Last updated on May 18th, 2024 at 12:55 pm

The recent Bitcoin price surge has come with a mix of excitement and FOMO (fear of missing out). Data from social media indicates that investors are showing major signs of euphoria which might lead to a reversal in the rally.

Bitcoin traders showing obvious bullish bias

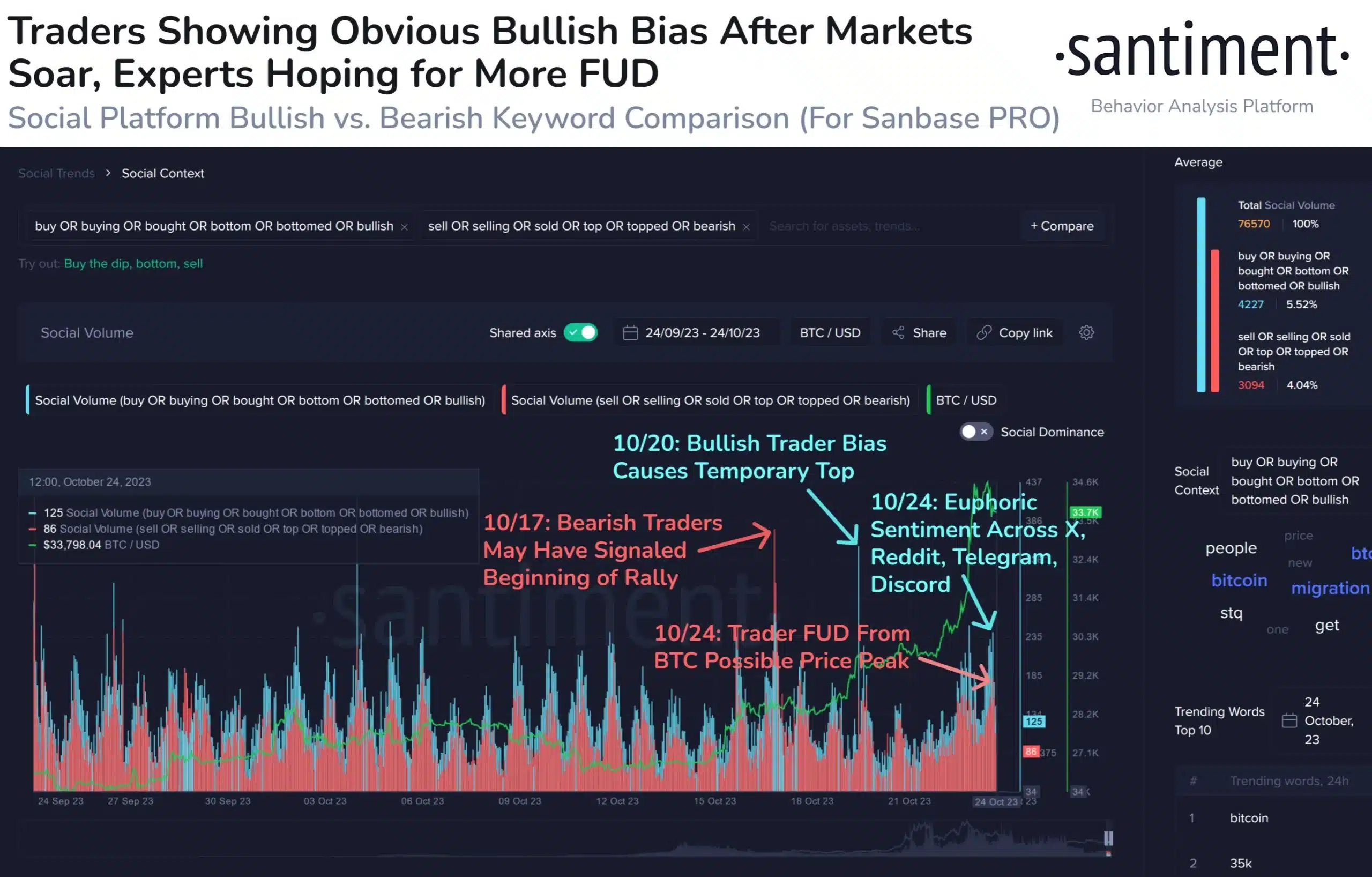

Santiment, an on-chain analytic platform, recently released data on its X (formerly Twitter) platform showing the social media sentiment on the ongoing market surge. Per the data, Bitcoin traders have become positive following the latest price trend.

The study concentrates on ‘social volume’ which is a measure of the number of discussions that the crypto community on social media is taking part in. Social volume is calculated by the number of posts, threads, and/or messages related to the topic in question.

In this metric, every post is calculated just once not minding the number of mentions containing the topic. Santiment first filtered this social volume for sentiment-specific keywords by using this metric for Bitcoin-related terms to gather information about all the posts addressing the market.

“$BTC‘s now +19% 1-week rise, and surging market caps have registered a high level of greed keywords,” Santiment wrote.

To focus on posts relating to bullish sentiments, Santiment initiated searches with keywords such as “bullish” or “buy.” On the other hand, to spot posts relating to bearish sentiment, the firm initiated searches with terms like “bearish” or “sell.”

The result was organized in a chart as seen below:

Source: Santiment Twitter

Observing the above chart, the volume of terms relating to Bitcoin’s bullish keywords has experienced a significant increase in recent times. This implies that FOMO among traders is also on the rise. Conversely, the volume relating to bearish terms is at a significant low right now.

Will the Bitcoin surge continue?

Judging from past events, the sentiment held by the majority has played a significant role in the price trend of Bitcoin. The price of the asset usually tends to go in the opposite direction of what investors expect.

Simply put, the more investors are inclined toward a particular sentiment, the more the possibility of the opposite of that idea happening. Evidently, at the beginning of this month, the market experienced a significant level of bearish sentiment, however, what came next is the rally we are experiencing presently.

Judging by this, since investors on social media are currently experiencing a bullish sentiment, it is very possible that Bitcoin might experience another major drop in price, possibly ending the ongoing rally.

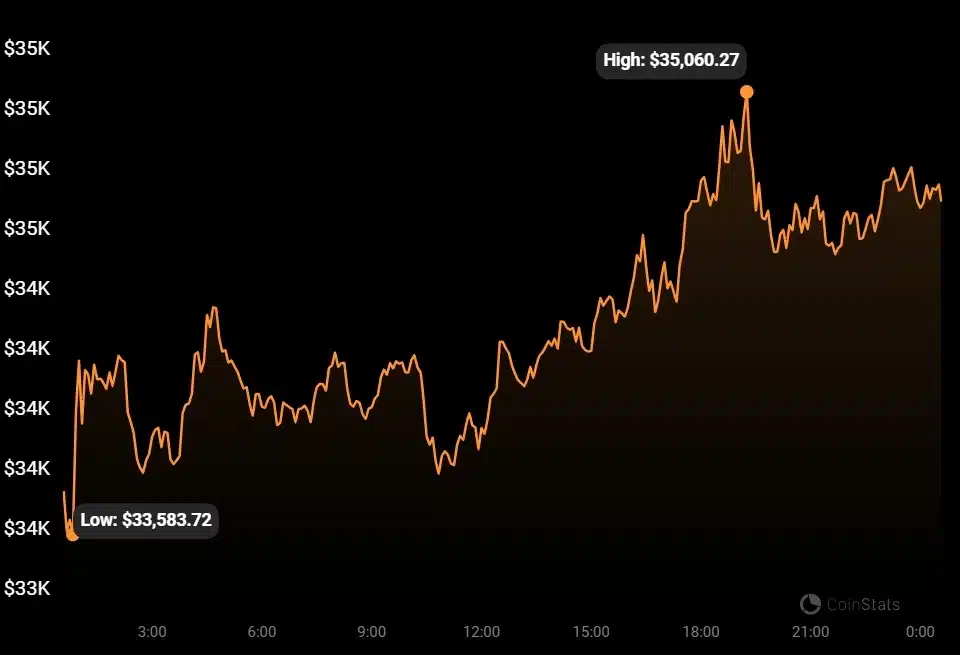

Bitcoin (BTC) price today

Source: Coinstats

According to live data from Coinstats, Bitcoin is currently changing hands at $34,697. The price is up 2.97% in the last 24 hours. What’s more, Bitcoin (BTC) has a 24-hour trading volume of $39,213,907,317 ($39.2 billion) with a live market cap of $677,429,437,166 ($677 billion).

Read more: