The U.S. Bitcoin ETF market is heating up, with BlackRock’s Bitcoin ETF (IBIT) posting impressive trading volume on Tuesday, October 29. The ETF reached $3.3 billion in trading volume, marking a six-month high as institutional investors show increased interest in Bitcoin. This surge is primarily attributed to FOMO (fear of missing out) as Bitcoin’s price approaches its all-time high.

On Tuesday alone, Bitcoin ETFs in the U.S. saw inflows of approximately $870 million, with BlackRock’s IBIT accounting for more than $599.8 million. This stands among the highest recorded daily net creations since the launch of the ETF and brings the product just within a whisker of the record-high daily creation of $1.045 billion recorded on March 12, 2024. Net inflows at IBIT are approaching $25 billion –twice the total inflows seen in rivals Fidelity’s FBTC fund.

Also Read: Bitcoin Price Tops $72K, Nears All-Time High; Is $74K Next?

Institutional Investors Dominate ETF Market Activity

Bloomberg ETF strategist Eric Balchunas noted that the trading volume surge is unusual since ETF trading typically spikes during market downturns. Balchunas said institutional FOMO could be at play given that the Bitcoin rally has pushed the digital currency to 8% higher in the past week alone. At the time of this writing, the price of Bitcoin is $72,267, close to its all-time high, and Its market capitalization is $1.429 trillion. BlackRock’s IBIT account tops off a surge in Bitcoin ETF trading, highlighting increased turnover and higher trading volumes.

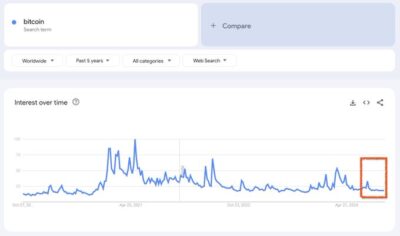

However, retail interest in Bitcoin remains subdued, even though analyst Miles Deutscher notes that retail participation was crucial in driving the asset to all-time highs during previous bull markets. With Bitcoin on the upswing and possibly preparing for its next high, a flood of retail traders could come into the market soon.

Source: @milesdeutscher

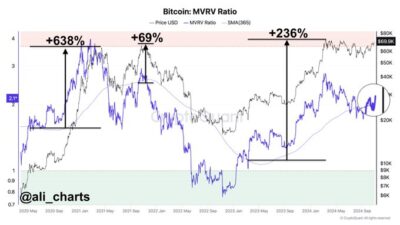

Bitcoin’s MVRV (Market Value to Realized Value) ratio recently surpassed its 365-day Simple Moving Average, a sign of potential bullish momentum. These indicators and a ‘golden cross’ pattern suggest that Bitcoin’s rally may be gaining steam.

Source:@ali_charts

In conclusion, BlackRock’s Bitcoin ETF dominates U.S. Bitcoin ETF inflows, with institutional FOMO driving significant volumes. As the U.S. election nears, further volatility could lie ahead.

Also Read: BlackRock Elevates Bitcoin to Gold Status, Expands Cryptocurrency Offerings