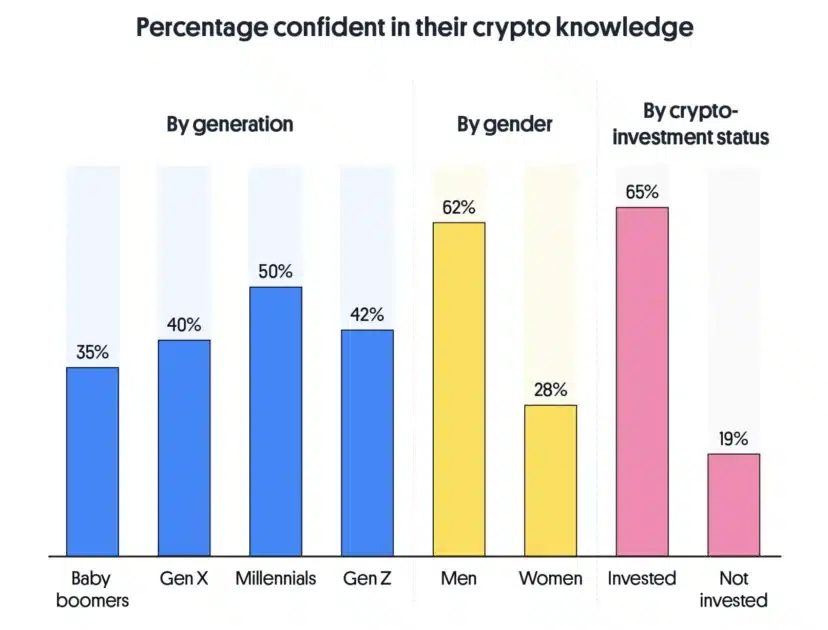

Millennials turned out to be the most confident generation in their knowledge of cryptocurrencies. This became known from a recent market research conducted by Preply, a language course platform. Despite this, the survey showed that 60% of US residents do not understand blockchain technology.

Percentage Confident in Their Crypto Knowledge

The results of the Preply study revealed a gender gap, showing that men tend to feel more confident in their knowledge of cryptocurrency than women. However, while 46% of respondents expressed their confidence overall, a significant portion of crypto investors themselves (35%) had doubts about their understanding of cryptocurrencies, and 3 out of 5 (60%) did not know what blockchain was. This uncertainty was most prevalent among Generation Z investors, 40% of whom had doubts about their knowledge. The survey also revealed a significant awareness gap regarding NFTs and the meta-universe. Only 42% of respondents expressed confidence in their knowledge.

Source: Preply

Read Also: Best Cryptocurrencies To Invest In For Long-Term Growth

Despite this, users are still showing interest. 53% of non-crypto investors are interested in learning more – most of them are Generation X. Of these, 27% said they would like to take courses to learn more about cryptocurrencies. That’s why having easy-to-understand educational resources is important to sustain this demand.

Ensuring the Educational Aspect of the Industry

The development of the educational process is undoubtedly the basis for the development of the industry. With the popularization of digital assets, the need to maintain users’ knowledge is also growing. A few years ago, it was quite problematic to find educational resources to enrich one’s knowledge, but now this issue is no longer so acute. After all, numerous training courses have been developed, and their number is constantly increasing.

For example, the University of Applied Sciences of Business Administration Zurich has recently launched a Bitcoin education course for those planning to integrate cryptocurrency into new business models. In addition, there are already several universities in the world that offer relevant blockchain education programs: the University of Nicosia, Massachusetts Institute of Technology, Cambridge University, etc.

However, support for the educational aspect of the industry does not end with universities. There is also a significant number of educational resources for users of different levels of complexity: from beginners to advanced.

Among them are learning platforms from crypto exchanges OKX, Bitget, Binance, etc., the WhiteBIT educational program in partnership with FC Barcelona “Game-changing technologies: Mastering Blockchain”, and countless other courses such as LearnCrypto and Coursera.

Read Also: The Power of Cryptocurrency: Insights from Cardano’s Founder Charles Hoskinson

Institutional Investors Enter Cryptocurrency

The interest in cryptocurrencies is growing, and this is demonstrated by other surveys. According to a KPMG study, institutional investors have become more interested in digital assets. One-third of the respondents have at least 10% of their portfolio in crypto assets, compared to only one-fifth of those surveyed two years ago.

KPMG also investigated the reasons for this increased interest. The majority (67%) cited market development as an important factor. 58% of respondents mentioned the high market performance of cryptocurrencies as a motivating factor for their investments. In recent years, the market performance of crypto assets has shown significant growth. Furthermore, the approval of spot Bitcoin ETFs in January also played a role in expanding institutional investor involvement.

In addition, the PitchBook report shows that in the first quarter of 2024, funding for crypto startups reached $2.4 billion. This means a 40% increase in invested capital compared to the last quarter of 2023.

“With positive investor sentiment returning to crypto and barring any major market downturns, we expect the volume and pace of investments to continue increasing throughout the year,” PitchBook analysts wrote in the report.

Summary

Although a large percentage of people are still unsure of their knowledge of cryptocurrencies, interest in them is potentially growing. This is especially true for non-crypto investors who are ready to gain more knowledge. Such moments emphasize the importance of accessible and high-quality educational resources to sustain interest and raise awareness. Therefore, various educational programs play an important role in the development of the cryptocurrency industry. Thus, the development of the educational process, combined with positive market trends, creates a favorable environment for the growth and spread of blockchain technologies.

Read Also: Crypto and Celebrities: How They are Shaping the Future of Finance