Changpeng “CZ” Zhao, co-founder and former CEO of Binance, recently urged his 9.4 million followers on X (formerly Twitter) to take advantage of market dips. His message came amidst Bitcoin’s volatile movements, highlighting opportunities during downturns.

“Buy the dip,” CZ advised, emphasizing the potential of long-term gains for investors who act decisively during challenging times.

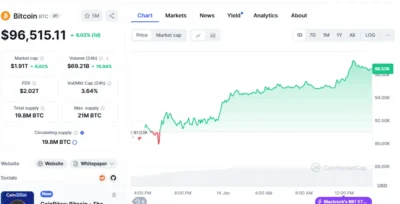

As of January 14, Bitcoin’s price has recovered to $96,515, representing a 6.03% increase in the past 24 hours. It slightly recovers from earlier this week’s low of reaching $91,030, the lowest level that it has not achieved since November 2024.

Some volatility remains in the market; now, several bearish signs point to $70,000 as the near-term bottom. But for the long-term, analysts still show optimism in Bitcoin.

Source: CoinMarketCap

Also Read: U.S. Government Cleared to Liquidate 69,370 Seized Bitcoins from Silk Road Case Amid Legal Pushback

Bitcoin’s Recovery Sparks Market Optimism

Currently, there is $1.91 trillion in market capitalization, while its 24-hour trading volume of $69.21 billion shows some activity in the market. Despite being down approximately 12.46% from its all-time high of $108,000 reached last month, the cryptocurrency is showing signs of stabilization.

Fundstrat’s Tom Lee remains optimistic, projecting that Bitcoin will reach $250,000 by year-end, viewing recent corrections as part of its natural price cycles.

CZ, in his X post, was kind to refresh our memories of the fact that market rebounds tend to reward investors who bought during the lows. He said that PT is the best practice by not focusing on FUD – fear, uncertainty, and doubts about the stock prices and grabbing opportunities whenever the prices are low.

“Today is earlier than all the days to come,” CZ said while ensuring his followers understood he was not offering investment tips.

Indicators Show Mixed Sentiment in the Market

The Crypto Fear and Greed Index currently sits at 46, reflecting neutral sentiment among investors. Last week, the index registered a higher value of 66, signaling greed in the market. The recent price corrections have contributed to a shift in sentiment.

Technical indicators also provide insights into Bitcoin’s current trajectory. The Relative Strength Index (RSI) stands at 47.21, suggesting sellers have a slight upper hand. Additionally, Bitcoin’s position near the lower end of the Bollinger Bands signals potential bearish pressure.

However, the recent rebound to $96,515 has sparked renewed optimism among investors and analysts alike.

Source: Tradingview

Conclusion

Bitcoin’s recovery from its recent lows underscores the volatility inherent in the cryptocurrency market. While challenges remain, the long-term outlook for Bitcoin remains positive, with industry leaders like CZ urging investors to take advantage of market opportunities.

As the market stabilizes, Bitcoin’s performance will continue to be closely monitored by traders and analysts seeking insights into its next major move.

Also Read: Peter Schiff Warns of Bitcoin Decline, Predicts MicroStrategy’s Strategy Will Backfire