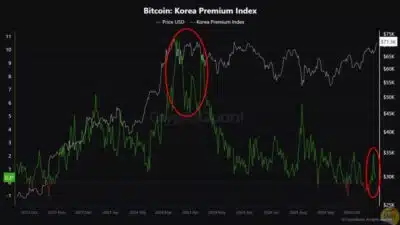

As Bitcoin surpasses the $70,000 mark, the excitement accompanying such rallies seems noticeably absent in South Korea. The kimchi premium, which refers to the difference between Bitcoin’s price in South Korea and on global exchanges, has dwindled to below 2%, indicating a sharp decline in local retail investor interest.

Also Read: Japanese Financial Firms Push for Bitcoin and Ether ETFs, Advocate for Crypto Tax Reform

Shift in Investor Sentiment Reflected in Korea Premium Index

The Korea Premium Index which has been used to gauge the sentiment of the South Korean market has been negative of late. While Bitcoin is sold at about $71,300 on other platforms internationally, it goes for a minor 1% less in South Korean exchanges. The fact, ringed by a red circle in the recent chart below, hints at the low demand within the country unlike the high interest witnessed in March where the premium was at around 10%.

Source: Coiness

There are several reasons for this decline. According to specific sources, several reasons include: there being less demand for computing power locally and possible capital control measures that may be affecting the South Korean investors. However, the global trend of pricing of bitcoin is still on the rise which makes one conclude that there is still a strong international confidence in the use of bitcoins.

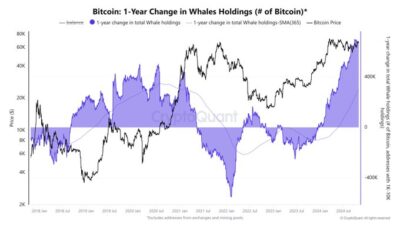

U.S. Markets Show Strong Institutional Involvement

On the other hand, the United States is experiencing massive institutional adoption of Bitcoin. Comprehensive estimates from Ki Young Ju reveal that custodial wallets that reflect institutional interests have expanded considerably. The U.S. spot ETFs have purchased 278K BTC in the last year; 80% of this quarter has come from retail investors.

Source: Ki Young Ju

Additionally, whale wallets—accounts holding between 1,000 and 10,000 BTC—have accumulated 670,000 BTC. This surge aligns with a noticeable increase in Bitcoin’s value, underpinning a bullish outlook among major investors for the cryptocurrency’s future.

Conclusion

Despite a global uptrend, Bitcoin’s journey in South Korea paints a different picture, with the falling kimchi premium highlighting a broader market shift. While international markets like the U.S. show a marked increase in retail and institutional engagement, South Korea’s lagging enthusiasm could signal a need for a strategic reassessment by local investors and policymakers. As the digital asset landscape evolves, tracking these divergent trends will be crucial for understanding the complex dynamics of global cryptocurrency markets.

Also Read: BRICS Summit Highlights Bitcoin as a Tool for Trade Amid Sanctions