Bitcoin is showing early signs of a major move as it holds firm in a narrow trading range following its historic run to nearly $109,000. Despite recent corrections, several on-chain indicators now suggest that the market may be primed for a sharp directional shift.

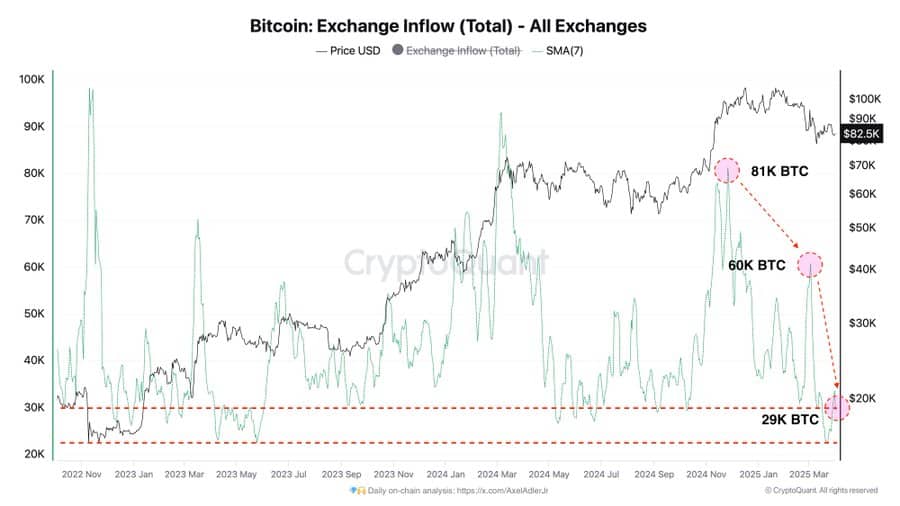

CryptoQuant analyst Axel Adler confirms that the average selling pressure of Bitcoin on major exchanges has experienced a substantial reduction. Based on the analyzed data, the daily BTC inflows decreased from 81,000 BTC to only 29,000 BTC over the specified period. The decrease indicates investors hold less eagerness to sell their assets, demonstrating accumulation market growth.

Source: @AxelAdlerJr

Market movements toward exchanges tend to decrease when sellers exit the trading arena. Price consolidation periods that witness such market events usually produce upward price growth unless demand fails to elevate levels at vital support points.

As of April 1, Bitcoin is trading at approximately $83,957, rebounding 2.1% in the past 24 hours from lows near $81,300. The bounce followed news of a significant Bitcoin acquisition by Strategy Inc., which briefly lifted confidence in the market.

However, the asset remains below the 20-day Exponential Moving Average near $84,824, which continues to act as short-term resistance.

Support Holds Tight as Demand Quietly Builds

Adler described the current environment as a potential “zone of asymmetric demand,” where most active sellers have likely exited after recent price peaks. This could mean that current buyers are more comfortable holding, rather than seeking quick exits.

The ongoing weak performance of exchange inflows supports market analysts who believe immediate selling pressure is currently low. The price patterns may lead to more powerful market movements once the market establishes its first catalyst.

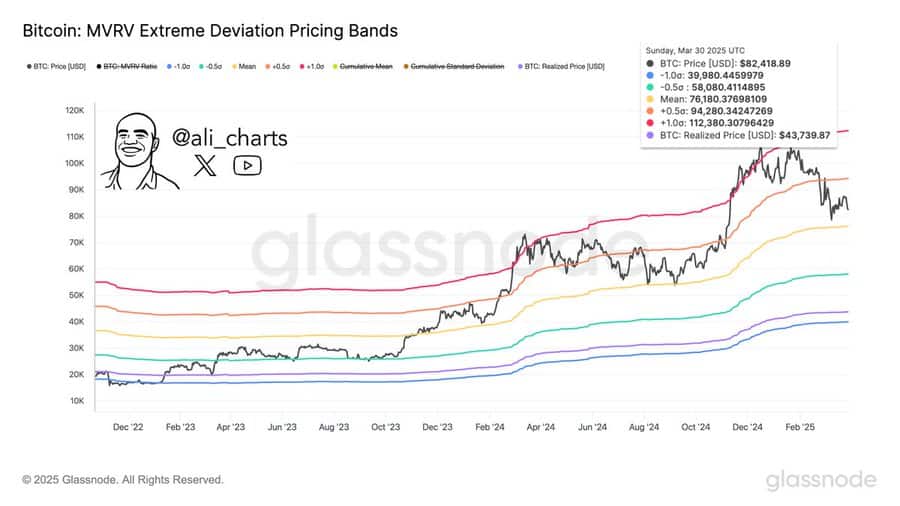

Technical specialist Ali Martinez identified crucial support levels that market participants need to focus on. The essential support areas extend from $76,180 down to $70,000 and continue below to $58,080 and $43,740.

The support level between $80,000 and $43,740 represents an important air gap that, according to Martinez, requires immediate defensive action from bull investors.

Currently, Bitcoin is trading within the $80,000–$85,000 band. Although sideways movement may continue into the coming weeks, analysts are closely watching for any surge in buying volume, which could trigger a breakout and catch the broader market by surprise.

Conclusion

Bitcoin’s tightening supply and steady demand may be signaling a larger move ahead. If key support levels hold, a sudden and sharp breakout could emerge sooner than expected.

Also Read: Analyst Predicts Three Key Targets For XRP, Says “Together We Rise”