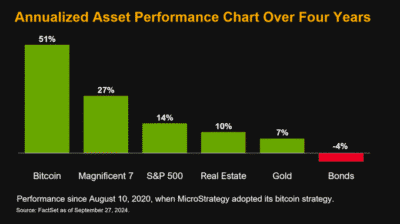

Bitcoin has once again demonstrated its superiority over traditional financial markets, surging past major assets in annual performance. According to data shared by Michael Saylor, co-founder of MicroStrategy, Bitcoin has outpaced leading financial instruments since August 2020, when his company first invested in the cryptocurrency. As of September 2023, Bitcoin’s annual gains have reached 51%, dwarfing the returns of conventional assets like stocks, real estate, and gold.

Saylor highlighted Bitcoin’s remarkable performance in a recent tweet, showing that it outperforms the “Magnificent 7” stocks index—comprising tech giants like Amazon, Microsoft, and Apple—which has seen a 27% increase. The S&P 500 is 14% higher, real estate is 10% higher, and gold is only 7% higher. Bonds are now in negative territory of 4% down. He then ended his post with the words “Bitcoin is winning” – a clear reminder that Bitcoin and other cryptocurrencies rule the financial world.

Source: Michael Saylor

Also Read: SEC Approves Options for BlackRock Bitcoin ETF, Highlighting New Financial Opportunities

Bitcoin Reclaims $66,000 Following Market Surge

This has been after a 5.32% hike over two days to hit $66,000 in price over the past week. The base price was $62,850, rose to $66,340, then fluctuated around $65,816. This recent rally was preceded by a 10% gain just a few weeks back, primarily attributed to great accomplishments in global stock markets. The Federal Reserve’s decision to cut interest rates by 50 basis points for the first time in four years was the initial catalyst, leading to a positive momentum for Bitcoin.

Additionally, similar rate cut announcements by the Central Bank of China and a major Bitcoin purchase by BlackRock further boosted the price. Over the past four days, BlackRock’s spot Bitcoin ETF, IBIT, has seen inflows totaling $388.19 million, signaling institutional solid demand for the digital asset.

Finally, Bitcoin’s steady price rise and great annual performance strengthen its position as a top asset in the financial markets, outperforming traditional assets in terms of growth and stability.

Also Read: BlackRock commends Bitcoin as the global monetary option in the rising Fiat anxiety