- Bitcoin ends July at $115K, setting a new record.

- Analyst PlanB forecasts potential average price of $500,000.

- RSI and realized price data support ongoing bullish momentum.

Bitcoin ended July with its highest-ever monthly close at $115,000, gaining $8,000 from June. This milestone adds momentum to what analysts are describing as a slow but steady bull market phase.

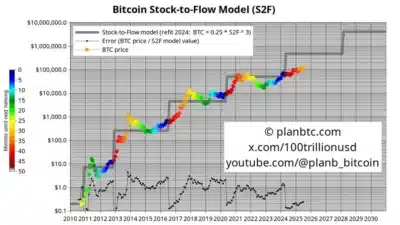

According to PlanB, the crypto analyst behind the Stock-to-Flow model, the current price move is in line with long-term projections. His model puts the average value of Bitcoin at about $500,000 in this cycle, with a maximum of $1 million.

Past bull markets have seen sudden price increases, such as 100x in 2013 and 10x in 2017. This cycle has already experienced a 3x move, which indicates a more manageable rate of growth.

According to PlanB, visible supply dynamics are influenced by a large number of investors changing their Bitcoin into ETFs and corporate treasuries. He affirmed that he has also done the same due to the ease of management and improved diversification.

Therefore, on-chain statistics show that this cycle is longer than previous ones and is still in effect. It has already gone past 18 months and continues to move upwards.

Also Read: RWA Inc. Launches Fully On-Chain Investor Platform for Early-Stage Startup Access

Technical Indicators Support Extended Rally Potential

Momentum remains strong across key indicators, pointing to more upside potential in the near term. Currently, the Relative Strength Index stands at 72.5, signaling a bullish trend and offering scope for further gains.

According to PlanB, the RSI will likely climb into the 80 range, an area that typically signals a bull run’s more aggressive phase. Further evidence, including the six-month realized price, is likewise bolstering the bullish narrative.

Bitcoin’s six-month realized price has surpassed $100,000 for the first time in the asset’s history. At the same time, the aggregate cost basis held by investors is steadily climbing, indicating confidence in the asset’s heightened price levels.

Resistance has moved up to $116,220, a level traders regard as a pivotal short-term barrier. Should Bitcoin confirm a breakout, the price may advance to roughly $119,200 and push higher, potentially reaching $126,000 if further momentum is maintained.

While some pullbacks have occurred recently, analysts still view the broader trend as positive. Price structure remains intact, and support zones continue to hold despite increased volatility.

Bitcoin’s record monthly close strengthens the argument for an extended bull cycle. With strong on-chain support and technical signals pointing upward, PlanB’s $500,000 forecast remains on the radar for market watchers.

Also Read: Prominent Trader Says XRP to $1,000 Will Eventually Happen — Here’s How Long it Could Take