a certain issue with one of the service partners we have worked with,” “We are now further investigating the issue with them and seeking a contingency plan to rectify the situation,” the South Korea-founded company said in a statement.

Related Reading: SEC Wants 120 Days to Respond to Coinbase Rulemaking Petition

A potential reason for Banq’s financial crisis

Banq said in its bankruptcy petition that $17.5 million of its assets were transferred to Fortress NFT Group in a transfer that was not authorized which may have contributed to the company’s financial situation.

Furthermore, the petition stated that the unapproved transfer by former Banq officials contained trade secrets and private information. Banq’s former CEO, CTO, and CPO created Fortress NFT Group. Banq has filed a lawsuit alleging that the former C-suite workers stole trade secrets to start Fortress NFT and then committed fraud to mask their tracks.

The court ordered all parties to address the case in arbitration in January, which is currently underway and may have an influence on Banq’s bankruptcy conclusion.

Prime Trust issues started in August 2022 when the company was sued by Celcius alleging that it withheld $17 million.