Bitcoin is holding above the six-figure mark, with its latest trading price at $104,678. The asset recently posted an intraday high of $105,997, continuing a month-long streak above $100,000 despite increased selling from long-term holders.

According to technical analyst EGRAG CRYPTO, Bitcoin could surge to a peak of $175,231 before facing a major correction. The projection comes from Fibonacci extensions and past market patterns that indicated peaks in 2017 and 2021.

It is foreseen that the bulls will meet resistance close to $103,225 and $120,239 on their way to the rally. The chart shared by EGRAG shows that Bitcoin may later plunge as low as $34,000.

Over this zone is multiple moving average support, which can help stop a further decline after a 66 percent drop. This resembles earlier major drops in the market, such as the one seen from $64,000 to $15,600 in 2022.

Also Read: RLUSD is the Biggest Existential Threat to XRP? Pundit Breaks it Down in Recent Warning

Source: X

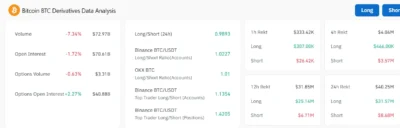

According to Coinglass, Bitcoin’s open interest is $70.61 billion, a slight step below its biggest prior record. Even though leverage is high, trading volume has dropped 7.34 percent, and more than $31.5 million in long positions were liquidated in the past day.

At the same time, options open interest has increased, indicating that there may be more volatility in the near future.

Analyst Forecast Sparks Debate as Bitcoin Eyes Sharp Surge and Major Crash

If Bitcoin breaks through the $120,000 resistance level, momentum could drive it toward the $175,000 cycle top. However, rising sell pressure and heavy resistance between $100,000 and $110,000 may hinder further gains in the short term.

EGRAG’s analysis reflects past market cycles that experienced sharp rallies followed by deep retracements. If the price fell to $34,000, it would reach a level where the price bounced back in the previous market bottoms in 2020 and 2023.

The general condition of the economy and additional cash flowing into ETFs could help keep the rally going. But if history repeats, a dramatic correction may follow the forecasted peak, making current market conditions critical for investors.

Bitcoin might soon reach a tipping point, and a severe drop-off could follow a significant upswing. Watchers in the crypto world are very interested in $120,000, considering the possible start of a substantial shift in the market.

Also Read: Ripple’s RLUSD Exceeds Traditional Stablecoin With XRP Compatibility – Here’s How