Note: the data and calculations are provided as of June 21, 2023, 11:40 pm GMT+3

That happened! On June 21, the crypto community witnessed a staggering event – Bitcoin crossed the price limit of $30k, and the growth is still continuing within the short term. Is it the quintessence of a recently started bullish trend, or an ordinary market fluctuation that distorts the stabilizing of Bitcoin’s volatility? Let’s find out!

Last week I focused my analysis on studying the decreasing Bitcoin’s and altcoins’ volatility. As the main concern for the investors according to Institutional Investor’s Digital Asset Study, I sought the lifesaving nature of steadying digital assets’ value and concluded that it was a foregone conclusion.

As a matter of fact, the crypto’s reliance on the fast-moving world, its tendencies, interests, geopolitics, and prevailing behaviorism turned out to be a basis for its price volatility, as well as the blockchain’s relevant newness on the market.

As a balancing answer to that issue, the crypto awareness and adoption indicated their boost, moving the cryptocurrencies from the category of “something niche” to a widely-accepted money type.

Related Reading: Binance to Integrate Bitcoin Lightning Network Soon

The alignment of forces began to slowly vacillate towards the stable value – according to CCData’s statement for May 23, 2023, “$BTC volatility has dipped to 48,2% in 2023, from 62,8% in 2022 and 79,0% in 2021”.

A pretty controversial reaction has been brought up – despite the increased potential for the major investors and a huge step towards crypto adoption, for a better part of crypto enthusiasts decreased volatility means losing the possibility to profit from rapid pumps and dumps.

Still, the expectations of stable cryptocurrencies price are now put under question, as soon as certain Meme coins experienced the most skyrocketing pump in their history, and Bitcoin passed the $30k threshold. However, does the latter have anything to do with presumed extreme volatility?

Pump or Not: the Analysis and Price Prediction

Let’s take a look at the bigger picture here.

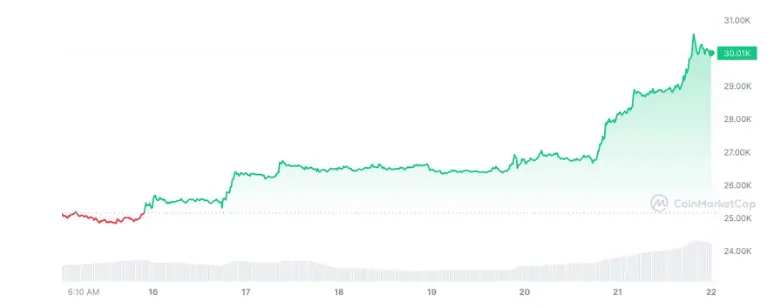

On June 16, Bitcoin broke free from the shackles of the continuous bearish trend and set up its slow and steady growth. At that stage, many investors turned themselves to the mode of $30k anticipation.

$BTC price fluctuations within the month. The bullish trend and dramatic growth are clearly visible. Source: CoinMarketCap

Amidst Bitcoin’s bull market, the mentioned above growth took place. As a matter of fact, it does look like a pump – for less than a day, Bitcoin increased in value by 8% and broke above $30k.

Nevertheless, considering this solely a pump would be a bit rash – the bullish trend is carrying on, and such an increase in Bitcoin’s price should be defined simply as a moderate fluctuation in terms of constant growth.

Check this out: Bitcoin, Sandbox, and Cardano, Among Others Listed for OKX Traders in Hong Kong

The Possible Reasons for Bitcoin’s Uprising

The bullish trend of Bitcoin is an outcome of a variety of causes combined. Regardless of the mass crypto adoption and normalization of cryptocurrencies, which were mentioned before, there are still two pivotal factors that drive $BTC value.

The first and foremost is the fourth halving of Bitcoin, which is taking place in 2024. As a matter of fact, halving is directly impacting the $BTC market state of things by deflating the asset and diminishing its supply, which consequently results in the coin’s higher price.

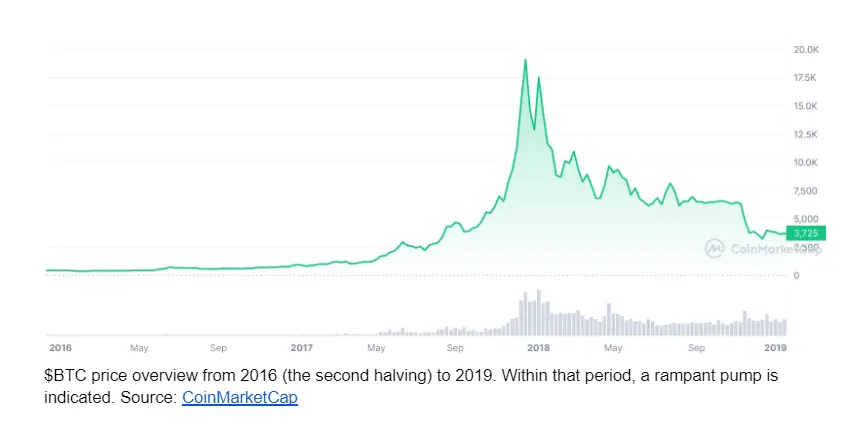

This point can be concluded as a result of taking a look at Bitcoin’s past. Notably, halvings took place in 2012, 2016, and 2020 – and they turned out to be the forerunners of skyrocketing $BTC pumps.

Source: CoinMarketCap

$BTC price overview from 2020 to 2022. As a result of the third halving, Bitcoin hit its historical maximum of $64,863.98 on November 12, 2021. Almost a similar price was reached before on April 14, 2021. Source: CoinMarketCap

Hence, many investors anticipate the peak of Bitcoins growth in the year 2024. But let’s just take one step at a time.

Another reason, which boosted not only $BTC but also the overall crypto market, is the U.S. Securities and Exchange Commission’s Enforcement of Coinbase and Binance. Presumably, the crypto community is being expanded with the ones who were reluctant to enter the realm, yet decided to in the background of such litigation. Supportive actions can also play a crucial role.

Yet, it is crucial not to neglect the paramount thesis – crypto is experiencing mass adoption and is becoming an integral element of the global economy. Volodymyr Nosov, the CEO of European largest crypto exchange WhiteBIT once insightfully stated:

You May Like This: Bitcoin Price Dips, See the Reason (May 16)

“There are many myths around cryptocurrencies, but there is only one reality. The future of the world lies in blockchain technologies and cryptocurrencies. This process cannot be stopped. (…) Bitcoin is the new gold. And those who understand this today will be far ahead of the rest tomorrow”

But still, will the $BTC bullish trend continue?

What is Awaiting $BTC: Price Predictions

Although the investors and price forecaster list slightly differing calculations, they converse on the same outcome – Bitcoin hopped on the bullish trend, and it will proceed.

Namely, according to Daria Morgen and the Changelly team, the price of Bitcoin will manage to reach $32,672,82 on its average, complying with crypto’s low volatility and monitored bullish trend.

Still, the halving alters the predictions, and by 2024 $BTC is foretold to hit $47,935.67 on average. A more optimistic forecast is cited by AMBCrypto. According to the resource, Bitcoin indicates long-term bullish sentiment and has a chance to reach the price of $38624.14 this year.

DigitalCoinPrice believes that $BTC is about to move intensively and show an average value of $59,898.56. What is more, in 2024 the price of Bitcoin is predicted to hit $72,949.40.

PricePrediction also gave a bullish forecast for Bitcoin’s future, as it is expected to reach the price of $32,769.36 this year and $47,945.25 the following one.

Ultimately, from what has been presented, we might conclude that Bitcoin is on the doorstep of its brightest future, and decreased volatility and constant growth will advance Bitcoin’s usage as a cutting-edge digital asset for transferring values, yet it will slightly spoil its trading potential.

Note: this article is not a financial recommendation. Please, carry out your own research before investing.