Bitcoin is approaching a critical resistance level after recovering from last week’s sharp sell-off. The cryptocurrency traded at $106,685 during early Monday trading, registering a 1.41 percent increase over the past 24 hours.

After dipping to a weekly low of $100,377, Bitcoin has now recorded four consecutive days of gains. Bitcoin moved up to a record high of $106,958 before pausing not far from $107,000.

After falling for three straight days, last week’s highest price was $106,901. This level is developing strong resistance that could impact prices soon.

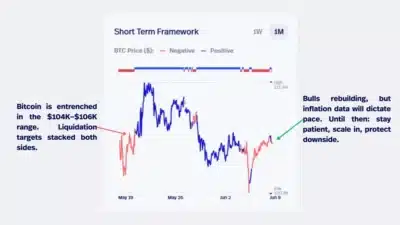

Swissblock has stated that market participants are getting ready for possible swings due to important reports expected soon. The consumer price index report will come out on Wednesday, and the producer price index report will be released a few days later. These reports might have a strong impact on investors’ views of the market.

Also Read: Ripple CLO Reveals Interesting Details About Crypto Ownership in the U.S.

If the inflation rate surpasses forecasts, investors may again worry about tightening monetary policy. Additionally, if the economic signals are weak, this could help a rally in risk assets, including Bitcoin. Traders are keeping an eye on how the market acts, as it may decide the market’s next direction.

Support Levels and Bullish Setups Emerge Despite Caution

While short-term resistance looms, technical indicators suggest a strengthening structure on the bullish side. According to Swissblock via X, bulls appear to be regrouping and preparing for a shift in momentum. Market caution remains, but recent price behavior hints at attempts to reverse last week’s weakness.

In the upcoming period, Bitcoin could go lower, trying to reach around $104,000, before making a notable move higher. According to Glassnode, Bitcoin is well supported by essential levels, including $103,700 and $95,600. This would make it possible for companies to cope if profit-taking increases.

The current short-term holder cost basis, valued at approximately $97,100, previously played a key role in shaping short-term market expectations. Additionally, the wider view of the market reveals that the resistance lies at $114,800, and the support is at $83,200. Gains or losses beyond this range could affect Bitcoin’s future direction for some time.

This week, key attention is on inflation numbers because they may significantly influence monetary policy. Bitcoin is presently moving above $107,000 and below $104,000. Traders are on alert for signs that may confirm whether bulls are indeed regaining control or if a deeper pullback is imminent.

Also Read: Black Swan Capitalist Founder Reminds Investors to Accumulate XRP Now – Here’s Why