Amidst another pre-halving bullish sentiment, Bitcoin has set up as the leader of November so far. With the minimum of price dips, it rallied through the month with an uprising trend and finished up scoring the highest of $37,978.

The tides yet turned with BTC hovering down by 2.53% to 34,999 for the last 24 hours. However, the market did not turn all red with the altcoin climbers that managed to get through a major price decrease.

In this post, we’ll outline the reasons behind BTC’s downsurge, the market reaction to it, and possible outcomes for the end of the year. Stay tuned!

TL;DR

- Bitcoin (BTC) dropped to $34,999 while later recovering to the $36,000 range. The whales are mainly in charge of the dip, hinting that $38k could have been the highest price of Bitcoin within a short-term period.

- Polygon (MATIC) rallies to become the 11th largest crypto with 80% month growth so far.

- WhiteBIT Coin (WBT) unlock set the coin onto a bullish trend, with a $5.652 highest price.

- Solana (SOL) is showing consistent bullish sentiment, surging by 80% this month.

Bitcoin Whales Are In Charge

As BTC surged to almost $38K and Ethereum pumped up to $2100 in momentum, the thrill of the bull run started to take over the crypto community. Just immediately Bitcoin returned to its moderate flow by dumping to $35,779.

For less than a week, Bitcoin has been indicating its regular pre-halving pattern, staying in the $36,000-$37,000 range with slight price dips.

The trend switched as Bitcoin abruptly dropped to $34,999. For a better part of the crypto community, such a move turned out to be out of the blue amidst bull run anticipation.

BTC/USD Source: TradingView

No doubt this downfall has become the main target for analysts in recent days. And they seem to have worked the things out.

A reputable analyst, Ali, in his post on X claims that the whales have been actively booking profits for the last week, causing the BTC price dip. According to him, large investors have already sold or redistributed 60,000 Bitcoin worth $2.22 billion

#Bitcoin whales have been booking profits, selling

or redistributing around 60,000 $BTC over the past week, worth roughly $2.22 billion. pic.twitter.com/xmzHGXs5gu

— Ali (@ali_charts) November 13, 2023

The whales’ moves can also be a sign of something else. While their BTC sale seems to be a firm tendency, $38,000 can be the highest price Bitcoin could have achieved within a short-term period.

Another core of crypto – Ethereum – followed in BTC steps and decreased to $1934.40 price just at the same time with it.

ETH/USD Source: TradingView

Still, the bullish sentiment has not been gone for long. Since the dump took place, Bitcoin and Ethereum were set for a recovery. That is, BTC has swiftly increased to $36,558.67 and is currently trading in this range with price dips as low as $36,200.

Meanwhile, Ethereum managed to score $2098.83 after an abrupt downfall to the $1950 rate.

MATIC Hits 2023 Milestone While WBT-Unlock Takes Place

Regardless of the bearish BTC and ETH patterns, the native token of Polygon L2 Blockchain – MATIC – managed to thrive. It has become one of the biggest winners in the crypto market resurgence that started in October.

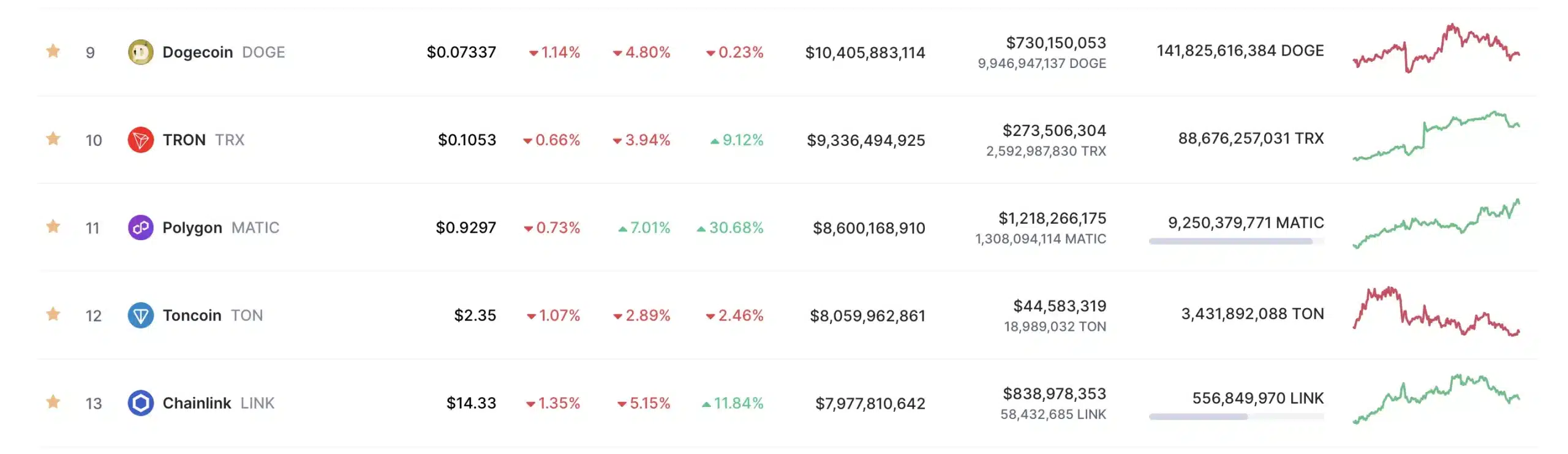

For the recent month, it added almost 80% in its price, according to the Coinstats data. On November 14, MATIC hit its highest of $0.93, surging by 5%.

Owing to a decent 30-day upsurging, MATIC market capitalization reached $8,661,484,313 as of the time of the report. This puts the asset in the eleventh position among the largest cryptocurrencies. By far, Polygon has outpaced UNI, DOT, LINK, and other major altcoins.

Rating of the largest cryptocurrencies as of November 15. Source: CoinMarketCap

Due to the recent surge, the token has now equaled the performances it last saw earlier this year in May. However, the current price remains below the February peak price of $1.5256, which has the MATIC community wondering if the token could equal that feat.

It bears mentioning that the token has equally benefited from the Bitcoin-ETF-fueled rally. Notably, the broader crypto recovery came on increased speculations regarding a spot Bitcoin ETF approval by the U.S. Securities and Exchange Commission.

Still, since November 16, it has started its way down with the most recent price of $0.80 and a market cap of $7,474,332,312, moving it two points down in CoinMarketCap’s top cryptocurrencies rating.

WhiteBIT (WBT) Rally

Meanwhile, another utility coin – WhiteBIT Coin (WBT) – was set on bullish rails amidst regular assets unlock. Fueled by the Bitcoin rally, the coin hit the highest price of 5.652 on October 25. From that time, it remained in the $5.4-$5.5 range.

WBT/USD chart. Source: Trading View

As of the time of the report, WBT is indicating slight bullish sentiment, spurred by an upcoming activity, dedicated to WhiteBIT’s 5th anniversary. While the users are eager to earn the reward, WhiteBIT Coin’s supply is showing more active distribution on the balances and exchange wallet.

Solana Breaking the Limits

WBT and MATIC are not the only outperformers of the fall. What truly staggering is the Solana uprising.

Since October 16, SOL has been indicating a strong bullish trend that boosted in recent weeks. On November 11, the coin skyrocketed to $63.97. After several price dips, it scored another highest price of $64.11 on November 15, summing up the total monthly growth rate of 181.41%.

SOL/USD chart. Source: Trading View

As of the time of the report, SOL has also significantly decreased in price, summing up the bearish sentiment with $57.04 against USD.

Disclaimer: As market volatility raises the bets, remember to stay cold-headed and to always do your research. Perceive this article as a base for your scrutiny, but not financial advice. Trade safe.

Read more: