Bitcoin grips above $71k amid high ETF demand. Is speculative interest back?

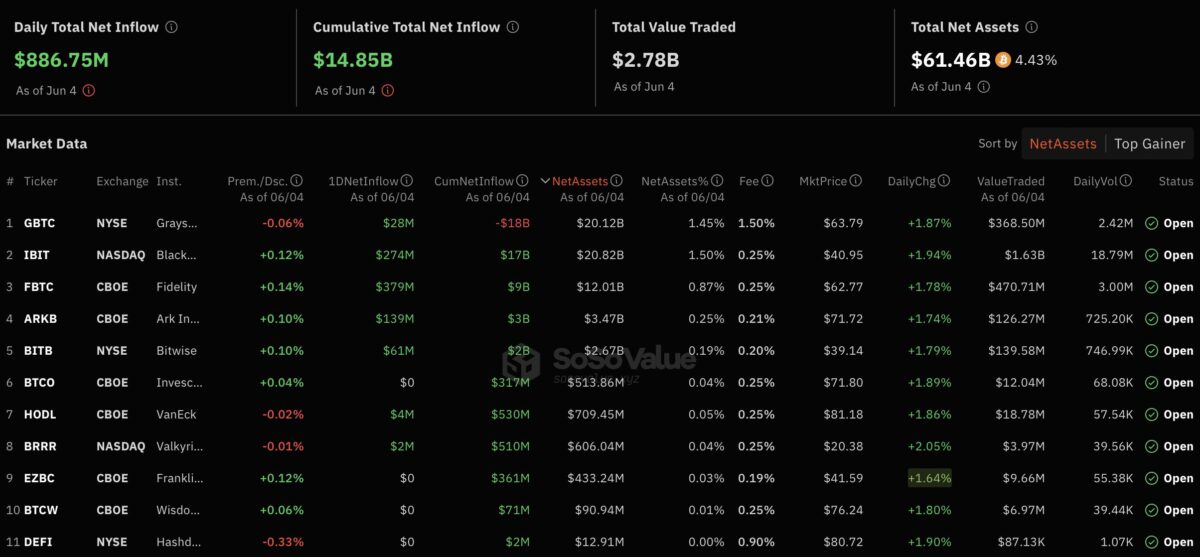

On June 5, sluggish Bitcoin dynamics switched to an abrupt volatility which paved the way to $71,540 at the writing time. The uptick kicked in as the positive two-week exchange-traded funds (ETFs) collective netflow hit the record $886.75 million on June 4, mainly driven by Fidelity’s FBTC’s $379 million inflows. Reacting to the massive inflows, Bloomberg analyst Eric Balchunas cited ones to be a “tidal wave”.

“Fidelity not messing around, big-time flows all around today for The Ten, nearly $1b in total. Second best day ever, since Mid-March. $3.3b in the past 4 weeks, net YTD at $15b (which was the top end of our 12-month est). The ‘third wave’ is turning into a tidal wave,” – he wrote in a post for X.

Read Also: BlackRock’s latest S-1 filing adds more details about Ethereum ETF and its business prospects

Bitcoin ETFs’ metric data. Source: SoSo Value

BlackRock’s IBIT also racked up substantial inflows on Tuesday, netting $274 million. Specifically, BlackRock possessed 291.5K Bitcoins as of June 3, which was equivalent to over 20 billion dollars as per market prices back in the day. ARK Invest’s ARKB stood out as well, collecting nearly $139 million of BTC.

Is Bitcoin Reached to ATH?

Decent metrics seemed to have brought speculative interest in Bitcoin back. One has recessed amidst Bitcoin’s robust dynamics, which prevailed over the last two weeks and forced market participants to seek volatility in memecoins and gaming tokens.

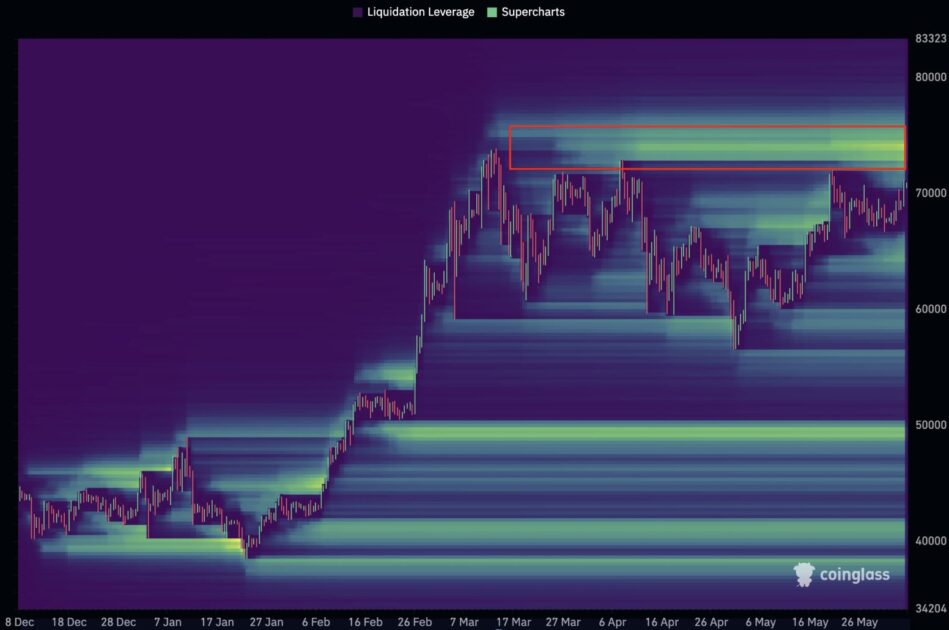

As the on-chain data reveals positive sentiment probability, Willy Woo took it further, claiming that Bitcoin is poised to update its all-time high (ATH). According to the crypto analyst, reaching the level of $72,000 will act as a “fuse”, triggering the breakthrough of the $75,000. Such price action would also spur a wave of liquidations and pave the way to a new historical maximum.

“Tapping 72k is the fuse that’s set to start a liquidation cascade. $1.5b of short positions ready to be liquidated up to $75k and a new all-time high,” Woo wrote in a post for X.

Bitcoin (BTC) liquidation heatmap. Source: Willy Woo/Coinglass

This outlook seems agreeable to HODL15 Capital, an entrepreneur and analyst. In his post for X, he stated that the $74,000 was feasible due to the “lack of sell walls” on order books across major exchanges. Still, the probability of Bitcoin achieving a $74,000 price range comes with an array of conditions.

According to RektCapital, a renowned market analyst, Bitcoin needs to turn the $72,000 resistance into support for it to enter a parabolic phase of the bull cycle, “Bitcoin just needs to break this final major resistance area (red) to enter the Parabolic Phase of the cycle.”

Read Also: SEC Approves 8 Spot Ethereum ETFs, Including BlackRock and Fidelity Offerings

BTC/USD 1D chart. Source: RektCapital

Before this, RektCapital noted that Bitcoin had broken out of a two-week downtrend on June 3, hinting at the bullish sentiment for the first cryptocurrency. “Bitcoin broke its two-week downtrend today. However, we have seen upside wicks beyond this downtrend before. Which is why a Daily Close later today is needed to confirm this breakout,” the analyst stated in a post on X.

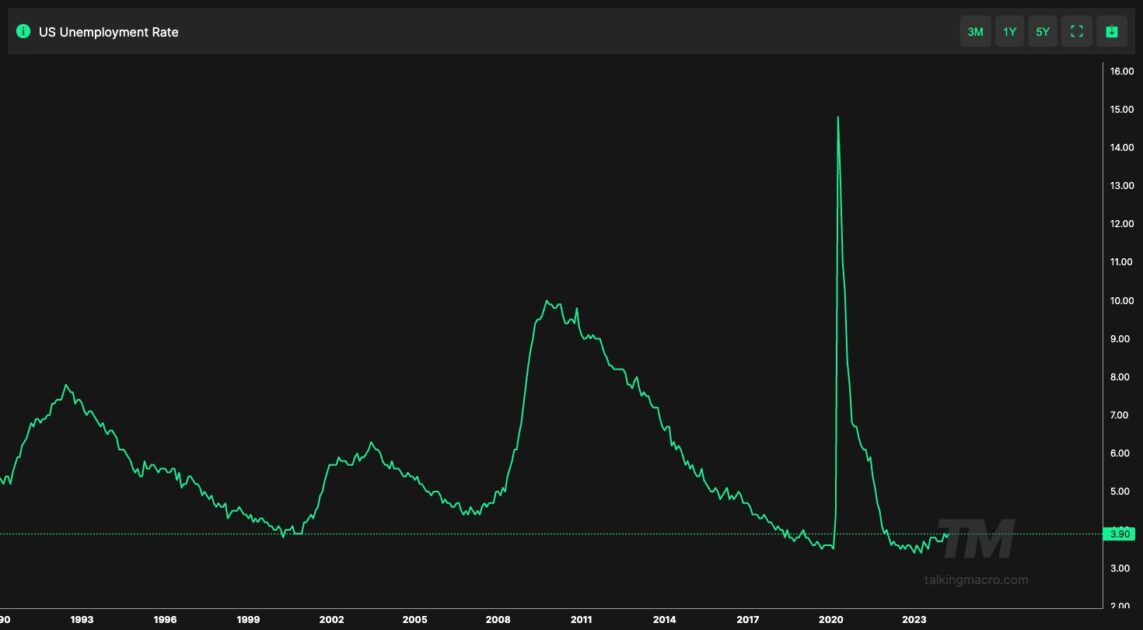

Meanwhile, macro analyst TedTalksMacro suggested that Bitcoin’s move above $74,000 could be confirmed after the May US employment data, scheduled for June 7, “…with inflation under control, the market’s focus will now turn to employment data – which is the other 50% of the Fed’s mandate.”

US Unemployment rate. Source: X/TedTalksMacro

Chart Reveals Bullish Sentiment

Bitcoin’s chart analysis correlates with optimism, demonstrated by on-chain data. As per the 1-day chart, the price has been tested to the higher boundary of the descending channel and the $69,000 resistance level. If Bitcoin breaks out of the zone further north, the market has all chances to run toward $75,000 and even create a new ATH.

BTC/USDT 1D chart. Source: WhiteBIT TradingView

The relative strength index (RSI) stands at 63, which proves the bullish momentum in a long-term perspective and hints at a potential upward rally. In the 4-hour chart, Bitcoin’s price has struggled to keep above the $69,000 resistance level and has been consolidating inside a symmetrical triangle pattern. Still, as the higher trendline of the pattern has been broken with a recent uptick, the chart may signal a further continuation of the bullish sentiment.

Read Also: Dapper Labs reaches $4 million settlement in NBA Top Shot NFT lawsuit

BTC/USDT 4h chart. Source: WhiteBIT TradingView

Nevertheless, if the price drops back inside the triangle pattern, a decline to $60,000 is possible. While the bullish scenario for Bitcoin seems more likable, traders should watch out for the increased volatility and speculative interest.