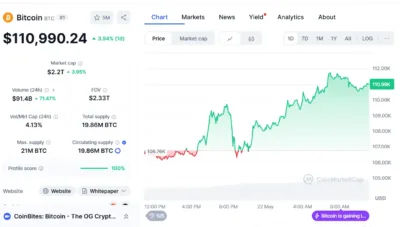

Bitcoin reached a new all-time high of US$111,000 earlier today, setting a historic record before easing slightly to US$110,990.24, based on data from CoinMarketCap. The cryptocurrency’s sharp rise marks a 3.94 percent gain in the last 24 hours and continues a strong upward trend since early April.

Since touching lows of US$76,273 on April 9, Bitcoin has climbed over 43 percent. Its market capitalization has surged to US$2.2 trillion, a 3.95 percent daily increase, placing it among the top five most valuable global assets. Furthermore, the total trade volume for the day was US$91.4 billion, an increase of 71.47 percent.

There are now 19.86 million bitcoins in circulation, and only 1.14 million left before the limit is reached. Today’s fully diluted valuation of the asset is US$2.33 trillion.

Source: CoinMarketCap

Also Read: XRP Traders are Excited Over What’s Coming Today – Details

ETF Inflows and Global Economic Conditions Trigger Rapid Price Action

The recent spike in Bitcoin’s value is driven primarily by strong institutional inflows through spot Bitcoin ETFs and evolving global economic conditions. Analysts point to the combined impact of these two forces on propelling the cryptocurrency to record levels.

According to Reece Hobson, crypto analyst at eToro Australia, more than US$2.8 billion was injected into US spot Bitcoin ETFs during May alone. The total assets of these ETFs have risen to more than US$122 billion, reflecting a strong increase in institutional involvement. Hobson found that one large investment firm now owns 506,000 BTC, which demonstrates a strong belief in Bitcoin’s ability to grow over the long term.

More than just ETF momentum, international financial trends support Bitcoin’s growth. The fall of the US dollar, which is happening due to higher liquidity and ongoing friction with China, is causing investors to look for other assets. It is becoming more evident that Bitcoin can be a reliable protection against changing currency values.

According to Coinstash’s co-founder, Mena Theodorou, Bitcoin’s hitting this valuation proves it has changed from a speculative asset to a worldwide savings option. He explained that, with its value higher than Amazon and Alphabet’s, Bitcoin is becoming more important in finance.

Conclusion

Bitcoin remains near its record peak following strong institutional ETF inflows and mounting global economic pressures. Market participants are now closely observing whether current momentum will continue to drive further price discovery in the days ahead.

Also Read: Bitcoin Blasts Past $110K as Altcoins Explode in Massive Market Rally!